Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

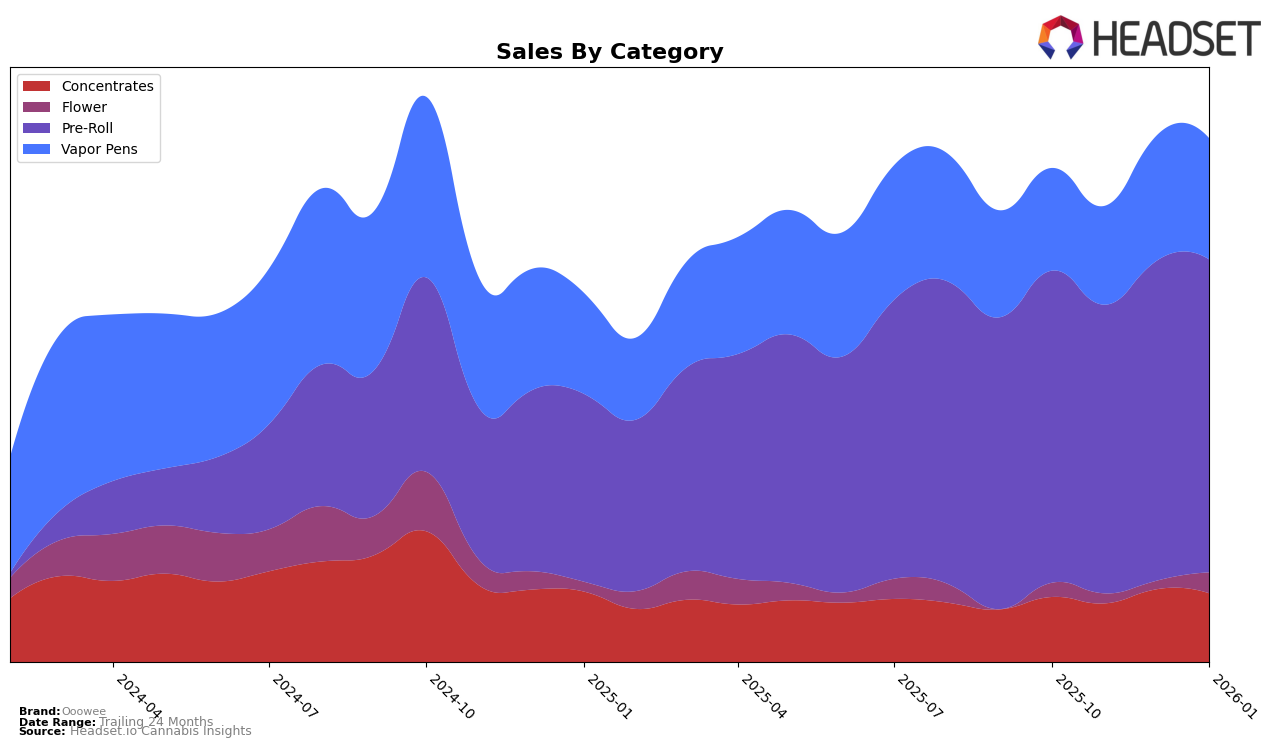

In the state of Washington, Ooowee has demonstrated a strong and consistent performance across several cannabis categories. Notably, the brand has maintained the top rank in both the Concentrates and Pre-Roll categories from October 2025 through January 2026, indicating a solid hold on consumer preferences in these segments. In the Vapor Pens category, Ooowee has shown a positive trend by improving its rank from 12th in October 2025 to 10th by January 2026. This upward movement suggests a growing acceptance and popularity of their products in this category. However, their presence in the Flower category has been more volatile, with rankings fluctuating but showing a promising improvement from 30th in December 2025 to 21st in January 2026.

