Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

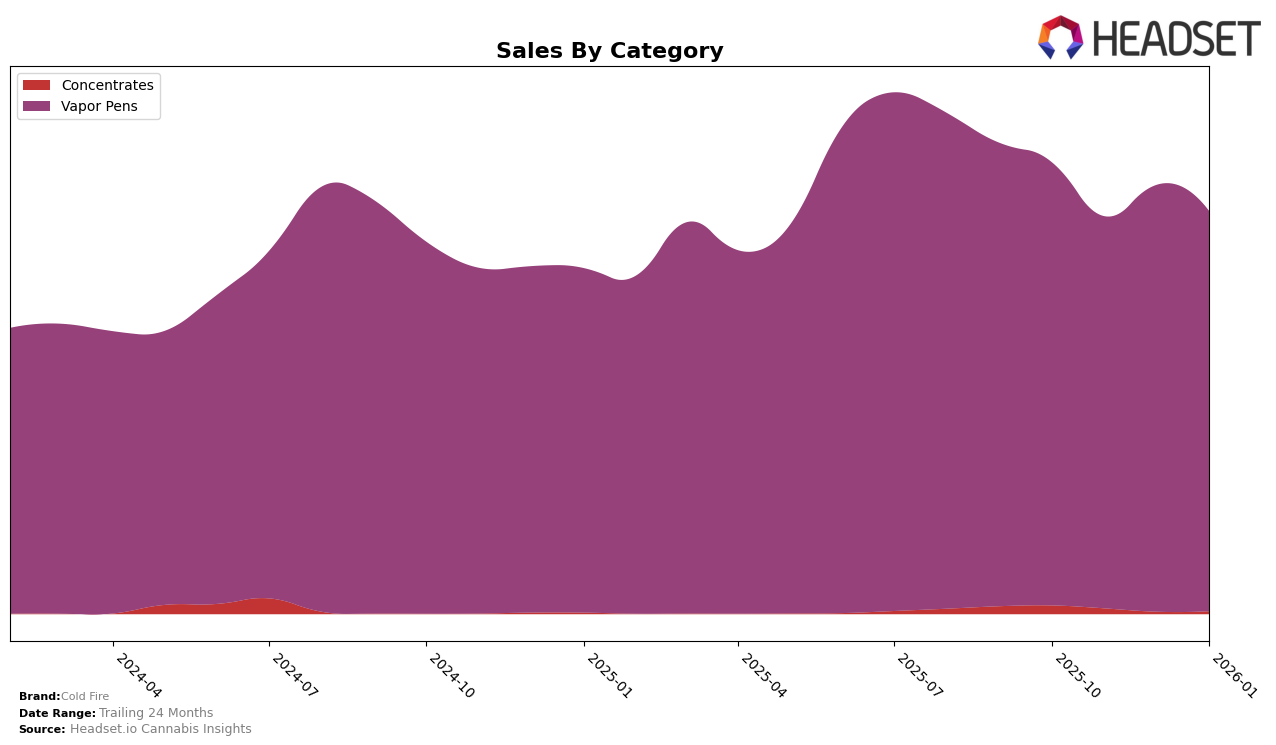

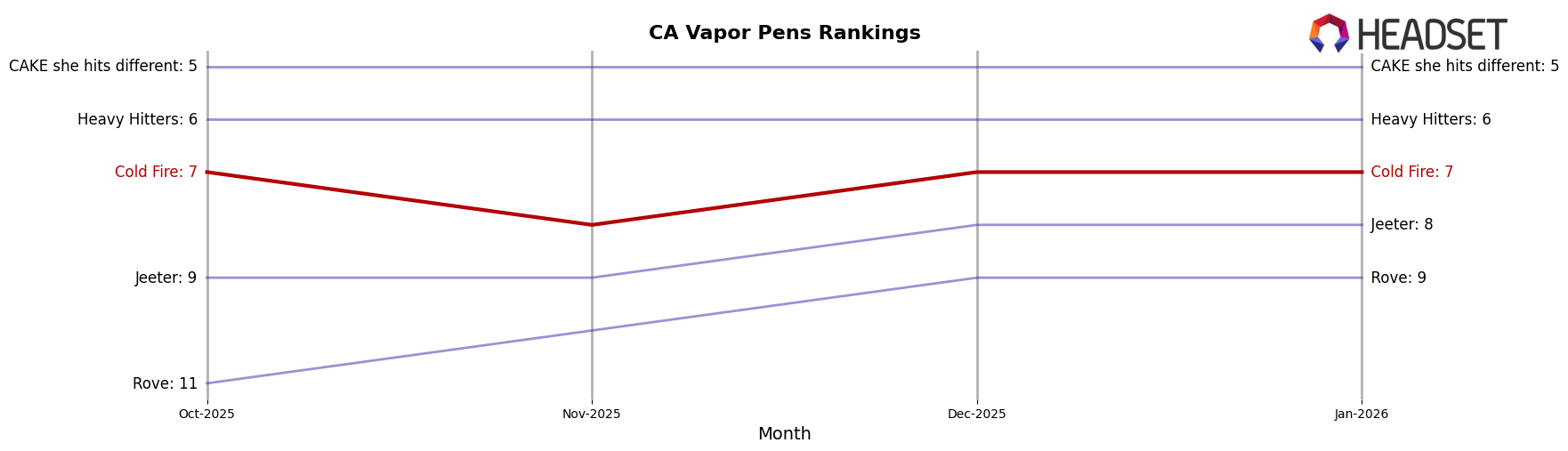

In the state of California, Cold Fire has maintained a consistent presence in the Vapor Pens category over the last few months. Despite a slight dip from 7th to 8th place in November 2025, the brand quickly regained its 7th position by December and maintained it through January 2026. This steady ranking indicates a strong foothold in the California market, which is crucial given the state's large consumer base and competitive landscape. The brand's ability to bounce back to its previous ranking suggests resilience and a loyal customer base.

While Cold Fire's performance in California highlights its strength in the Vapor Pens category, it's important to note that the brand does not appear in the top 30 rankings for any other state or category during this period. This absence could be interpreted as a missed opportunity for expansion or a strategic focus on dominating the California market. The brand's sales figures in California show a slight fluctuation, with a notable dip in November 2025, but overall, they indicate a stable performance. Understanding the dynamics of other markets and categories could provide further insights into Cold Fire's growth potential and strategic direction.

Competitive Landscape

