Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

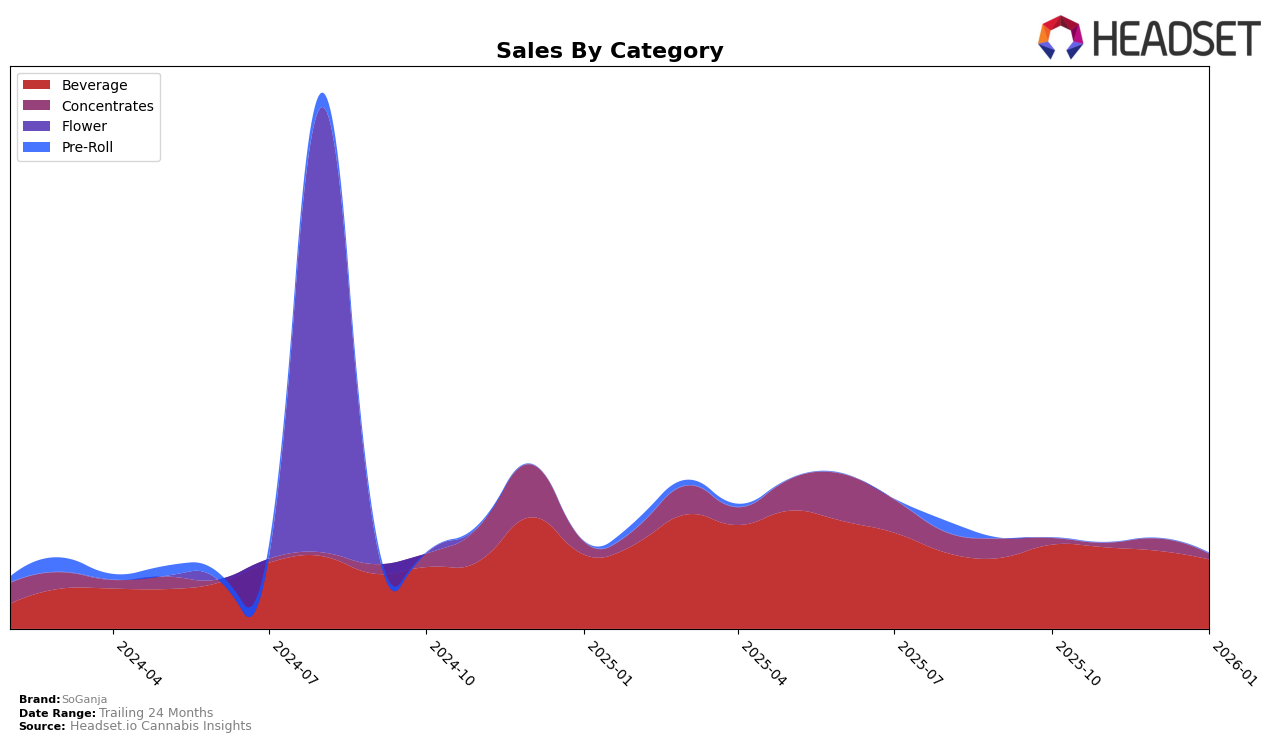

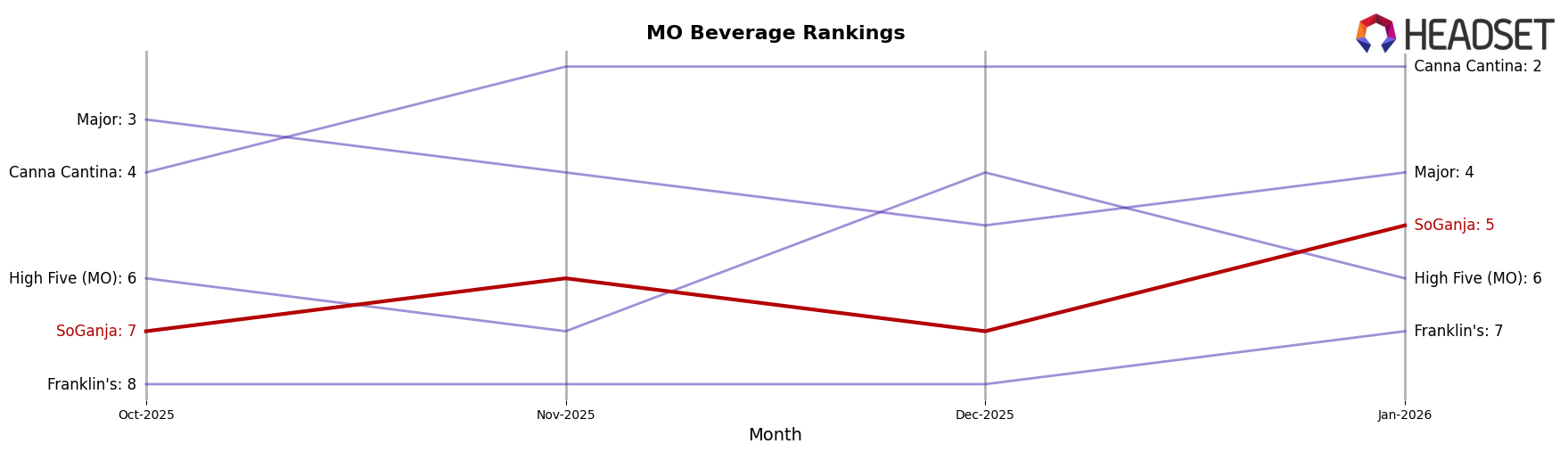

SoGanja has demonstrated notable performance across different categories and states, with particular strength in the Missouri market. In the Beverage category, SoGanja has maintained a consistent presence within the top 10 brands over the past few months. Starting from a rank of 7 in October 2025, the brand improved to 6 in November before returning to 7 in December, and then climbing to 5 in January 2026. This upward trend in rankings suggests a positive reception and growing demand for SoGanja's beverage offerings in Missouri, despite a gradual decline in sales figures over the same period.

Interestingly, outside of Missouri, SoGanja's performance in other states and categories is less prominent, as they do not appear in the top 30 rankings. This absence could be interpreted as a challenge for the brand to increase its visibility and market share in these areas. The contrast between its stronghold in Missouri and the lack of presence elsewhere highlights potential opportunities for strategic expansion and marketing efforts. Understanding the dynamics of these markets could be crucial for SoGanja to replicate its Missouri success in other regions.

Competitive Landscape

In the competitive landscape of the beverage category in Missouri, SoGanja has shown a dynamic shift in rankings over the past few months. Starting at rank 7 in October 2025, SoGanja improved to rank 6 in November, dipped back to 7 in December, and