Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

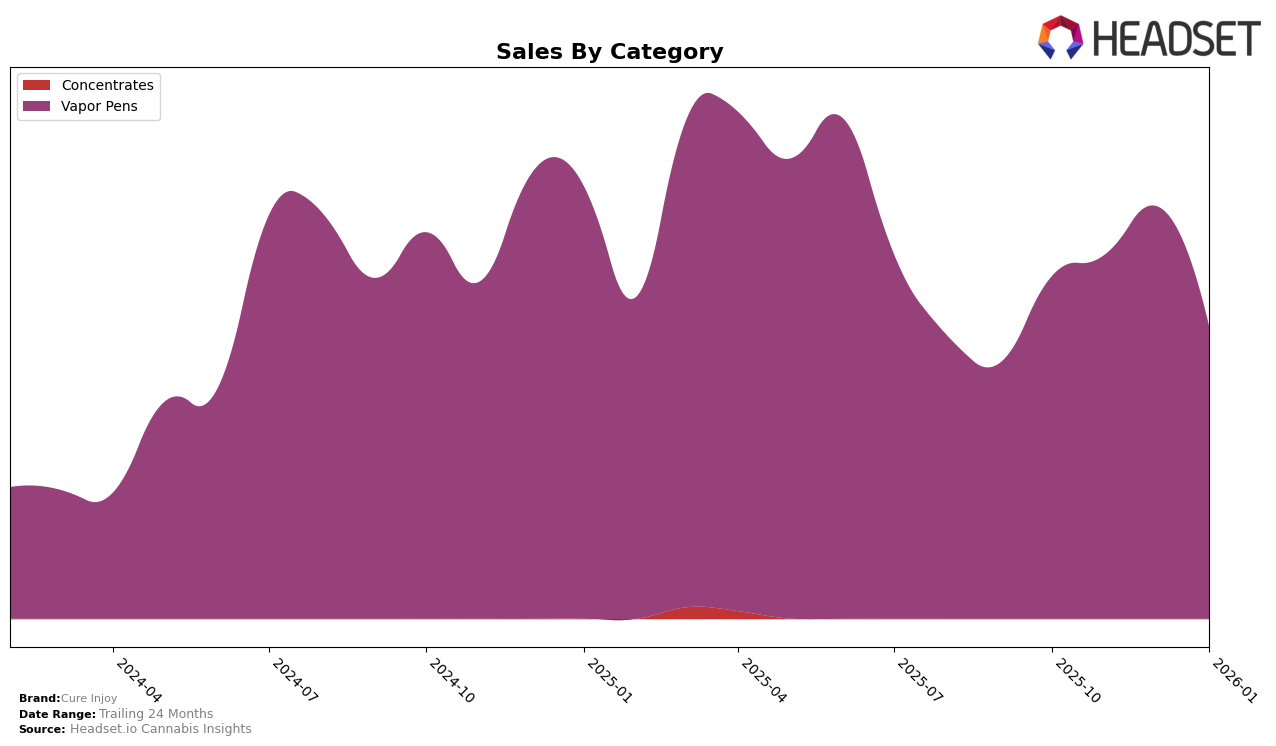

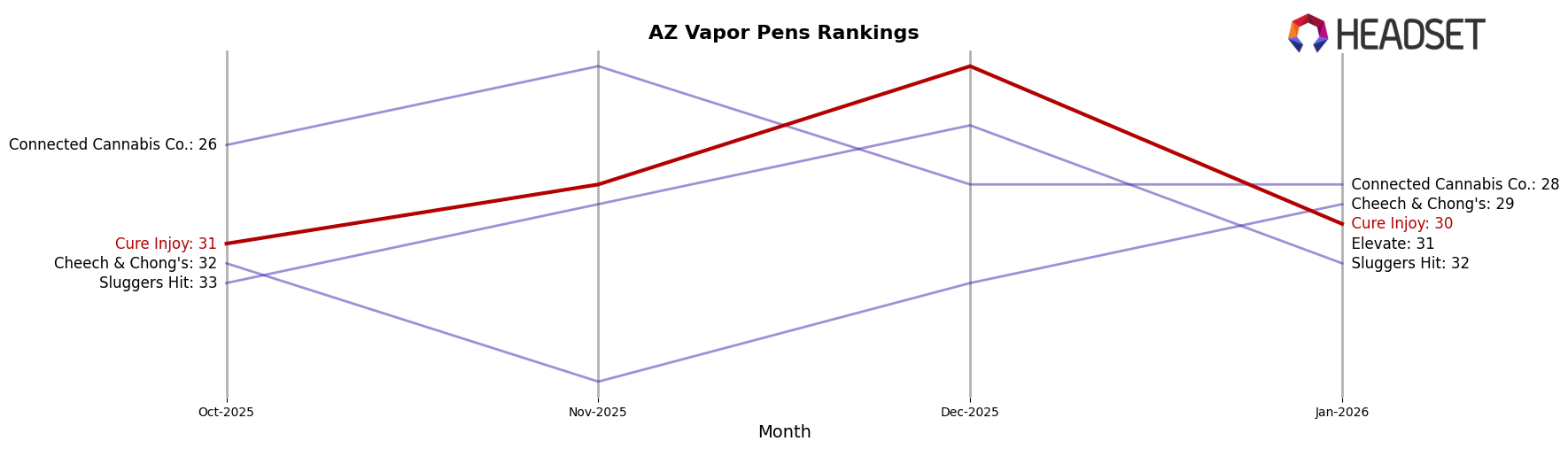

Cure Injoy's performance in the Vapor Pens category has shown varied results across different states. In Arizona, the brand managed to secure a spot within the top 30, with rankings improving from 31st in October 2025 to 22nd by December 2025, before slightly dropping to 30th in January 2026. This indicates a positive trend over the quarter, although the dip in January suggests a potential seasonal or competitive influence. The sales figures in Arizona reflect a peak in December, suggesting a successful holiday season, but the subsequent decline in January could be a point of concern for sustaining momentum.

In contrast, Cure Injoy's presence in California remains outside the top 30 rankings, with positions hovering in the 90s throughout the observed months. Despite a consistent presence, the brand's inability to break into the top 30 highlights challenges in penetrating the competitive California market. Sales figures in California show a slight decline from October to January, suggesting that while the brand maintains a steady presence, it may need strategic adjustments to improve its standing in this key market. Understanding the competitive landscape and consumer preferences in California could be crucial for Cure Injoy to enhance its performance in the Vapor Pens category.