Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

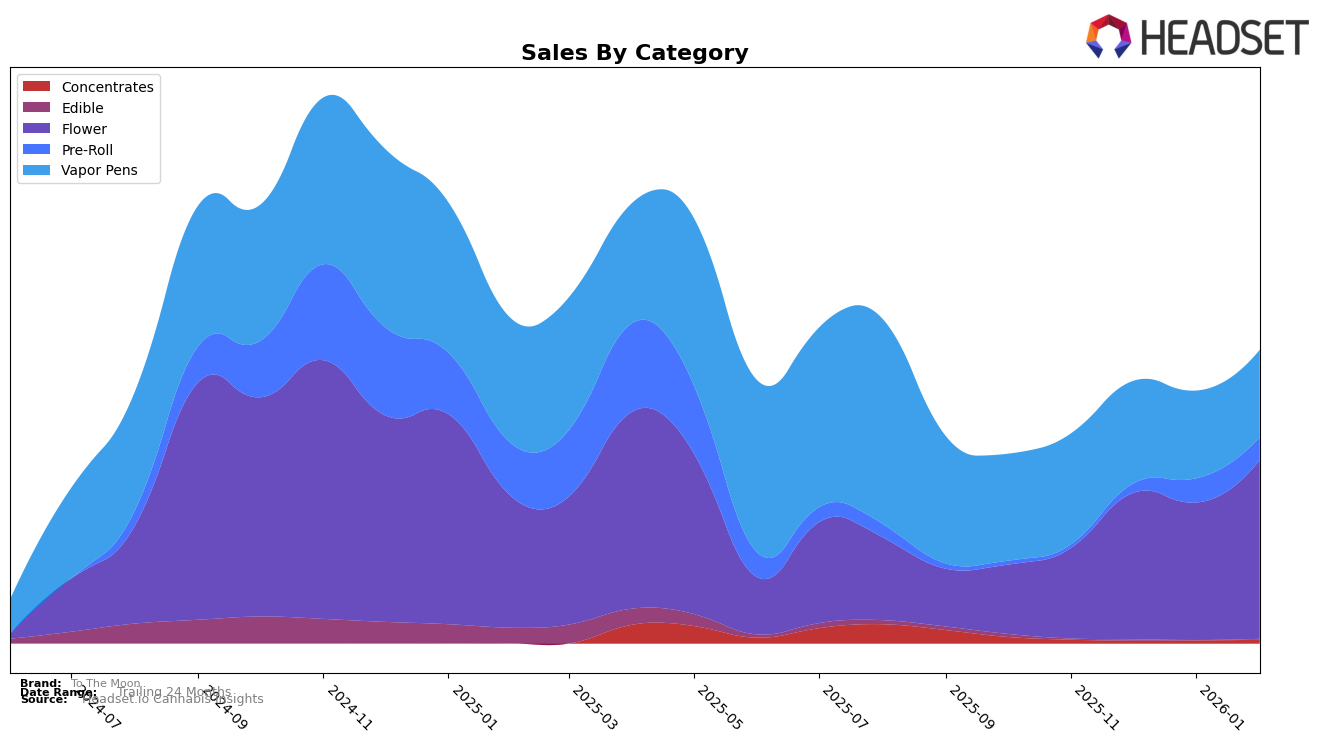

To The Moon has shown a dynamic performance across various categories in New York. In the Flower category, the brand has made significant strides, moving from a rank of 45 in November 2025 to 28 by February 2026. This upward trajectory indicates a growing acceptance and popularity of their flower products in the market. The Vapor Pens category, however, tells a different story, with To The Moon experiencing a slight decline in rankings from 34 in November 2025 to 35 in February 2026, despite maintaining relatively stable sales figures. This suggests a competitive landscape in the vapor pen market, where maintaining rank is as challenging as climbing it.

In contrast, To The Moon's presence in the Pre-Roll category in New York is notably absent from the top 30 rankings until February 2026, when it appears at rank 82. This late entry into the rankings could be seen as a disadvantage, indicating either a late start in this category or a struggle to gain traction against established competitors. Despite this, the brand's overall sales figures reflect a positive trend, particularly in the Flower category, where sales have seen a substantial increase from November 2025 to February 2026. The mixed performance across categories highlights the brand's strengths and areas for potential growth in the evolving cannabis market.

Competitive Landscape

In the competitive landscape of the New York flower category, To The Moon has shown a remarkable upward trajectory in rank over the past few months, moving from 45th in November 2025 to 28th by February 2026. This improvement is significant, especially when compared to brands like Jetpacks and Hepworth, which have struggled to maintain consistent rankings, often fluctuating outside the top 30. Notably, Left Coast has maintained a stable presence around the 27th rank, closely competing with To The Moon's recent rise. On the sales front, To The Moon's sales have surged, particularly in February 2026, surpassing brands like Good Green, which has seen more modest sales growth. This upward trend in both rank and sales positions To The Moon as a formidable player in the New York market, suggesting a strong brand momentum that could potentially challenge higher-ranked competitors in the near future.

Notable Products

In February 2026, the top-performing product from To The Moon was Permanent Marker (1g) in the Flower category, maintaining its position at rank 1 for two consecutive months with sales of 1,428 units. Honeymoon (1g) climbed to the second spot, showcasing its debut in the rankings with notable sales of 1,201 units. Blue Moon Dream (1g) followed closely as the third top seller, indicating a strong entry into the rankings. Cyber Diesel (1g) experienced a slight drop from its previous second position in January to fourth in February, reflecting a decrease in sales to 927 units. Alien Cookies (1g) re-entered the rankings at fifth place, after being unranked in January, with sales of 899 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.