Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

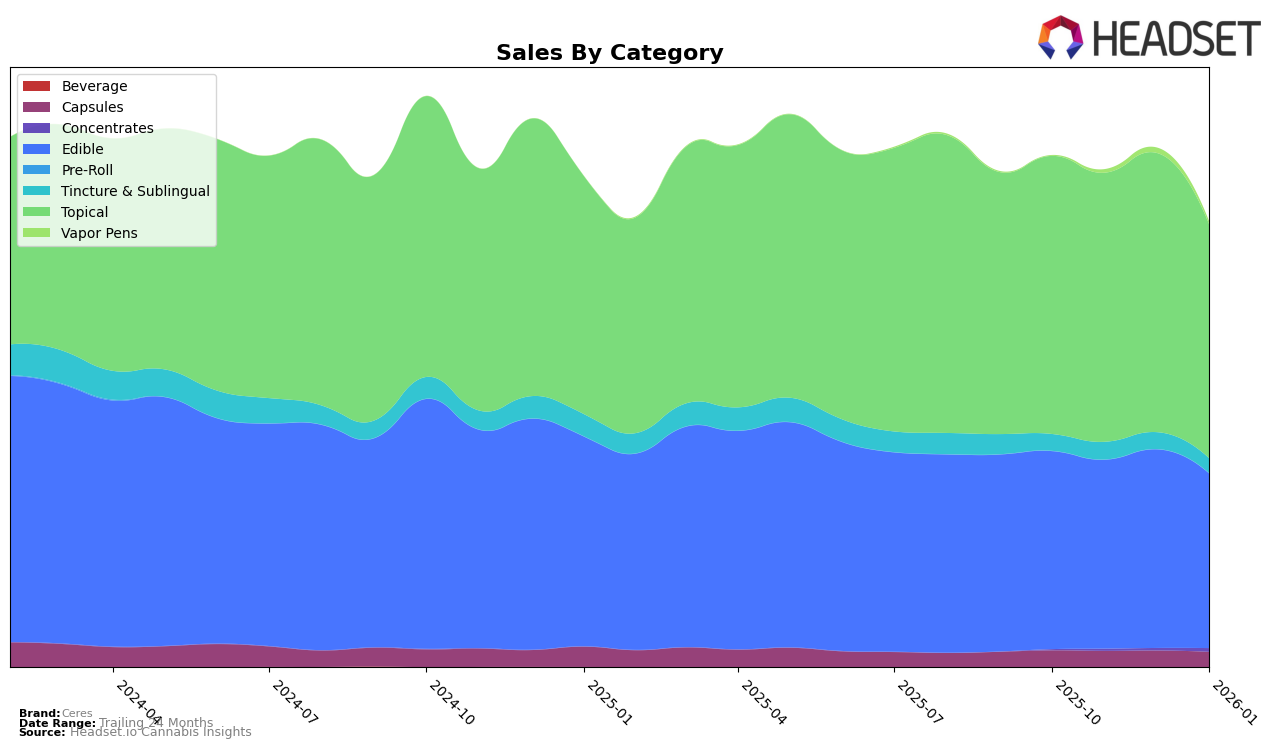

Ceres has demonstrated consistent performance in the Washington market, maintaining stable rankings across multiple product categories. Notably, in the Topical category, Ceres has held the top position consistently from October 2025 through January 2026. This indicates a strong foothold and brand loyalty in this segment. In the Capsules and Tincture & Sublingual categories, Ceres has also maintained its rank at 3rd and 4th positions respectively, showcasing steady demand for these products. However, despite their solid performance, the sales figures for these categories have shown a slight decline over the months, which could suggest either seasonal variations or increased competition.

In the Edibles category, Ceres has consistently ranked 8th, which, while stable, highlights a potential area for growth if they aim to break into the top tier of the market. The consistent ranking across all months suggests that while they have a reliable customer base, there is room for improvement in market penetration. Interestingly, the absence of Ceres in the top 30 brands for any other state or category implies that their market presence is currently concentrated within Washington. This could be seen as a limitation if they are looking to expand their brand footprint geographically. Understanding these dynamics can help Ceres strategize their next steps in both product innovation and market expansion.