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Cure Injoy has demonstrated notable fluctuations in its market position over the past few months. In October 2025, Cure Injoy was ranked 31st, but it climbed to 22nd by December 2025, indicating a significant improvement in its market standing. However, by January 2026, it slipped to 30th, suggesting challenges in maintaining its competitive edge. Despite this, Cure Injoy's sales in December 2025 were notably higher compared to its competitors, such as Connected Cannabis Co. and Cheech & Chong's, which both experienced lower sales figures. Sluggers Hit also saw a decline in January 2026, which may have influenced Cure Injoy's relative positioning. Meanwhile, Elevate re-entered the top 20 in January 2026, further intensifying the competition. These dynamics highlight the volatile nature of the vapor pen market in Arizona and underscore the importance for Cure Injoy to strategize effectively to sustain its sales momentum and improve its rank.

Notable Products

In January 2026, Pink Panties Distillate Disposable (1g) reclaimed its top position among Cure Injoy's products, with sales reaching 1,422 units. Strawnana Distillate Disposable (1g) slipped to the second spot after leading in December 2025, indicating a decrease in demand. Passion Fruit Live Resin Disposable (1g) made a remarkable entry at the third rank, showing a strong sales performance with 892 units sold. Big Kiwi Live Resin Disposable (1g) and Pineapple Dream Distillate Disposable (1g) debuted at fourth and fifth positions, respectively, suggesting a growing interest in live resin products. The shifts in rankings highlight a dynamic market where product preferences are rapidly evolving.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.