Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

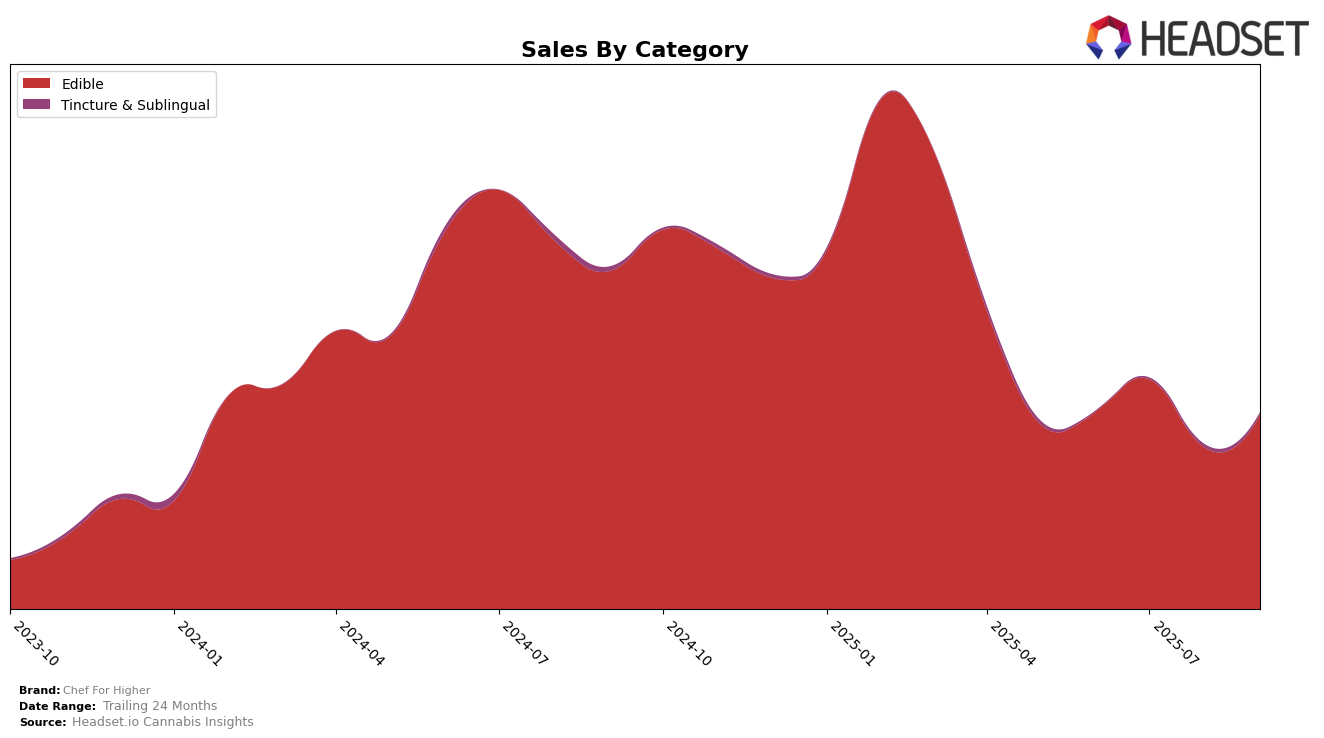

Chef For Higher, a cannabis brand specializing in edibles, has shown varying performance across different states and categories. In New York, the brand has not broken into the top 30 rankings from June through September 2025, indicating a competitive market landscape. Despite not being in the top tier, Chef For Higher experienced a notable increase in sales from June to July, suggesting a growing consumer interest or successful promotional efforts during that period. However, this momentum did not sustain into August, where a decline in sales was observed, only to recover slightly in September. This fluctuation highlights the challenges and opportunities within the New York edible market.

While Chef For Higher's performance in New York reflects a struggle to gain a top position, the brand's resilience is noteworthy as it attempts to capture market share in a highly competitive environment. The consistent sales figures in September, which are close to those in June, suggest a stabilization after the mid-year dip. The absence of Chef For Higher in the top 30 rankings across the months might indicate either a strong presence of established brands or the need for strategic adjustments in marketing or product offerings. Observing these trends can provide insights into the brand's potential strategies for growth and market penetration in the future.

Competitive Landscape

In the competitive landscape of the New York edible cannabis market, Chef For Higher has experienced fluctuations in its ranking over the months from June to September 2025. Notably, Chef For Higher's rank improved from 59th in August to 53rd in September, indicating a positive trend in market positioning. This improvement is significant when compared to competitors like Cheeba Chews, which remained consistently lower in rank, and Happy Cabbage Farms, which saw a decline from 19th in June to 52nd in September. Meanwhile, MyHi showed a similar pattern of rank fluctuation but maintained a slightly better position than Chef For Higher in August. Additionally, Veterans Choice Creations (VCC) entered the top 60 in July and improved its rank steadily, albeit starting from a lower base. These dynamics suggest that while Chef For Higher is gaining ground, it faces stiff competition from brands that are either stabilizing or improving their market positions, highlighting the need for strategic marketing and product differentiation to maintain and enhance its competitive edge.

Notable Products

In September 2025, Chef For Higher's top-performing product was Honey (240mg) in the Edible category, maintaining its rank at number one for the fourth consecutive month with a sales figure of 225 units. Coconut Oil (240mg) saw an impressive rise in popularity, climbing from third place in previous months to secure the second spot, with sales increasing to 114 units. Extra Virgin Olive Oil (240mg) dropped to third place, continuing its downward trend in sales. Olive Oil Tincture (240mg) remained steady at fourth place in the Tincture & Sublingual category, showing a slight improvement in sales figures. Ghee Butter (240mg) was not ranked in September, indicating a possible discontinuation or low sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.