then climbed to rank 5 in January 2026. This fluctuation indicates a competitive market where SoGanja is gaining traction, especially against brands like Franklin's, which consistently held the 8th position. However, SoGanja faces stiff competition from Major and High Five (MO), both of which have shown strong sales figures, with Major consistently ranking higher. Notably, Canna Cantina has maintained a top-tier position, indicating a significant lead in sales, which presents a challenge for SoGanja to capture more market share. The overall trend suggests that while SoGanja is making strides, there is a need for strategic initiatives to further improve its ranking and sales in this competitive market.

Notable Products

In January 2026, the top-performing product from SoGanja was Starberry Cream Live Rosin Soda (25mg), reclaiming the first position after slipping to third in December 2025, with sales of 725 units. Rocket Rootbeer (Burger Belts) Live Rosin Soda (25mg THC, 12oz) maintained a strong performance, ranking second after leading in both November and December 2025. Galactic Grape (Mimosa Pie) Live Rosin Soda (25mg THC, 12oz) held steady in the third position, despite a slight dip in sales. Blue Buzzberry (Fruit Cocktail #5) Soda (25mg THC, 12oz) consistently ranked fourth, showing a gradual decline in sales over the months. Cosmic Creamsicle (Super Jedi) Live Resin Soda (25mg THC, 12oz, 355ml) remained in fifth place, experiencing a continuous decrease in sales figures since October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.