In the competitive landscape of vapor pens in California, Cold Fire has shown fluctuating performance in recent months, maintaining a steady rank of 7th in October and December 2025, and January 2026, but slipping to 8th in November 2025. This slight dip in rank coincides with a drop in sales during November, suggesting potential challenges in maintaining market share. Notably, Heavy Hitters has consistently held the 6th position, indicating a stable presence just above Cold Fire. Meanwhile, Rove and Jeeter have shown gradual improvements, with Rove climbing from 11th to 9th and Jeeter advancing from 9th to 8th by January 2026. The consistent top performance of CAKE she hits different at 5th place highlights a strong competitor in the market. These dynamics suggest that while Cold Fire remains a key player, it faces pressure from both established and rising brands, necessitating strategic efforts to enhance its market position.

Notable Products

In January 2026, the top-performing product from Cold Fire was Bubba's Girl Cured Resin Juice Cartridge (1g) in the Vapor Pens category, which climbed to the number one spot with sales of 2281 units. Tangie Ting Cured Resin Juice Cartridge (1g) maintained its position at rank two, showing consistent demand. Unruly OG Cured Resin Juice Cartridge (1g), previously the top product for three consecutive months, dropped to third place. Papaya Fuel Live Resin Juice Cartridge (1g) entered the rankings at fourth place, while Hawg Cured Resin Juice Cartridge (1g) secured the fifth position. The reshuffling of ranks indicates a dynamic market with shifting consumer preferences among Cold Fire's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.