Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

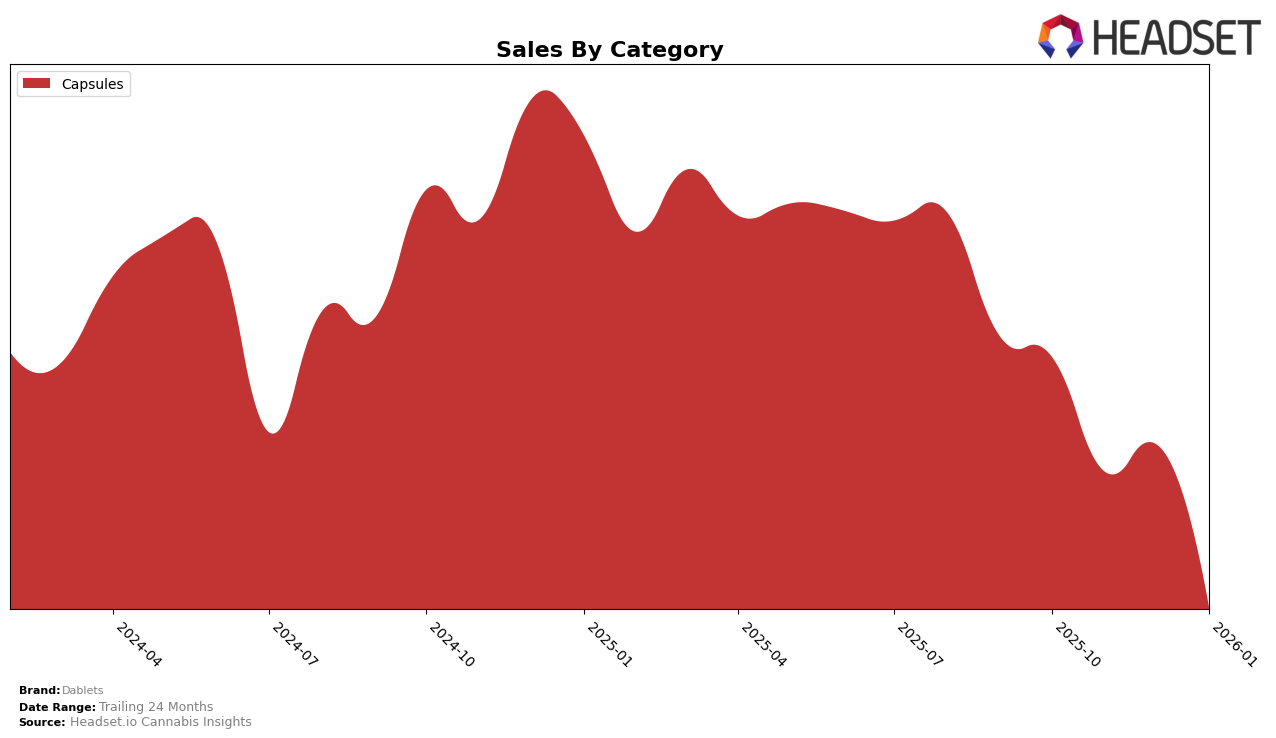

Dablets has shown consistent performance in the Capsules category in Colorado, maintaining a steady rank at number 2 from October 2025 through January 2026. This stability suggests a strong foothold in the market, despite a noticeable decline in sales from $44,402 in October 2025 to $29,036 in January 2026. The ability to maintain a high ranking amidst declining sales indicates that Dablets may be facing increasing competition or changing consumer preferences, yet still commands a significant portion of the market share.

It's important to note that Dablets' absence from the top 30 brands in other states or provinces during this period suggests a limited geographic reach or varying competitive dynamics in those regions. This could be seen as a drawback if the brand aims to expand its influence beyond Colorado. However, their strong performance in one state might indicate a strategic focus on markets where they have established a robust presence, potentially allowing them to concentrate resources and marketing efforts to bolster their position further.

Competitive Landscape

In the competitive landscape of the Capsules category in Colorado, Dablets consistently holds the second rank from October 2025 to January 2026. Despite maintaining this position, Dablets faces a significant sales gap when compared to the leading brand, Ripple (formerly Stillwater Brands), which has consistently secured the top spot during the same period. Ripple's sales figures are notably higher, indicating a strong market presence and customer preference. Dablets' sales show a declining trend from October 2025 to January 2026, which could be a concern if the trend continues, potentially impacting its ability to close the gap with Ripple. This analysis highlights the need for Dablets to strategize effectively to enhance its market share and possibly explore innovative marketing tactics or product enhancements to boost sales and challenge the dominance of Ripple in the Colorado Capsules market.

Notable Products

In January 2026, Dablets' top-performing product was Sativa Energy Tablets 10-Pack (100mg) in the Capsules category, maintaining its number one rank consistently since October 2025, despite a sales drop to 2653 units. Indica Sleep Tablets 10-Pack (100mg) also held its second-place position throughout the same period. Max Relief Dablets 20-Pack (1000mg) improved its standing, rising from fourth to third place, although its sales remained low at 21 units. The CBD/THC 4:1 Daily Plus Capsules did not rank in January 2026, having been consistently third in the preceding months. This indicates a stable preference for energy and sleep aids among consumers, with slight shifts in the lower rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.