Competitive Landscape

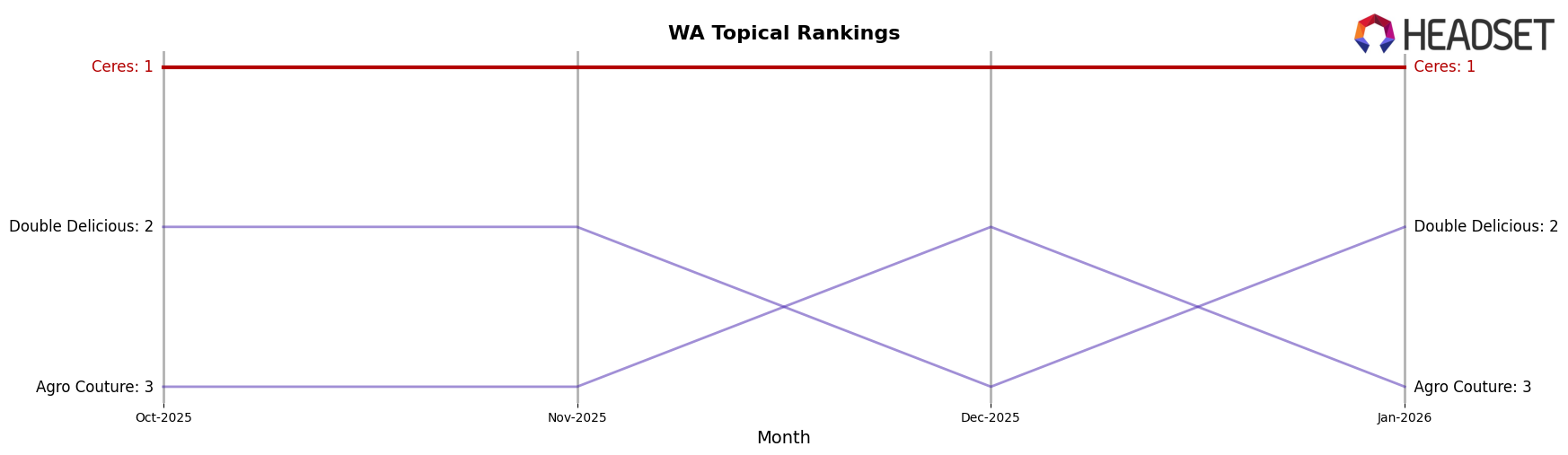

In the Washington topical cannabis market, Ceres has consistently maintained its top rank from October 2025 through January 2026, showcasing its dominance in this category. Despite a noticeable dip in sales from December 2025 to January 2026, Ceres remains significantly ahead of its competitors. Double Delicious and Agro Couture, which have been vying for the second and third positions, have not surpassed Ceres in rank during this period. While Double Delicious experienced a slight fluctuation, dropping to third place in December 2025, Agro Couture briefly climbed to the second position in the same month, indicating a competitive but stable market landscape. Ceres' ability to maintain its lead suggests strong brand loyalty and market presence, although the sales decline in January 2026 could signal potential challenges or seasonal trends that warrant closer examination.

Notable Products

In January 2026, Ceres' top-performing product was the CBD/THC/CBG/CBN 1:1 Xtra Strength Dragon Balm Roll on within the Topical category, maintaining its consistent first-place ranking from previous months despite a decrease in sales to 6324 units. Following closely, the CBG/CBN/CBD/THC 1:1 Gold Maximum Strength Dragon Pain Relieving Roll on held its second-place position, showing a slight decline in sales figures compared to December. The Sativa Sea Salted Caramel Chocolate Balls 10-Pack made a notable jump to third place in the Edible category, improving from its fifth-place ranking in December. Meanwhile, the CBD/THC 1:1 Indica Assorted Fruit Chews 10-Pack dropped to fourth place from its previous third-place standing, indicating a shift in consumer preference within the Edibles. Lastly, the newly introduced CBD/THC 1:1 Sativa Assorted Fruit Chews 10-Pack entered the rankings in fifth place, marking its debut in the January 2026 sales data.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.