The consistent top ranking in Concentrates and Pre-Rolls highlights Ooowee's strong market position and consumer loyalty in Washington. The brand's ability to improve its ranking in the Vapor Pens category also suggests strategic efforts to capture more market share. Conversely, the fluctuations in the Flower category rankings indicate a competitive landscape where Ooowee is working to strengthen its foothold. The absence of ranking outside the top 30 in any category underscores their comprehensive market strategy. This performance across categories and the state reflects a well-rounded brand that is both resilient and adaptable to market dynamics.

Competitive Landscape

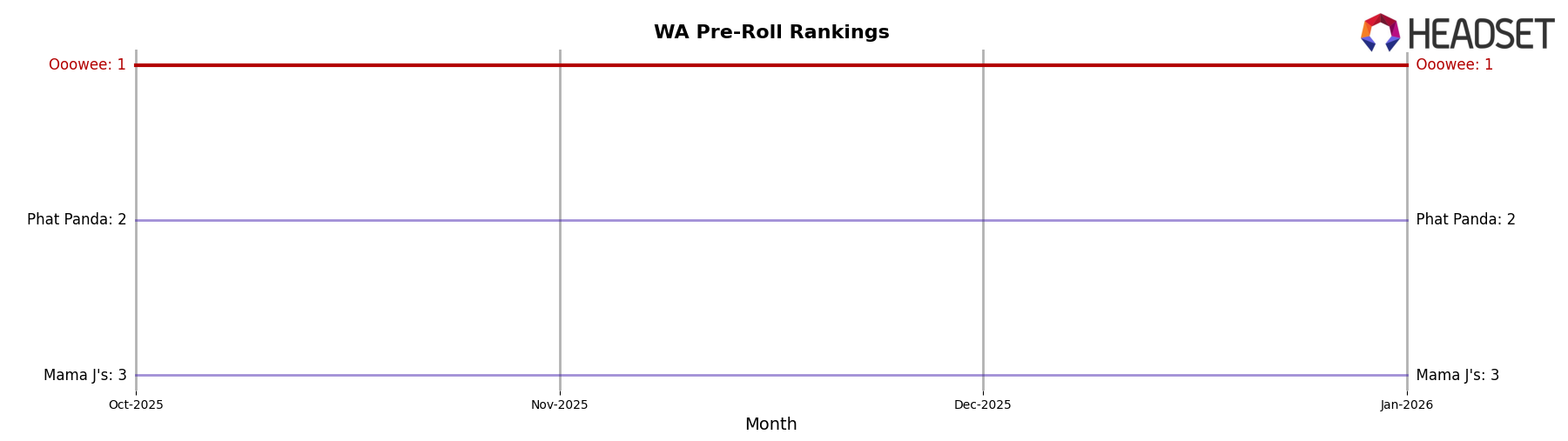

In the Washington pre-roll category, Ooowee has consistently maintained its top position from October 2025 to January 2026, showcasing its strong market presence and consumer preference. Despite a slight fluctuation in sales figures, Ooowee's leadership remains unchallenged. Its closest competitor, Phat Panda, has consistently held the second rank during the same period, with sales figures trailing behind Ooowee's by a notable margin. Mama J's remains a steady third, with sales figures significantly lower than both Ooowee and Phat Panda. This consistent ranking indicates a stable competitive landscape, where Ooowee's brand strength and consumer loyalty continue to drive its dominance in the market.

Notable Products

In January 2026, the top-performing product from Ooowee was the Seattle Strawberry Cough Pre-Roll 5-Pack (5g) in the Pre-Roll category, maintaining its rank as number one with sales of 6,151 units. The Face Lock Sugar Wax (1g) in the Concentrates category made a significant leap to the second position, having not been ranked in the previous months. The FaceLock Pre-Roll 5-Pack (5g) dropped to third place, continuing a downward trend from its top position in October 2025. The Blueberry Dream Infused Pre-Roll 5-Pack (5g) entered the rankings for the first time at fourth place. Lastly, the Ooowee Marker Pre-Roll 5-Pack (5g) retained its fifth position, showing consistent performance since its last appearance in October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.