Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

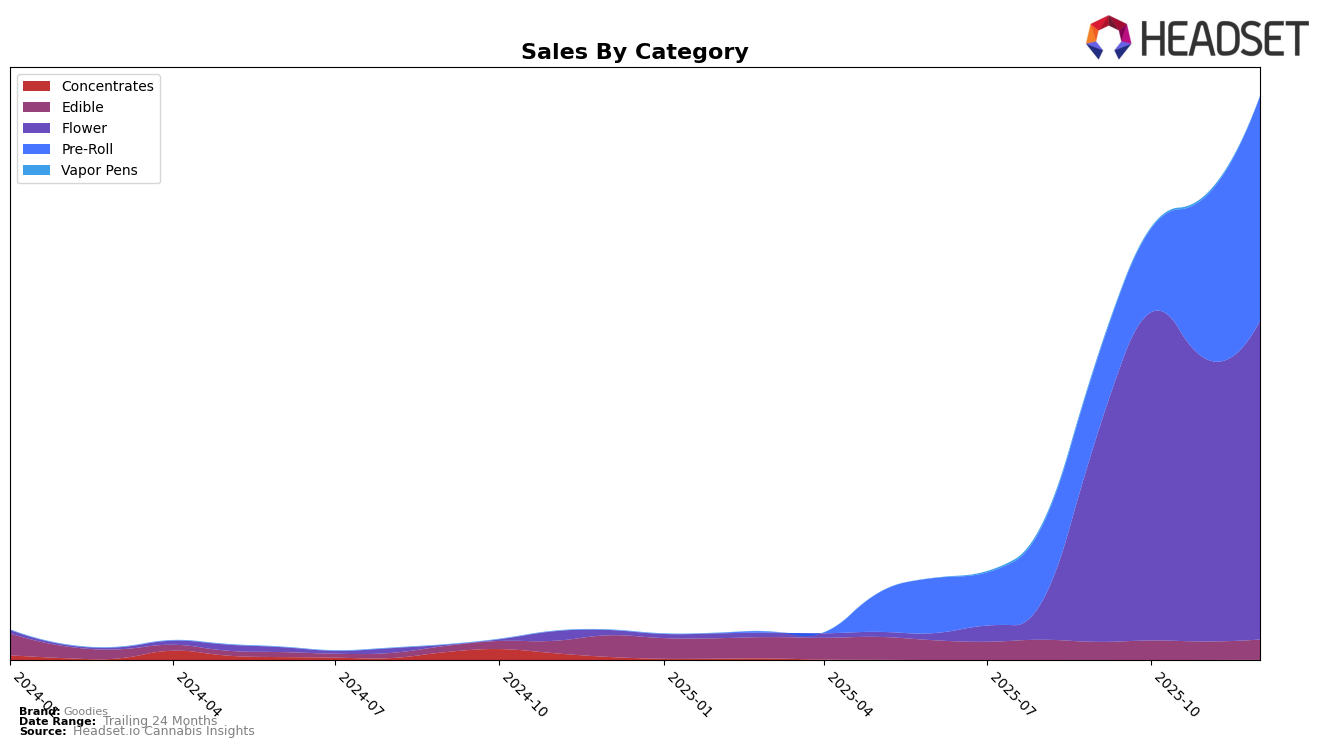

In the Massachusetts market, Goodies has demonstrated a notable upward trajectory in the Pre-Roll category. After starting at the 78th position in September 2025, they climbed significantly to reach the 50th spot by December. This improvement suggests a growing consumer preference or effective marketing strategies that have enhanced their market presence. Conversely, in New Jersey, Goodies has shown fluctuations in the Flower category, where they have maintained a position within the top 35, peaking at 29th in October, indicating a consistent yet competitive standing in the market.

Goodies' performance in the Pre-Roll category in New Jersey is particularly impressive, with a dramatic leap from being outside the top 30 in September to securing the 21st rank by December. This rapid ascent underscores a strong consumer demand or successful promotional efforts. Meanwhile, in the Washington market, Goodies has maintained a stable presence in the Edible category, consistently holding the 32nd rank from October to December. This steadiness suggests a loyal customer base or a consistent product offering, though it also highlights the challenges in breaking into higher ranks within this competitive category.

