Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

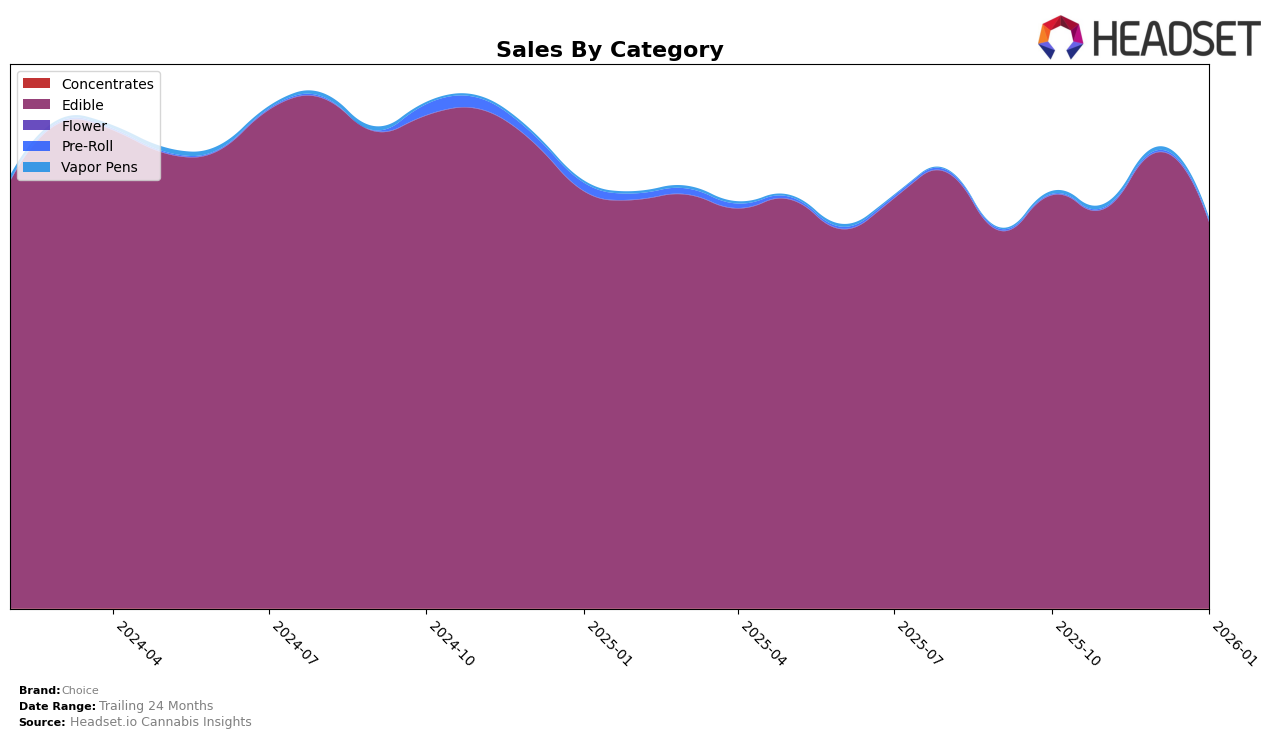

Choice has maintained a consistent presence in the Edible category across both Massachusetts and Michigan. In Massachusetts, Choice has consistently held the 7th rank from October 2025 through January 2026. Despite a dip in sales in January 2026, the brand's ranking suggests a stable market position. In Michigan, Choice has been performing exceptionally well, consistently holding the 2nd rank over the same period. This consistency in ranking in both states highlights the brand's strong foothold in the Edible category, despite the fluctuations in sales figures.

The performance of Choice in Michigan is particularly noteworthy, as it has managed to maintain its 2nd place ranking despite a noticeable dip in sales from November 2025 to January 2026. This suggests that while competitors might be gaining ground, Choice's brand loyalty or product differentiation is keeping it near the top. In contrast, Massachusetts presents a different scenario where Choice's sales saw a decline in January 2026, which could be indicative of market saturation or increased competition. The absence of Choice from the top 30 in other states or categories could be seen as a potential area for growth or a strategic decision to focus on specific markets.

Competitive Landscape

In the Michigan edible market, Choice consistently held the second rank from October 2025 through January 2026, indicating a strong and stable presence. Despite maintaining its position, Choice faces stiff competition from Wyld, which dominates the market as the top-ranked brand. Although Choice's sales figures showed a slight fluctuation, with a peak in December 2025, they remained significantly lower than Wyld's, suggesting room for growth. Meanwhile, MKX Oil Company and Good Tide are vying for the third position, with Good Tide showing an upward trend by January 2026. This competitive landscape highlights the importance for Choice to innovate and possibly expand its product offerings to increase its market share and challenge Wyld's dominance.

Notable Products

In January 2026, the top-performing product from Choice was Orange Creamsicle Gummies 10-Pack (200mg), debuting at the number one spot with sales of $47,743. Chronic Cherry Berry Soft Chews 10-Pack (200mg) maintained strong performance, ranking second after previously holding the top position in October 2025. Sativa Red Raz Haze Gummies 10-Pack (200mg) dropped to third place from its first-place position in December 2025. Granddaddy Grape Soft Chews 10-Pack (200mg) consistently held fourth place, showing stable performance over the months. Sativa Blue Razz Dream Gummies 10-Pack (200mg) experienced a notable decline, falling from first in November 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.