Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

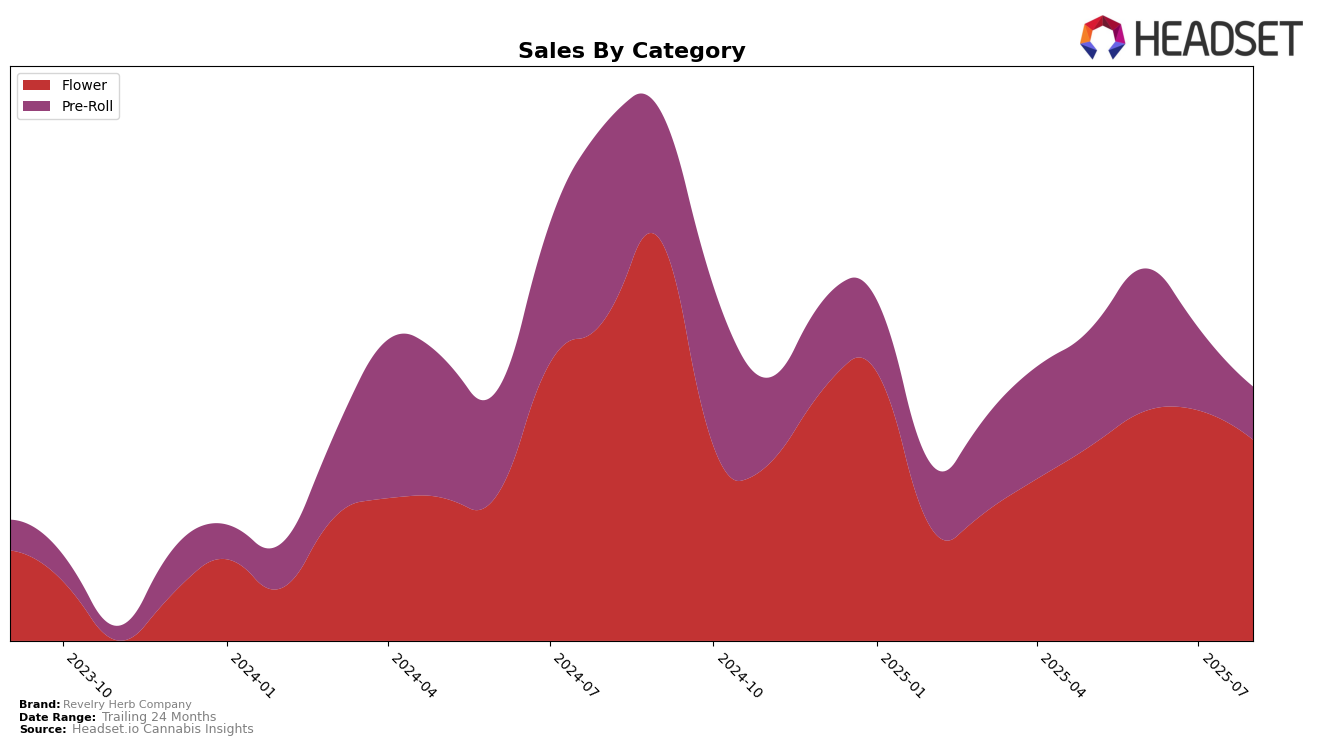

Revelry Herb Company has shown varied performance across different states and categories, reflecting both opportunities and challenges. In California, the brand's presence in the Flower category was not strong enough to place it in the top 30, indicating a potential area for growth or reevaluation. However, in the Pre-Roll category, the brand maintained its presence within the top 60, albeit with a slight decline from 44th to 55th place over four months. This suggests a need for strategic adjustments to regain a stronger foothold in the competitive market. Meanwhile, in Maryland, the brand's performance in the Flower category saw a steady decline, moving from 36th to 53rd, while in Pre-Rolls, it dropped from 27th to 39th, reflecting a similar trend of diminishing market share.

On a more positive note, Revelry Herb Company has experienced a more stable trajectory in New Jersey. The Flower category saw the brand climb from 38th to 25th by July, before a minor drop to 27th in August, suggesting a relatively strong position compared to other states. This upward movement could highlight successful marketing strategies or product offerings resonating with consumers. However, the Pre-Roll category in New Jersey presented a different story, with rankings falling from 36th to 56th, indicating potential challenges in maintaining consumer interest or facing increased competition. These mixed results across states and categories underline the importance of tailored strategies to address specific market dynamics.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Revelry Herb Company has shown a dynamic shift in its market position from May to August 2025. Initially ranked at 38th in May, Revelry climbed to 27th by June, maintaining a strong position at 25th in July before slightly declining to 27th in August. This upward trend in rank correlates with a notable increase in sales, peaking in July. Comparatively, Verano experienced a significant drop from 11th in May and June to 35th in July, recovering slightly to 29th in August, indicating potential volatility in their sales performance. Meanwhile, Anthologie maintained a stable mid-tier position, consistently ranking between 25th and 27th, suggesting steady sales. Superflux showed a remarkable ascent from 48th in May to 26th in August, highlighting a significant growth trajectory. Full Tilt Labs fluctuated slightly but remained close to Revelry's rank, indicating a competitive environment. These insights suggest that while Revelry Herb Company is gaining traction, it faces stiff competition from both established and emerging brands in the New Jersey market.

Notable Products

In August 2025, the top-performing product for Revelry Herb Company was Sour Tangie (3.5g) in the Flower category, which climbed from third place in July to first place, achieving sales of 4318. Blue Slushy (3.5g) maintained its position as the second-ranked product from July, despite a decrease in sales. Sunshine Daydream (3.5g), which was the top product in July, fell to third place in August. Blackberry Lemonade (3.5g) re-entered the rankings in fourth place, showing a notable return after not being ranked in June and July. Forbidden Fruit Cake (3.5g) saw a decline from its top position in June to fifth place in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.