Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

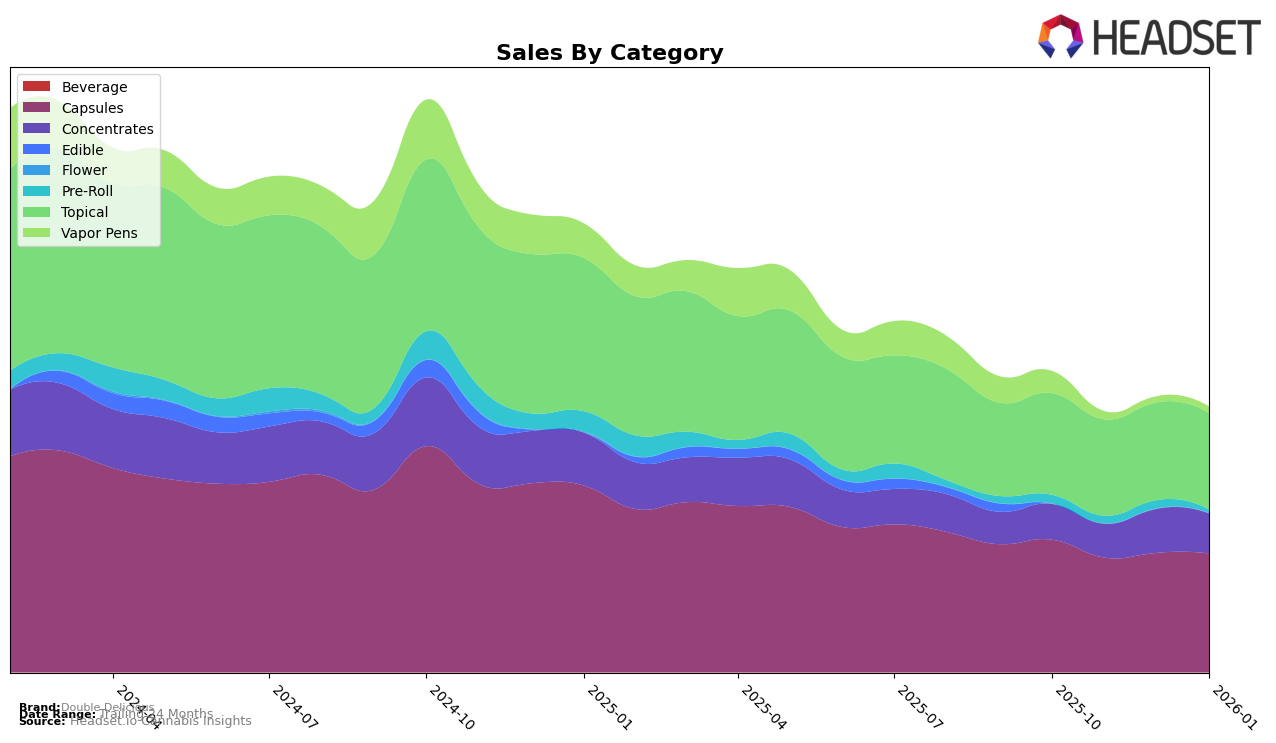

Double Delicious has shown a commendable performance in the Washington market, particularly in the Capsules category, where it has consistently maintained the top position from October 2025 through January 2026. This sustained leadership suggests a strong consumer preference and effective brand positioning within this segment. In the Topical category, Double Delicious has also demonstrated resilience, maintaining a steady ranking of second place, except for a brief dip to third in December 2025. These consistent rankings indicate a solid foothold in the Washington market, although the brand's performance in the Concentrates category shows room for improvement, with rankings fluctuating outside the top 30 for several months, suggesting potential challenges in this segment.

In the Concentrates category, Double Delicious has not managed to break into the top 30 in Washington for several months, which could be a point of concern for the brand's market strategy. Despite this, there was a notable improvement in December 2025, where the brand climbed to the 64th position, indicating some positive momentum. However, this was not sustained into January 2026 as the ranking slipped to 67th, highlighting the competitive nature of this category. The brand's ability to maintain top positions in Capsules and Topicals suggests that while it faces challenges in certain segments, it remains a formidable player in others. The fluctuating sales figures across these categories reflect broader market dynamics and consumer preferences, providing valuable insights for strategic adjustments.

