Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

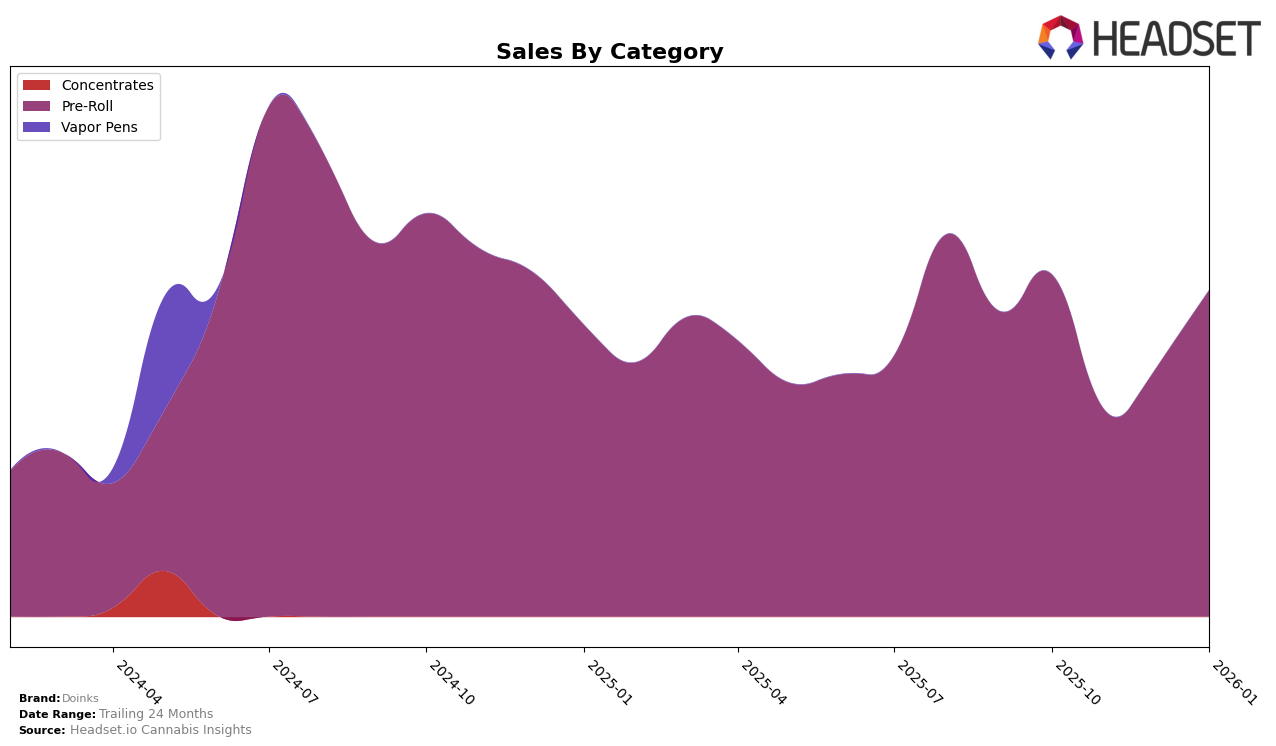

Doinks has shown varied performance across different states and categories, with notable movements in rankings that highlight both opportunities and challenges. In Colorado, the brand's presence in the Pre-Roll category fluctuated slightly, dropping out of the top 30 in November and December 2025 before regaining its position by January 2026. This suggests a resilience in the market despite a dip in sales during the holiday season. Meanwhile, New Jersey has seen a consistent upward trend in Doinks' rankings, improving from 56th in October 2025 to 46th by January 2026. This steady climb indicates a growing acceptance and popularity of the brand in the state, accompanied by increased sales month over month.

