Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

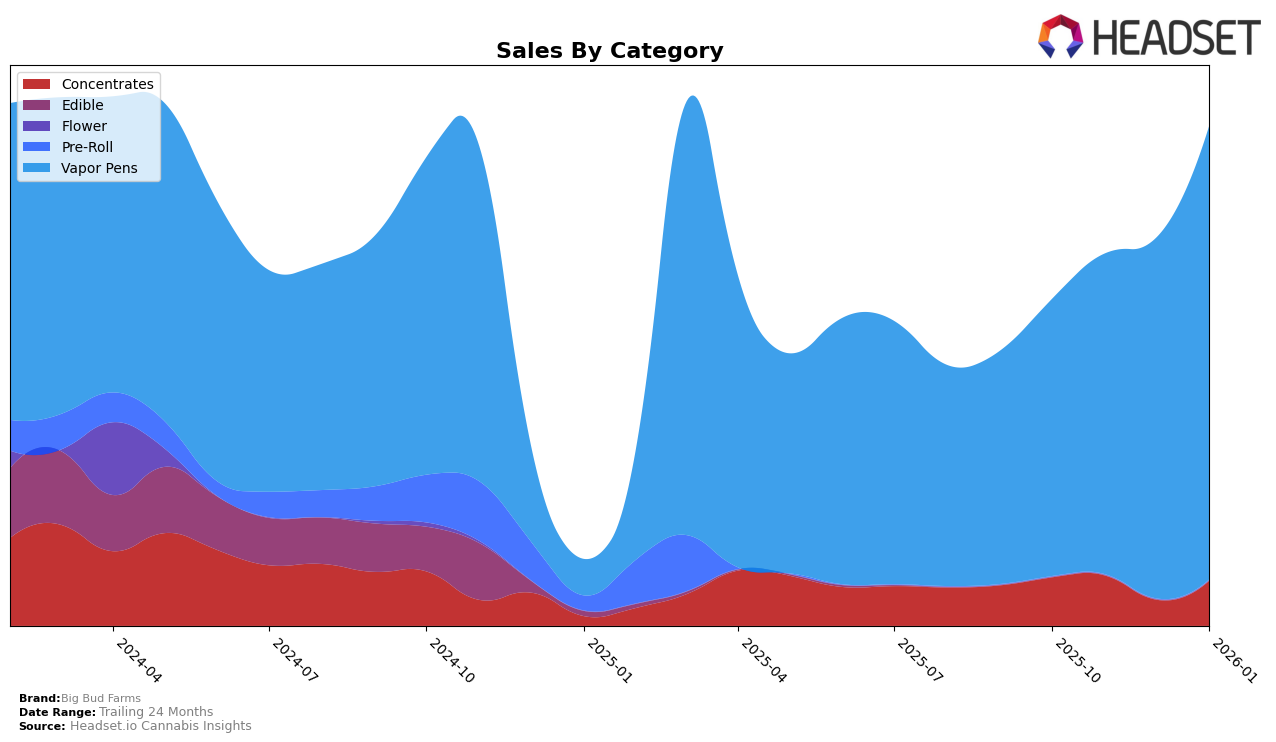

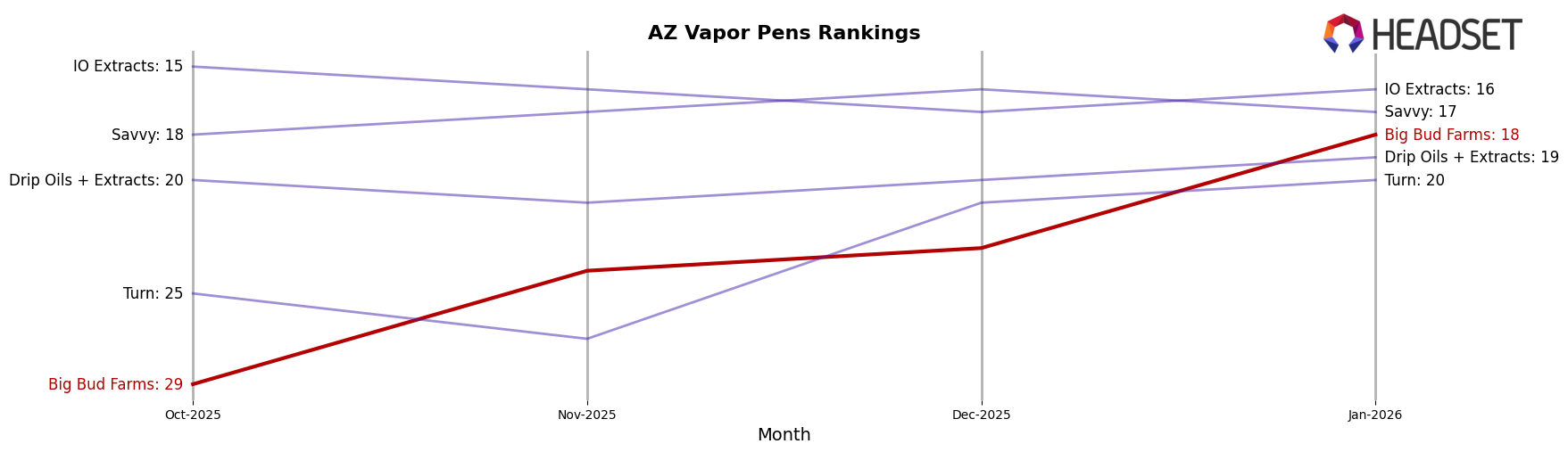

Big Bud Farms has shown varying performance across different product categories and states. In the Arizona market, the brand's presence in the Concentrates category has been inconsistent, with rankings fluctuating from 34th in October 2025 to 35th in January 2026, indicating they were not in the top 30 during this period. This could suggest challenges in maintaining a competitive edge or shifts in consumer preferences. Conversely, their Vapor Pens category has shown a positive trajectory, with the brand climbing from 29th position in October 2025 to an impressive 18th by January 2026. This upward movement highlights their growing popularity and possibly effective strategies in this category.

The sales figures further illustrate these trends. While the Concentrates category saw a decline in sales from November to December 2025, the Vapor Pens category experienced a consistent increase, peaking in January 2026. This suggests that Big Bud Farms is gaining traction in the vapor pen market, potentially due to product innovations or successful marketing efforts. However, the absence of a top 30 ranking in the Concentrates category during these months indicates areas where the brand might need to focus on revitalizing its strategy to regain its competitive position. Exploring the reasons behind these movements could provide deeper insights into the brand's overall market strategy and consumer engagement.