Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

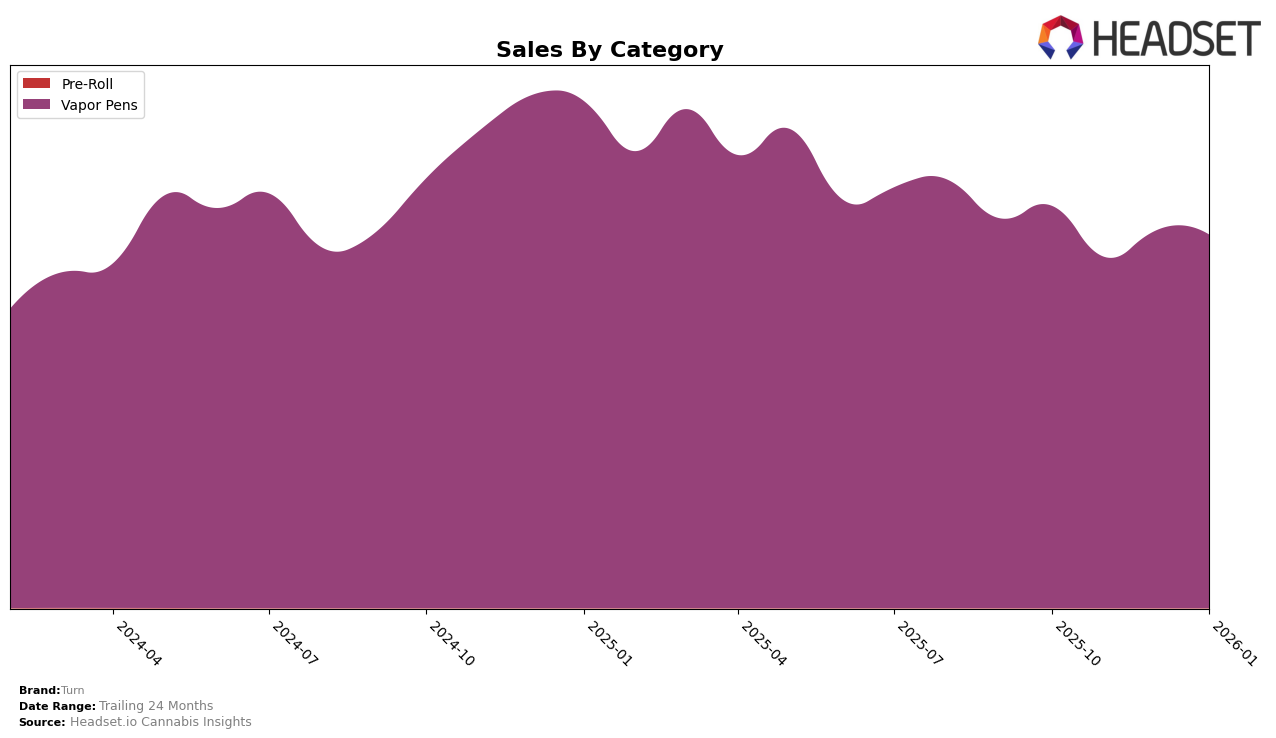

Turn has demonstrated varying performance across different states and categories, with notable trends in the Vapor Pens segment. In Arizona, Turn's ranking in the Vapor Pens category has shown a gradual improvement from 25th in October 2025 to 20th by January 2026, indicating a positive trajectory. This upward movement is supported by a consistent increase in sales over the same period, suggesting strengthening market presence. In contrast, Turn's position in California has remained stable at the 11th rank from November 2025 through January 2026, highlighting a steady performance in a competitive market. However, the sales figures in California have shown a slight decline, which could be a point of concern for sustaining its position in the future.

In New York, Turn has made significant strides in the Vapor Pens category, climbing from the 21st position in October 2025 to 17th by January 2026. This improvement is mirrored by a notable increase in sales, indicating growing consumer acceptance and market penetration. The brand's ability to break into the top 20 in New York is a positive indicator of its expanding footprint. However, the absence of Turn in the top 30 rankings in any other categories across the states suggests areas where the brand might need to focus on diversification or improvement. This mixed performance across states and categories provides a nuanced picture of Turn's market dynamics and potential areas for strategic growth.

Competitive Landscape

In the competitive landscape of vapor pens in California, Turn has experienced a slight decline in its ranking over recent months, moving from 10th in October 2025 to 11th by January 2026. This shift is notable as competitors such as Rove and Dime Industries have maintained or improved their positions, with Rove climbing from 11th to 9th and Dime Industries holding steady at 10th. Meanwhile, West Coast Cure and Bloom have shown upward momentum, with West Coast Cure moving from 14th to 12th and Bloom from 16th to 13th. Despite Turn's sales decreasing over this period, it remains competitive, though the brand may need to strategize to regain its earlier position amidst the dynamic shifts among its rivals.

Notable Products

In January 2026, the top-performing product for Turn was the Granddaddy Purple Live Resin Disposable Pod, reclaiming its number one position with sales of 8,597 units. This product consistently held the top spot from October through November 2025, briefly dropping to second place in December. The Strawberry Haze Botanical Blends Oil Disposable Pod moved to second place with 8,440 units sold, maintaining a strong position after briefly topping the December 2025 rankings. The Watermelon Sugar High Live Resin Disposable Pod remained steady in third place, although its sales dropped significantly to 4,792 units. Notably, the Dragon Fruit Acai Botanical Blend Live Resin Disposable Pod debuted in the rankings at fifth place, indicating a promising entry into Turn's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.