Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

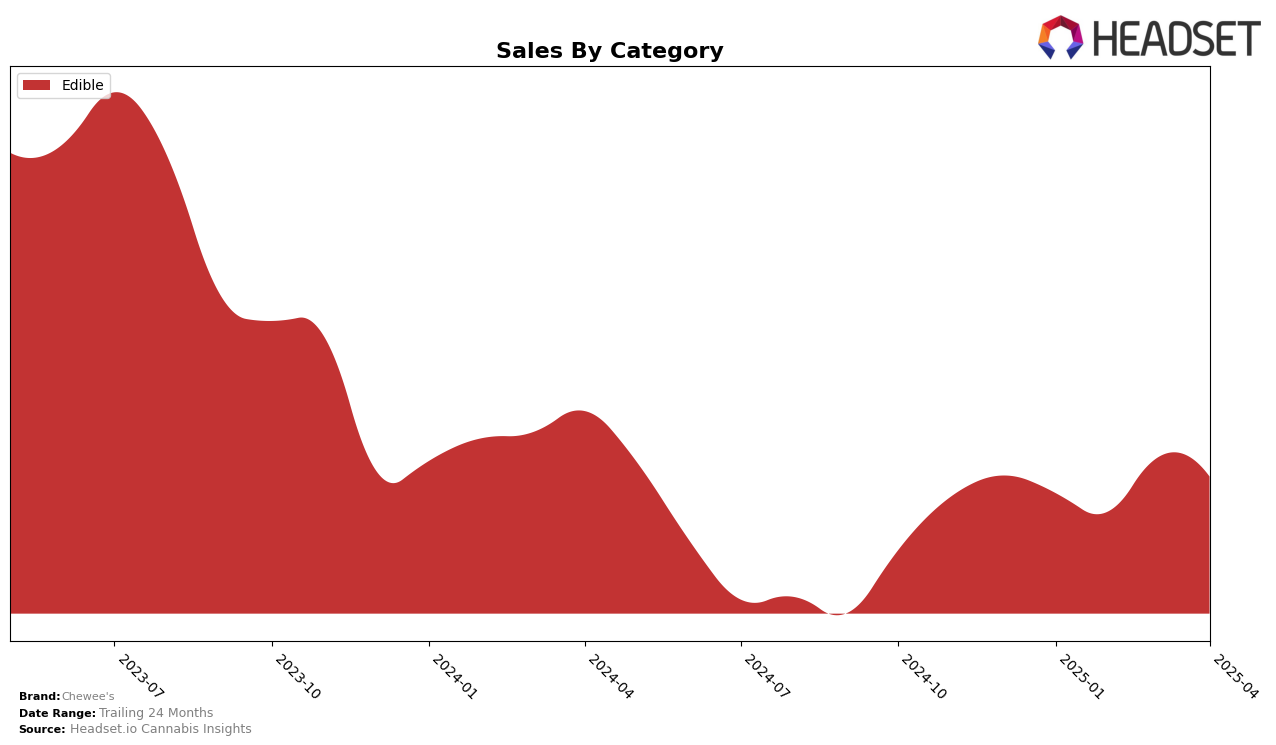

Chewee's has shown some interesting trends in the edible category across different states in early 2025. In Massachusetts, the brand has been making steady progress, improving its rank from 59th in January to 51st by April, indicating a growing presence in the market. This upward movement is noteworthy, especially considering the competitive nature of the cannabis edible category. On the other hand, the brand's performance in Washington has been relatively stagnant, maintaining a consistent rank of 30th from February through April. Despite the lack of upward movement in Washington, Chewee's has managed to maintain its position within the top 30, which is a testament to its established consumer base in the state.

Examining sales trends, Chewee's experienced a noticeable increase in Massachusetts from February to March, with sales jumping from $16,200 to $20,285, before slightly declining in April. This fluctuation suggests a potential seasonal or promotional influence impacting consumer purchasing behavior. In contrast, Washington's sales figures have remained relatively stable, with minor fluctuations over the months, reflecting a more consistent consumer demand. The absence of Chewee's from the top 30 in Massachusetts earlier in the year, combined with its steady ranking in Washington, highlights the brand's varying market dynamics and potential growth opportunities in different regions.

Competitive Landscape

In the Washington edibles market, Chewee's has maintained a consistent rank at 30th place from February to April 2025, indicating a stable position despite fluctuations in sales. This steadiness contrasts with competitors like Agro Couture, which remained outside the top 20, and Goodies, which improved its rank from 31st to 28th over the same period. Notably, Binske emerged in March at 25th place, suggesting a potential threat to Chewee's market share. While Chewee's sales saw a slight decline in April compared to March, the brand's consistent ranking suggests a loyal customer base, though it may need to innovate or adjust strategies to compete with rising brands like Binske and Goodies.

Notable Products

In April 2025, Chewee's top-performing product was Sea Salt Caramel 10-Pack (100mg) in the Edible category, reclaiming its number one spot from March with sales reaching 783 units. Indica Classic Caramel 20-Pack (100mg) held steady at second place, showing a slight decline from its previous top rank in March. Sativa Classic Caramel 20-Pack (100mg) moved up to third place, continuing its upward trend from fourth place in January. Indica Sea Salt Caramel Chews 10-Pack (100mg) dropped to fourth position, reflecting a decrease in sales compared to March. Sativa Sea Salt Caramel 10-Pack (100mg) remained consistent in fifth place throughout the months, despite a sales dip in April.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.