Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

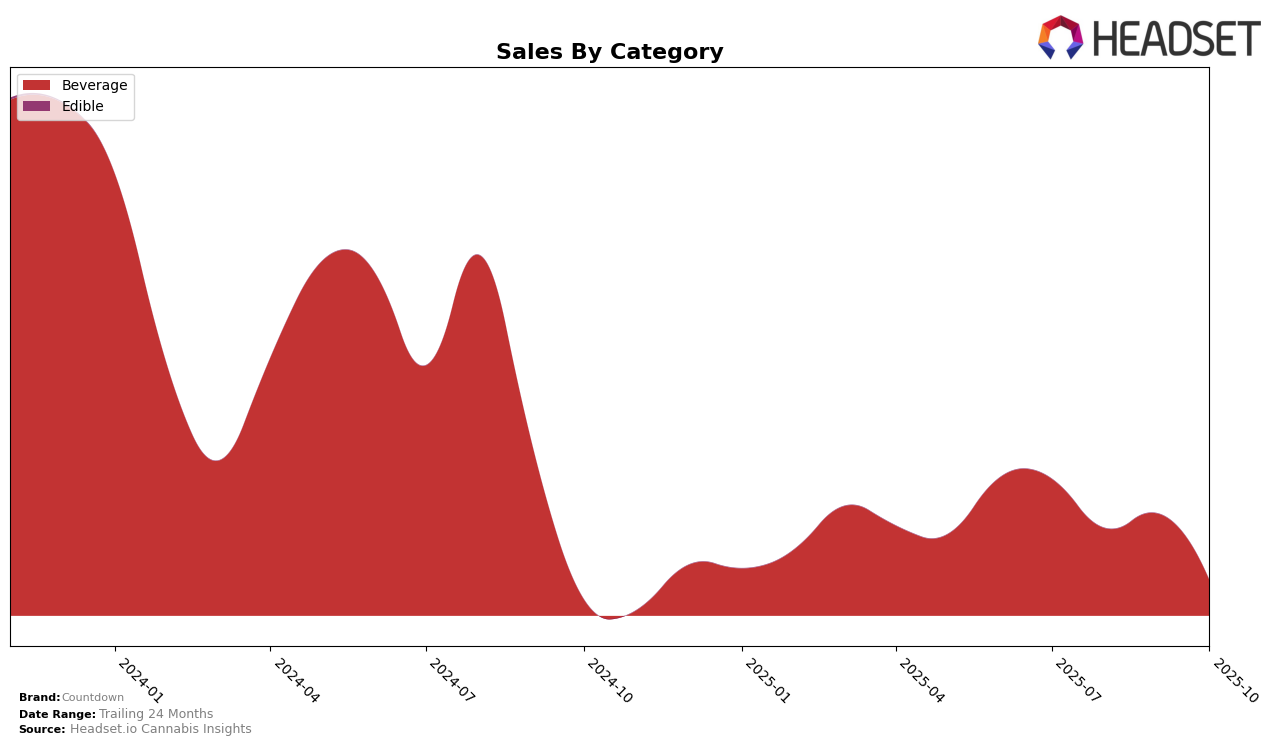

In the state of Missouri, Countdown has shown some interesting movements in the Beverage category over the past few months. In July 2025, Countdown ranked 8th, but by September, the brand had slipped to 11th place. Notably, Countdown did not appear in the top 30 rankings for August and October, which could be a point of concern for the brand. This fluctuation suggests a volatile performance in Missouri's Beverage market, where maintaining a consistent presence in the top ranks is crucial for sustained visibility and sales growth.

Examining the sales figures, Countdown's performance in Missouri's Beverage category saw a decline from July to September. Despite not being in the top 30 in August and October, the brand achieved sales of $15,015 in July, which indicates a strong start to the quarter. However, the drop in ranking and absence in the top 30 in subsequent months suggest that Countdown may need to reassess its market strategies to regain and sustain its competitive edge in Missouri. The lack of top 30 presence in multiple months could be seen as a negative indicator, potentially impacting overall brand perception and market share in the region.

Competitive Landscape

In the Missouri beverage category, Countdown has experienced notable fluctuations in its market ranking over recent months. In July 2025, Countdown held the 8th position, but it dropped out of the top 20 in August, indicating a significant decline in its market presence. By September, Countdown re-entered the rankings at 11th place, but again fell out of the top 20 by October. This inconsistency contrasts with competitors like SoGanja, which maintained a stable rank of 6th place from July to September before slipping slightly to 7th in October. Similarly, Franklin's demonstrated steadiness, holding ranks between 7th and 8th throughout the same period. The fluctuations in Countdown's rank suggest challenges in maintaining consistent sales performance, especially when compared to the more stable trajectories of its competitors. This volatility could signal potential areas for strategic improvement to bolster Countdown's market position.

Notable Products

In October 2025, Countdown's top-performing product was Cosmic Lemonade Seltzer (100mg THC, 12oz) in the Beverage category, maintaining its number one rank consistently since July. Despite a slight decrease in sales from previous months, with 553 units sold in October, it remains unmatched in popularity. This product has shown remarkable stability, holding the top position across all months analyzed. Other products in the portfolio have seen fluctuating ranks, but none have surpassed Cosmic Lemonade Seltzer's consistent performance. The Beverage category continues to be a strong performer for Countdown, driven largely by the success of this flagship product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.