Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

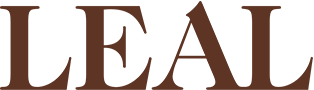

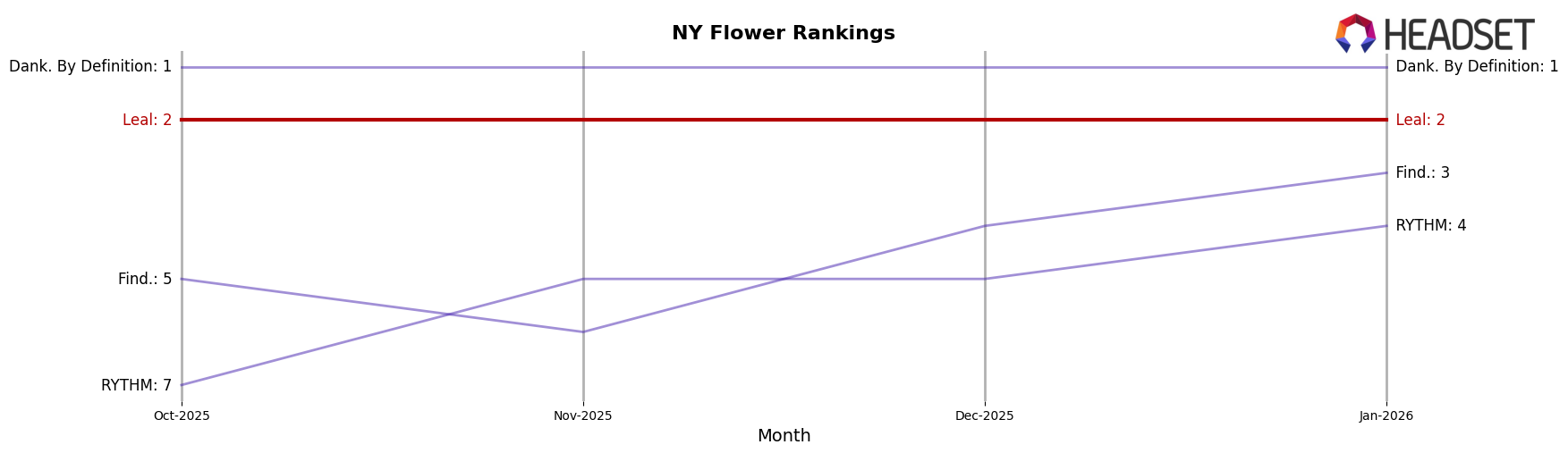

Leal has demonstrated a consistently strong performance in the Flower category in New York, maintaining a solid rank of 2nd place from October 2025 through January 2026. This stability in ranking is accompanied by an upward trend in sales, peaking in December 2025 before seeing a slight dip in January 2026. This indicates a robust market presence and consumer loyalty within the Flower category. In contrast, Leal's performance in the Pre-Roll category shows more variability, with rankings fluctuating between 8th and 12th place during the same period. This suggests a more competitive landscape for Pre-Rolls, where Leal faces challenges in maintaining a top-tier position.

The shifting ranks in the Pre-Roll category highlight areas of potential improvement for Leal, as they strive to climb back into a more favorable position. Notably, while the Flower category has shown a marked increase in sales, the Pre-Roll category experienced a dip in sales in December before recovering somewhat in January. This recovery could indicate effective strategic adjustments or seasonal factors influencing consumer preferences. The absence of Leal from the top 30 in other states or categories could be seen as an opportunity for expansion and growth, or it may reflect the brand's strategic focus on specific markets like New York. Understanding these dynamics is crucial for Leal to leverage its strengths and address areas where it can enhance its market presence.

Competitive Landscape

In the competitive landscape of the New York flower category, Leal consistently holds the second rank from October 2025 to January 2026, demonstrating a stable position amidst dynamic market shifts. Despite its steadfast ranking, Leal faces fierce competition from Dank. By Definition, which maintains the top spot throughout the same period. Leal's sales figures, while impressive, show a slight dip in January 2026, suggesting potential challenges in maintaining momentum. Meanwhile, RYTHM and Find. are climbing the ranks, with RYTHM advancing from seventh to fourth place and Find. moving from fifth to third by January 2026, indicating increasing competition. These shifts highlight the importance for Leal to innovate and adapt to sustain its market position and capitalize on growth opportunities in the evolving New York flower market.

Notable Products

In January 2026, Hella Jelly Pre-Roll (1g) emerged as the top-performing product for Leal, maintaining its number one rank from November 2025 and achieving a significant sales figure of 16,371 units. All Gas OG Pre-Roll (1g) debuted in the rankings at the second position, contributing to a strong sales performance. Lemon Venom Pre-Roll (1g) secured the third spot, showing a robust entry into the rankings. Queen of Diamonds Pre-Roll (1g) improved from fifth to fourth place, indicating a positive shift in consumer preference. Lastly, Thin Mint GSC Pre-Roll (1g) dropped from third to fifth, suggesting a slight decrease in its market appeal.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.