Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

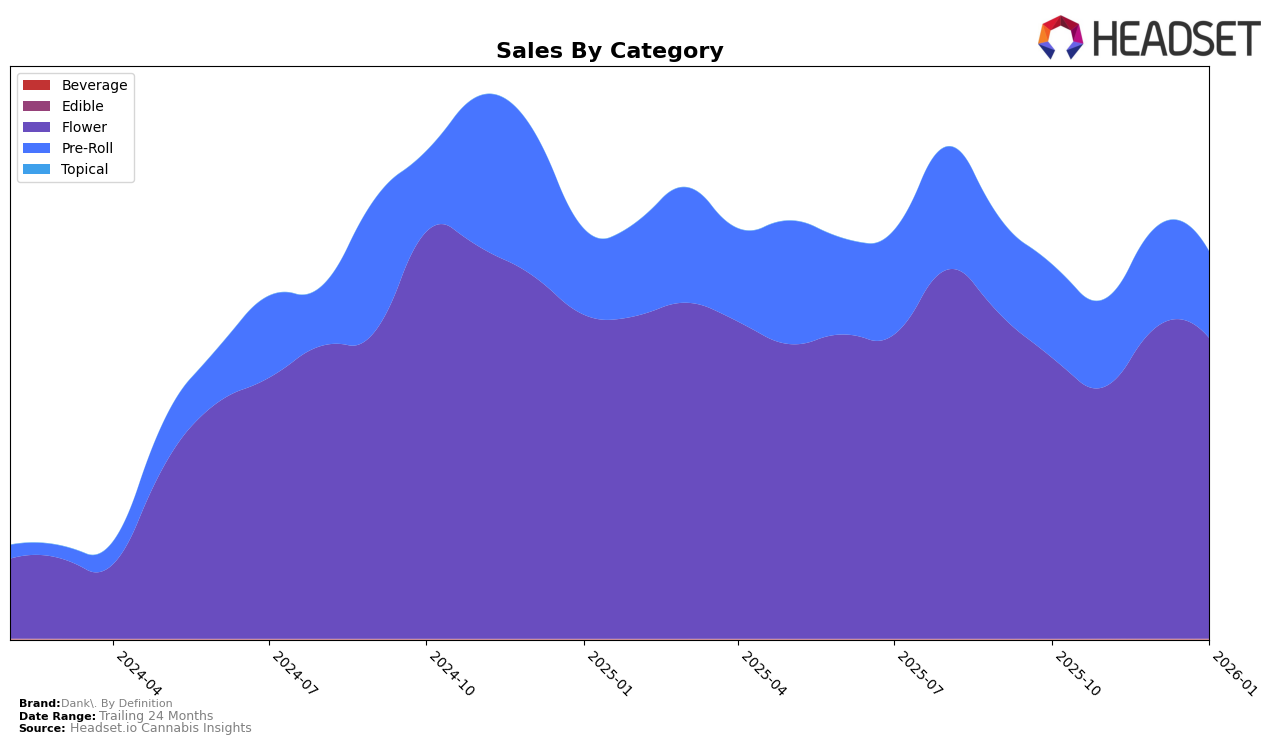

Dank. By Definition has demonstrated a consistent and impressive performance in the New York market, particularly in the Flower category, where it maintained the top position from October 2025 to January 2026. This consistency indicates a strong brand presence and consumer trust in this category. Despite fluctuations in sales figures, the brand's ability to hold the number one rank suggests effective strategies in maintaining customer loyalty and market share. However, it's important to note that while the Flower category remains robust, the Pre-Roll category, though consistently ranked third, shows a slight dip in sales from December to January, which could be a point of concern for future strategic adjustments.

The performance of Dank. By Definition in the Pre-Roll category in New York has been stable, maintaining a third-place ranking over the same period. While this is commendable, the absence from the top two positions might indicate room for growth and competition from other brands. The sales figures in Pre-Roll have experienced a decline from December to January, which may suggest seasonal trends or increased competition. This stability in rankings, despite the sales dip, could imply a loyal customer base but also highlights the need for potential innovation or marketing efforts to climb higher in the rankings.

Competitive Landscape

In the competitive landscape of the New York flower category, Dank. By Definition has maintained a consistent lead, holding the number one rank from October 2025 through January 2026. This stability at the top is indicative of strong brand loyalty and effective market strategies. However, the brand faces competition from Leal, which consistently ranks second, suggesting a close rivalry. Meanwhile, Find. has shown notable upward movement, improving from fifth place in October 2025 to third by January 2026, which could signal a growing threat if this trend continues. While Dank. By Definition's sales figures have fluctuated, peaking in December 2025, the brand's ability to maintain its top rank amidst these shifts highlights its resilience and market strength. This competitive analysis underscores the importance of continuous innovation and customer engagement to sustain its leading position in a dynamic market.

Notable Products

In January 2026, the top-performing product for Dank. By Definition was Alaskan Thunderfuck Pre-Roll (1g) in the Pre-Roll category, which climbed to the number one rank with notable sales of $5,031. Alien Cookies Pre-Roll (1g) followed closely as the second best-seller, making a strong debut in the rankings. Randy Marsh (3.5g) in the Flower category experienced a slight drop to third place after leading in December 2025. Biggie Smalls OG Pre-Roll (1g) and Gorilla Candy Pre-Roll (1g) secured the fourth and fifth positions respectively, both entering the rankings for the first time. The shifts in rankings highlight a dynamic market where new entries can quickly rise to prominence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.