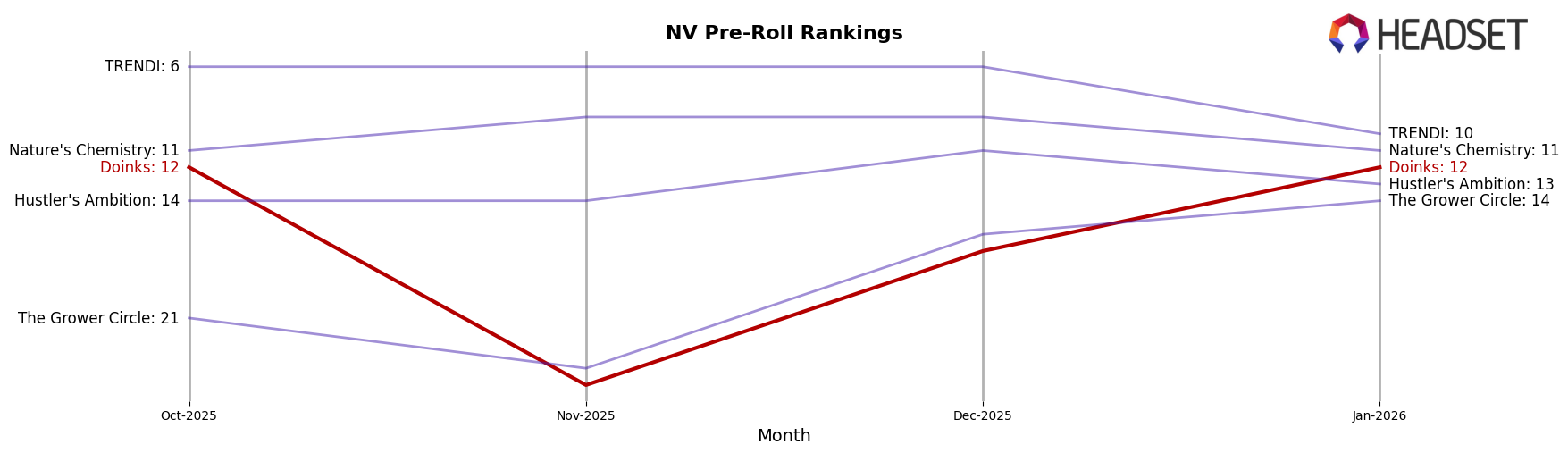

In contrast, Nevada presents a more dynamic landscape for Doinks. The brand experienced a significant drop in rank from 12th in October 2025 to 25th in November, yet it managed to bounce back to its original position by January 2026. This volatility could be attributed to competitive pressures or seasonal factors, yet the recovery suggests a strong brand loyalty or effective marketing strategies that helped regain its standing. The sales figures in Nevada also reflect these movements, with a notable increase from November to January, indicating a successful rebound. Overall, Doinks' performance in these states highlights both the challenges of maintaining a top position and the potential for growth in emerging markets.

Competitive Landscape

In the competitive landscape of the Nevada pre-roll category, Doinks experienced notable fluctuations in its ranking and sales over the observed months. Starting in October 2025, Doinks held the 12th position but dropped out of the top 20 in November, only to recover to 17th in December and return to 12th by January 2026. This volatility contrasts with the stability of competitors like Nature's Chemistry, which consistently maintained a top 11 rank, and TRENDI, which only saw a slight dip from 6th to 10th. Despite these fluctuations, Doinks' sales rebounded significantly from a low in November, suggesting a resilient market presence. Meanwhile, The Grower Circle and Hustler's Ambition showed more stable but lower sales figures, indicating that Doinks remains competitive in terms of sales volume, albeit with a need to stabilize its market rank.

Notable Products

In January 2026, the Lime Sorbet Distillate Infused Blunt (1g) emerged as the top-performing product for Doinks, climbing from third place in December 2025 to first place with notable sales of 1484 units. The Strawnana Distillate Infused Blunt (1g) maintained its position as the second-best seller, showing a consistent performance over the past months. The Wild Melon Distillate Infused Blunt (1g) held steady in the third position, continuing its stable ranking from December. The Green Apple Infused Blunt (1g) saw a slight drop, moving from fifth place in December to fourth in January. A new entrant, the Blueberry Infused Pre-Roll (1g), debuted in the fifth position, marking its entry into the top five products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.