Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

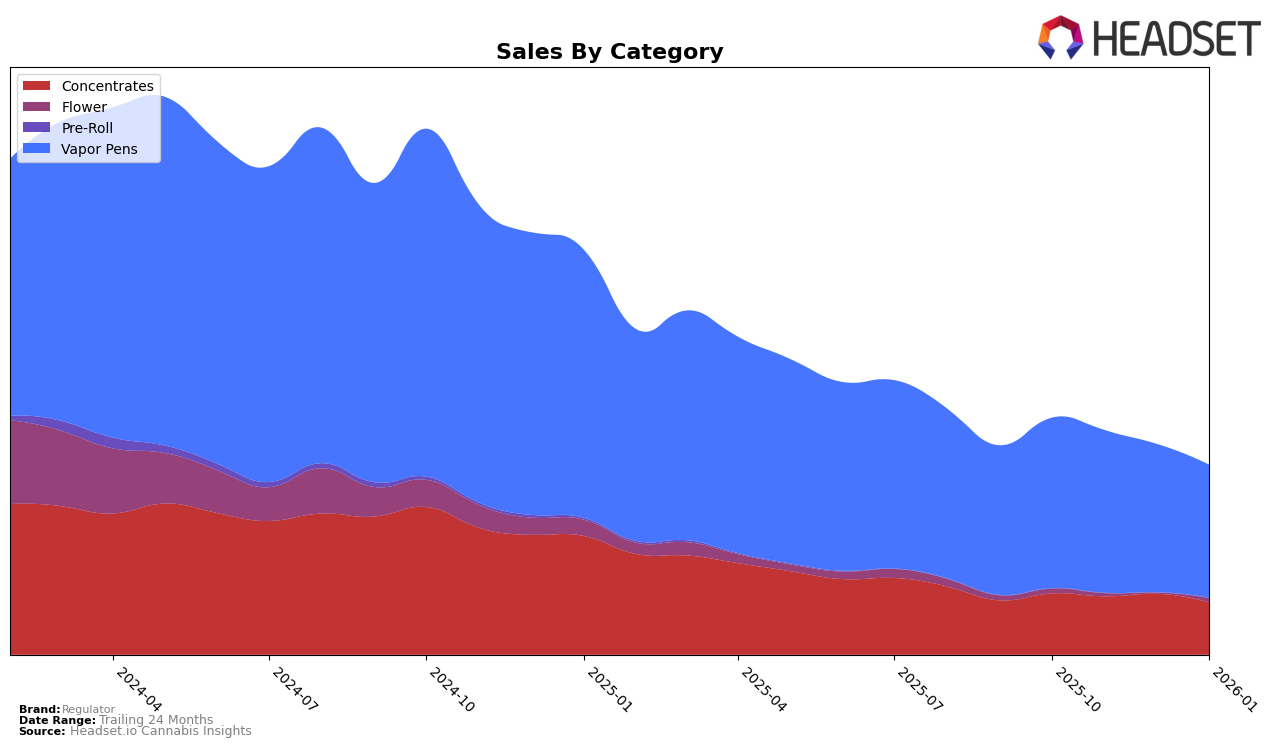

In Washington, Regulator's performance in the Concentrates category has shown a slight decline over the observed months. Starting at the 10th position in October 2025, the brand managed to climb to 9th in November, only to slip back to 10th in December, and further down to 12th by January 2026. This downward trend is mirrored in their sales figures, which decreased from approximately $150,792 in October to $128,039 in January. Such a drop in rank and sales might suggest increasing competition or shifts in consumer preferences within the Concentrates category in Washington.

In the Vapor Pens category, Regulator maintained a relatively stable presence in Washington, although it did experience some fluctuations. The brand held the 16th position in both October and November 2025, dropped to 18th in December, and improved slightly to 17th by January 2026. Despite these minor rank changes, the sales figures reveal a more significant downward trend, with sales decreasing from $420,306 in October to $327,979 in January. This consistent decline in sales might indicate challenges in maintaining consumer interest or perhaps increased competition from other brands in the Vapor Pens market.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Regulator has experienced fluctuations in its market position over the past few months. Starting from October 2025, Regulator held a steady rank of 16th, but saw a dip to 18th in December before slightly recovering to 17th by January 2026. This indicates a downward trend in sales, with a notable decrease from October's figures to January's. In contrast, competitors such as Plume (WA) and Slusheez have shown upward momentum, with Plume climbing from 20th to 15th and Slusheez improving from 19th to 16th over the same period. Meanwhile, Forbidden Farms and O'Geez (WA) also made gains, with both brands entering the top 20 by January 2026. These shifts suggest that Regulator faces increasing competition, necessitating strategic adjustments to regain its footing in the Washington vapor pen market.

Notable Products

In January 2026, Regulator's top-performing product was Mandarin Cookies Sugar Wax (1g) in the Concentrates category, which climbed to the number one spot from fifth place in December 2025, with sales reaching 1533 units. Cherry Pie Sugar Wax (1g), also in the Concentrates category, maintained its position as the second-best seller, closely following with 1478 units sold. Hawaiian Shaved Ice Distillate Cartridge (1g) in the Vapor Pens category dropped to third place from its previous first-place ranking in December, with 1061 units sold. Pineapple Orange Soda Distillate Cartridge (1g) remained consistent in fourth place, showing stable sales figures. Notably, Blueberry Muffin Live Resin Cartridge (1g) entered the top five for the first time, ranking fifth with 1050 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.