Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

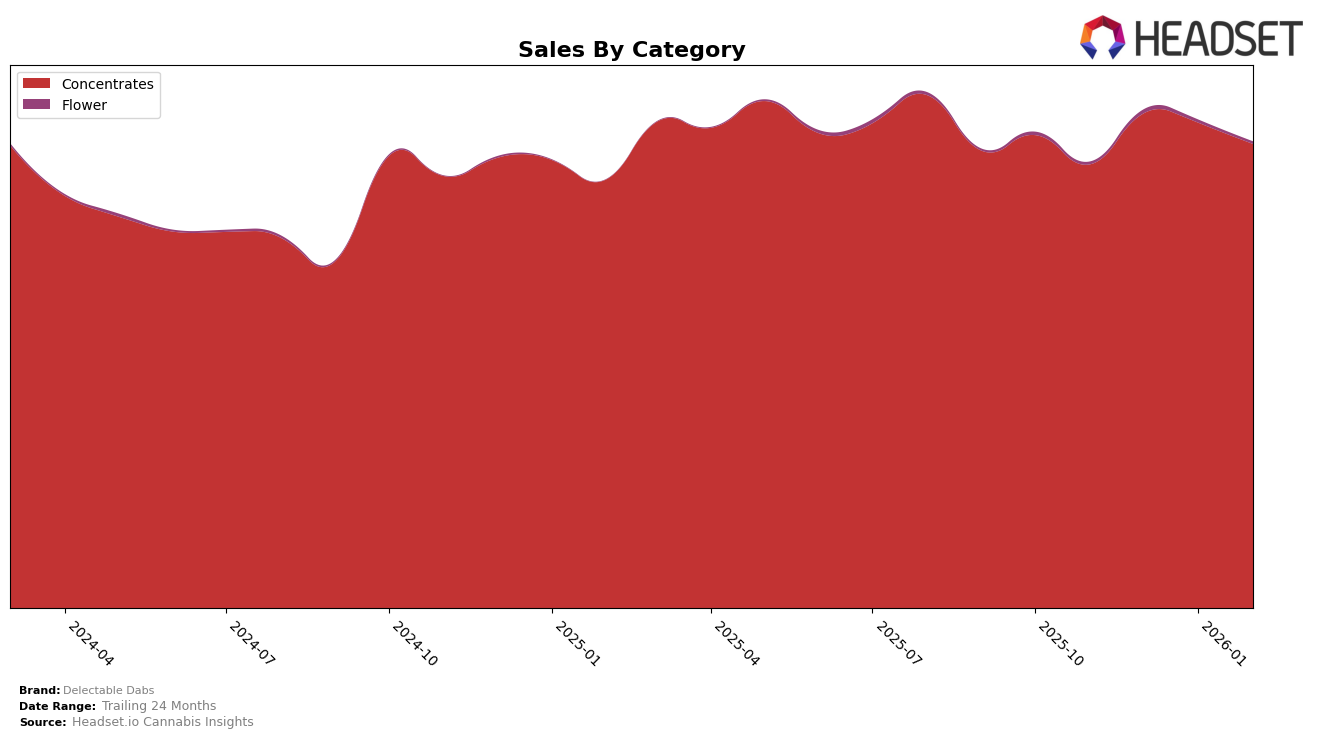

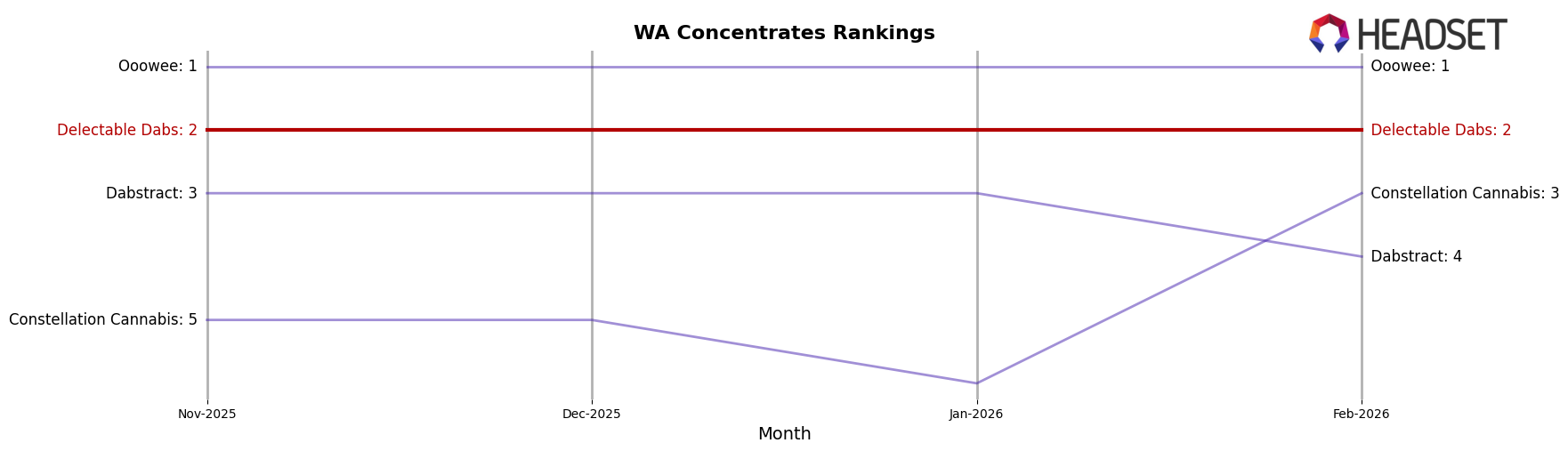

Delectable Dabs has consistently maintained a strong presence in the Washington concentrates market, holding the second position from November 2025 through February 2026. This stability in ranking indicates a robust brand performance, especially given the competitive nature of the concentrates category. The sales figures reflect a slight fluctuation, with a peak in December 2025 followed by a gradual decline through February 2026. This trend suggests a seasonal sales pattern or possible market saturation, which could be areas to explore further for insights into consumer behavior and market dynamics.

While Delectable Dabs shines in the Washington concentrates market, the absence of ranking data in other states or categories implies that the brand has not broken into the top 30 elsewhere. This could be seen as a limitation in their market penetration strategy, potentially missing out on opportunities in other states or categories. Understanding the reasons behind this limited geographical and categorical reach could provide valuable insights into the brand's overall market strategy and growth potential. Exploring whether this is due to regulatory challenges, market competition, or brand focus could offer deeper perspectives into their performance landscape.

Competitive Landscape

In the competitive landscape of the Washington concentrates market, Delectable Dabs consistently maintained its position as the second-ranked brand from November 2025 through February 2026. Despite a strong performance, it trails behind Ooowee, which holds the top spot with a significant sales lead. While Delectable Dabs experienced a slight dip in sales from January to February 2026, its rank remained stable, indicating a resilient market presence. Meanwhile, Dabstract saw a decline in rank from third to fourth place in February 2026, potentially opening opportunities for Delectable Dabs to strengthen its hold on the second position. Additionally, Constellation Cannabis showed a notable improvement, climbing from sixth to third place in February 2026, which could signal increasing competition for Delectable Dabs in the coming months.

Notable Products

In February 2026, the top-performing product from Delectable Dabs was Indica Wax 3-Pack (3g) in the Concentrates category, maintaining its consistent first-place ranking for four consecutive months with sales of 8,976 units. Kimbo Kush Wax (1g) held steady in the second position, mirroring its January 2026 ranking. Maui Wowie Wax (1g) remained in third place, continuing its trend from the previous month. Lemon Walker OG Wax (1g) improved its position to fourth place, recovering from its fifth-place ranking in December and January. Blue Dream Sugar Wax (1g) re-entered the rankings at fifth place, having not been ranked in December and January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.