Competitive Landscape

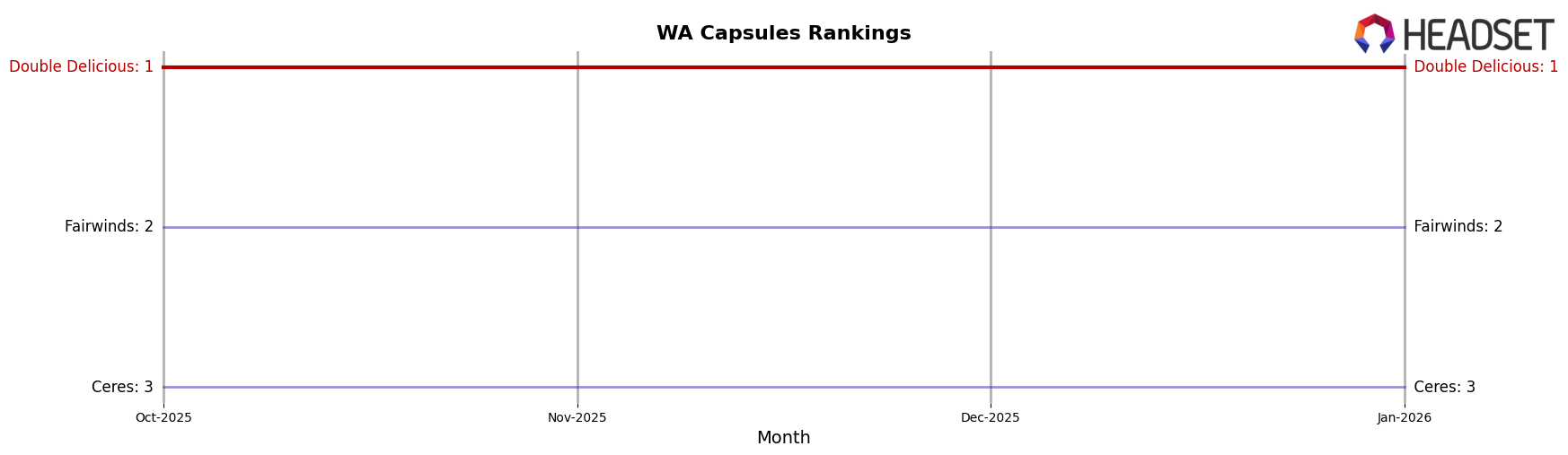

In the Washington capsules category, Double Delicious has consistently maintained its top position from October 2025 through January 2026, demonstrating a strong hold on the market. This stability in rank highlights its dominance over competitors such as Fairwinds and Ceres, which have remained in the second and third positions, respectively, during the same period. Despite a noticeable dip in sales from October to November 2025, Double Delicious managed to recover and maintain its sales figures through December 2025 and January 2026, indicating resilience and effective market strategies. In contrast, Fairwinds experienced a more significant sales fluctuation, and Ceres showed a slight downward trend in sales, further solidifying Double Delicious's leading position in this competitive landscape.

Notable Products

In January 2026, the top-performing product from Double Delicious was the Sativa RSO Capsules 10-Pack (100mg) in the Capsules category, which climbed to the number one spot from its consistent second place in the previous three months, maintaining a sales figure of 2394. The Indica RSO Capsules 10-Pack (100mg), which had been the top seller from October to December 2025, slipped to second place. The Hybrid Capsules 10-Pack (100mg) maintained its third-place ranking, showing a slight increase in sales to 1339. The Hybrid Super RSO Infusionz 3-Pack (600mg) in the Topical category held steady at fourth place, while the newly ranked Indica Super RSO Infusionz 3-Pack (600mg) debuted at fifth. These rankings indicate a slight shift in consumer preference towards Sativa products at the start of 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.