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Big Bud Farms has shown a notable upward trajectory in rankings from October 2025 to January 2026. Initially ranked 29th in October, Big Bud Farms climbed to 18th by January, indicating a significant improvement in market presence. This rise in rank is accompanied by a steady increase in sales, suggesting effective strategies in capturing consumer interest. In contrast, competitors such as IO Extracts and Savvy maintained relatively stable positions, with IO Extracts slightly declining from 15th to 16th and Savvy fluctuating between 16th and 17th. Meanwhile, Drip Oils + Extracts and Turn also showed minor rank changes, with Drip Oils + Extracts moving from 20th to 19th and Turn improving from 25th to 20th. These dynamics highlight Big Bud Farms' aggressive market penetration and potential for continued growth in the Arizona vapor pen category.

Notable Products

In January 2026, Big Bud Farms' top-performing product was the Super Lemon Haze Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank for four consecutive months with sales of $850. The Berry Bliss Distillate Disposable (1g) emerged as the second-best seller, marking its debut in the rankings. Granddaddy Purple Distillate Disposable (1g) secured third place, closely followed by Wedding Cake Distillate Disposable (1g), which dropped from its previous third rank in December 2025 to fourth. God's Gift Distillate Disposable (1g) rounded out the top five, making its first appearance in the rankings. Notably, the Vapor Pens category dominated the top ranks, reflecting a strong consumer preference for these products in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.