Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

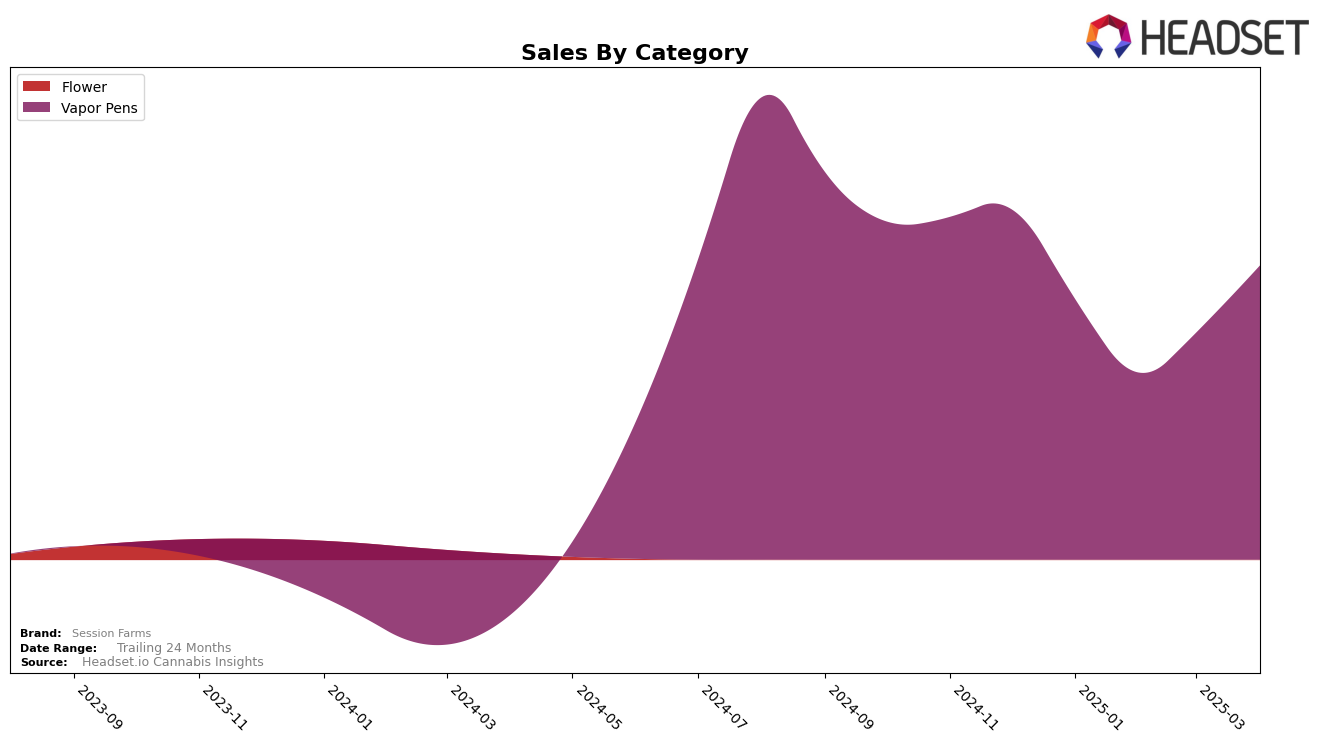

Session Farms has shown notable fluctuations in their performance across various states and categories, particularly in the Vapor Pens category. In Arizona, Session Farms experienced a significant improvement in their ranking from the start of the year, moving from 25th place in January to a commendable 19th place by April. This upward trajectory suggests a growing consumer interest or effective market strategies in this state. However, it's worth noting that they momentarily dropped out of the top 30 in February, indicating some volatility in their performance. Despite this, the recovery in subsequent months highlights a positive trend worth watching.

In terms of sales, Session Farms saw an impressive increase in their total sales figures in Arizona, with April sales reaching a high point compared to the beginning of the year. This growth could be attributed to strategic market positioning or an increase in consumer demand for their Vapor Pens. The brand's ability to recover and surpass their initial rankings after a dip in February is a testament to their resilience and potential for future growth in the state. However, the absence from the top 30 in February indicates areas where the brand may need to focus on sustaining its market presence consistently.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Session Farms has demonstrated a notable upward trajectory in the first quarter of 2025, particularly in April where it climbed to the 19th rank from being outside the top 20 in January. This improvement is significant, especially when compared to competitors like Turn, which consistently maintained a higher rank, peaking at 15th in March before dropping slightly to 18th in April. Meanwhile, CAKE she hits different experienced fluctuations, dropping from 15th in January to 21st in April, indicating potential volatility. Micro Bar showed steady performance, hovering around the mid-teens, while Cure Injoy made a significant leap from 34th in January to 20th in April. Session Farms' sales in April surpassed those of CAKE she hits different, suggesting a positive momentum that could be capitalized on to further improve its market position.

Notable Products

In April 2025, Blue Dream Live Resin Disposable (1g) emerged as the top-performing product for Session Farms, achieving the number one rank in the Vapor Pens category with sales of 1,343 units, marking a significant rise from its third position in March. Mule Fuel Live Resin Disposable (1g) secured the second spot, re-entering the rankings after not being listed in February and March, with notable sales momentum. G6 OG Live Resin Disposable (1g) climbed to third place from fourth in March, indicating steady growth. Las Vegas Triangle Kush Live Resin Disposable (1g) dropped from second to fourth place, while Royal Cherry Diesel Live Resin Disposable (1g) made its first appearance in the rankings at fourth, sharing the position with Las Vegas Triangle Kush. The data highlights a dynamic shift in product popularity within the Vapor Pens category over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.