Competitive Landscape

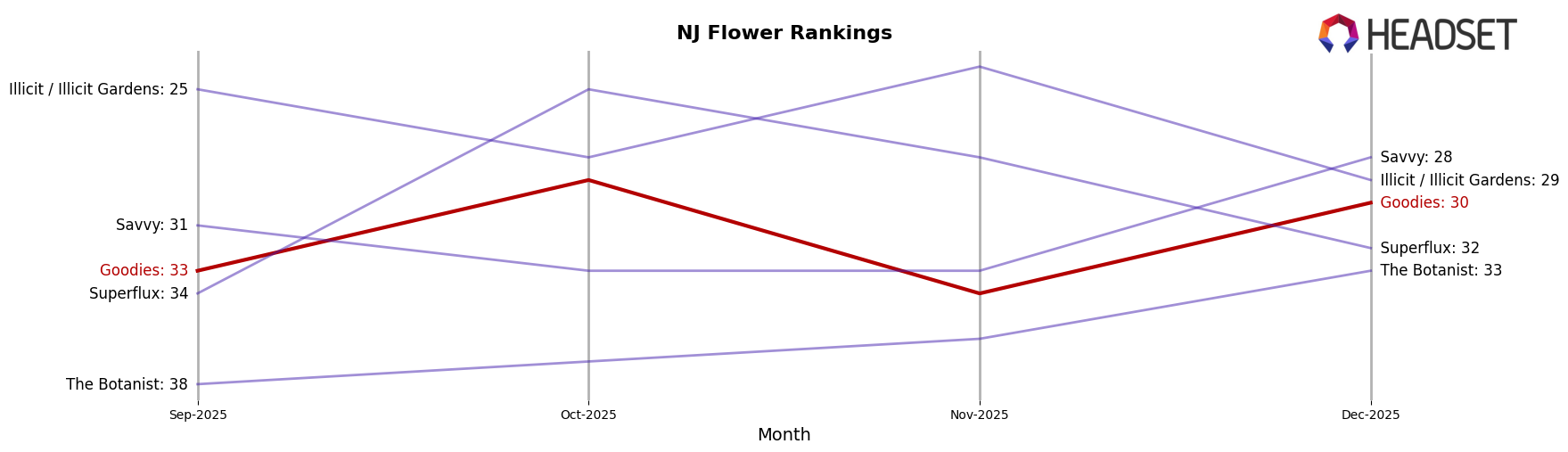

In the competitive landscape of the Flower category in New Jersey, Goodies has shown a fluctuating performance in the latter part of 2025. While Goodies improved its rank from 33rd in September to 29th in October, it slipped back to 34th in November before climbing again to 30th in December. This volatility in rank is mirrored in its sales figures, which saw a significant increase from September to October but experienced a dip in November before recovering in December. In comparison, The Botanist consistently improved its rank, ending the year at 33rd, while Superflux had a more stable performance, peaking at 25th in October. Savvy also showed a positive trend, finishing December at 28th, indicating stronger sales momentum. Meanwhile, Illicit / Illicit Gardens maintained a relatively stable position, though it experienced a slight drop in December. These dynamics suggest that while Goodies has potential for growth, it faces stiff competition, particularly from brands like Superflux and Savvy, which have shown more consistent upward trends in both rank and sales.

Notable Products

In December 2025, Watermelon Infused Pre-Roll (1g) maintained its top position as the best-selling product from Goodies, with an impressive sales figure of 3228 units. Blue Raspberry Infused Pre-Roll (1g) made a strong debut, securing the second rank. Mango Sorbet Infused Pre-Roll (1g) followed closely at third place, showcasing a competitive entry. Cotton Candy Infused Pre-Roll (1g) improved its standing from fifth in October to fourth in December, while American Popsicle Infused Pre-Roll (1g) re-entered the rankings at fifth place. Overall, December saw significant shifts with new entries and consistent performance from existing top sellers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.