Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

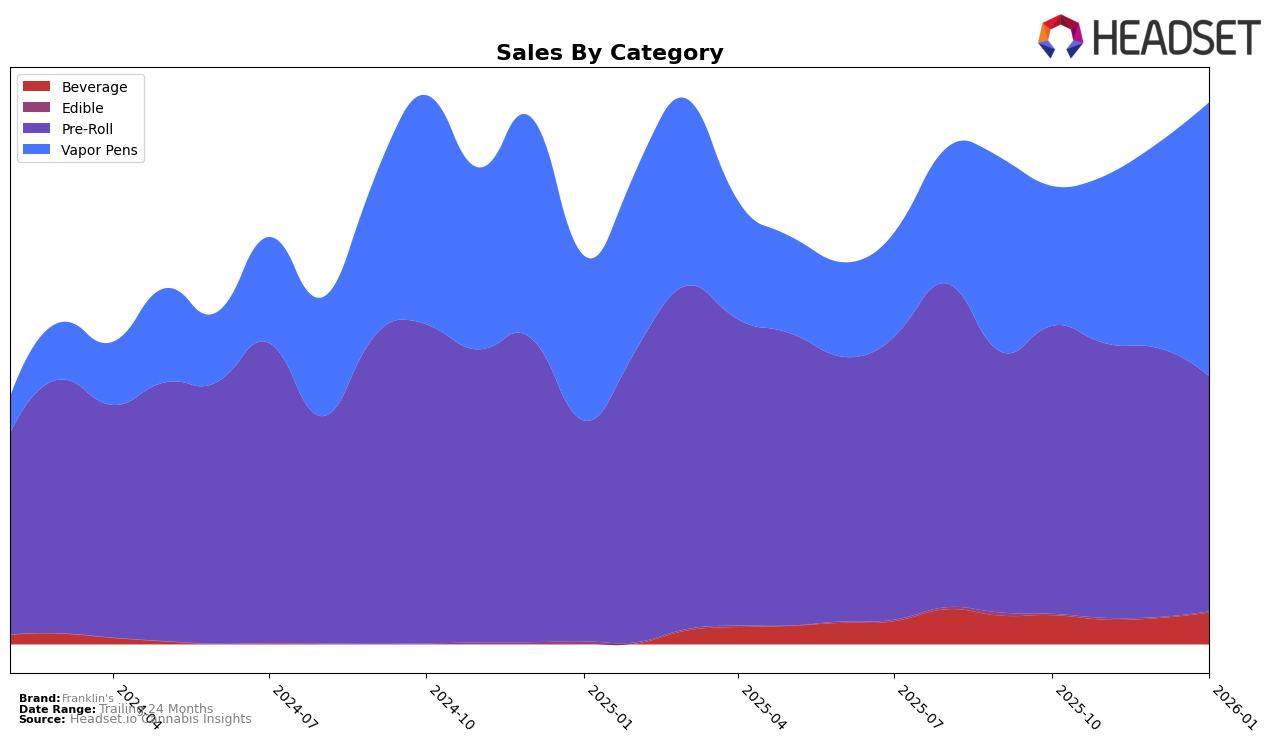

Franklin's has demonstrated a notable performance in the cannabis market of Missouri across several categories. In the Beverage category, Franklin's has maintained a consistent presence, securing the 8th position from October through December 2025, before advancing to the 7th position in January 2026. This upward movement suggests a positive reception and growing consumer preference for their beverage offerings. Furthermore, Franklin's has shown remarkable progress in the Vapor Pens category, climbing from a rank of 40 in October 2025 to 28 by January 2026. This significant leap indicates a strong upward trend in consumer demand for their vapor pens, which could be attributed to either product innovation or effective market strategies.

Conversely, Franklin's performance in the Pre-Roll category in Missouri has seen a slight decline. The brand held the 18th position from October through December 2025 but dropped to the 20th position in January 2026. This movement might suggest increased competition or a shift in consumer preferences within the pre-roll segment. Despite the drop, Franklin's remains within the top 30 brands, indicating a stable yet challenging position in the market. It's also worth noting that Franklin's was not listed in the top 30 for certain categories, which could either reflect strategic decisions to focus on specific product lines or potential areas for growth and market penetration.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Franklin's has demonstrated a notable upward trajectory in both rank and sales over the past few months. Starting from a rank of 40 in October 2025, Franklin's climbed to 28 by January 2026, showcasing a significant improvement compared to its competitors. This rise is particularly impressive when contrasted with brands like Curio Wellness and Kusch, which have seen more modest rank improvements. Meanwhile, Heartland Labs experienced a decline in sales, which may have contributed to Franklin's gaining ground. Local Cannabis Co. also showed a positive trend, but Franklin's sales growth was more pronounced, indicating a strong market presence and potential for continued success. This upward momentum positions Franklin's as a formidable player in the Missouri vapor pen market.

Notable Products

In January 2026, Berries & Cherries Distillate Cartridge (1g) reclaimed its position as the top-performing product for Franklin's, with sales reaching 1513 units. Galactic Glue Distillate Cartridge (1g) rose to the second position, maintaining strong sales momentum from December 2025. Kush Kingdom Distillate Cartridge (1g) secured the third spot, falling one rank from December. Koughman Stadium Distillate Cartridge (1g) witnessed a drop, moving to the fourth position after leading in November and December. Lastly, Draco Distillate Cartridge (1g) remained consistent in the rankings, finishing January in fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.