Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

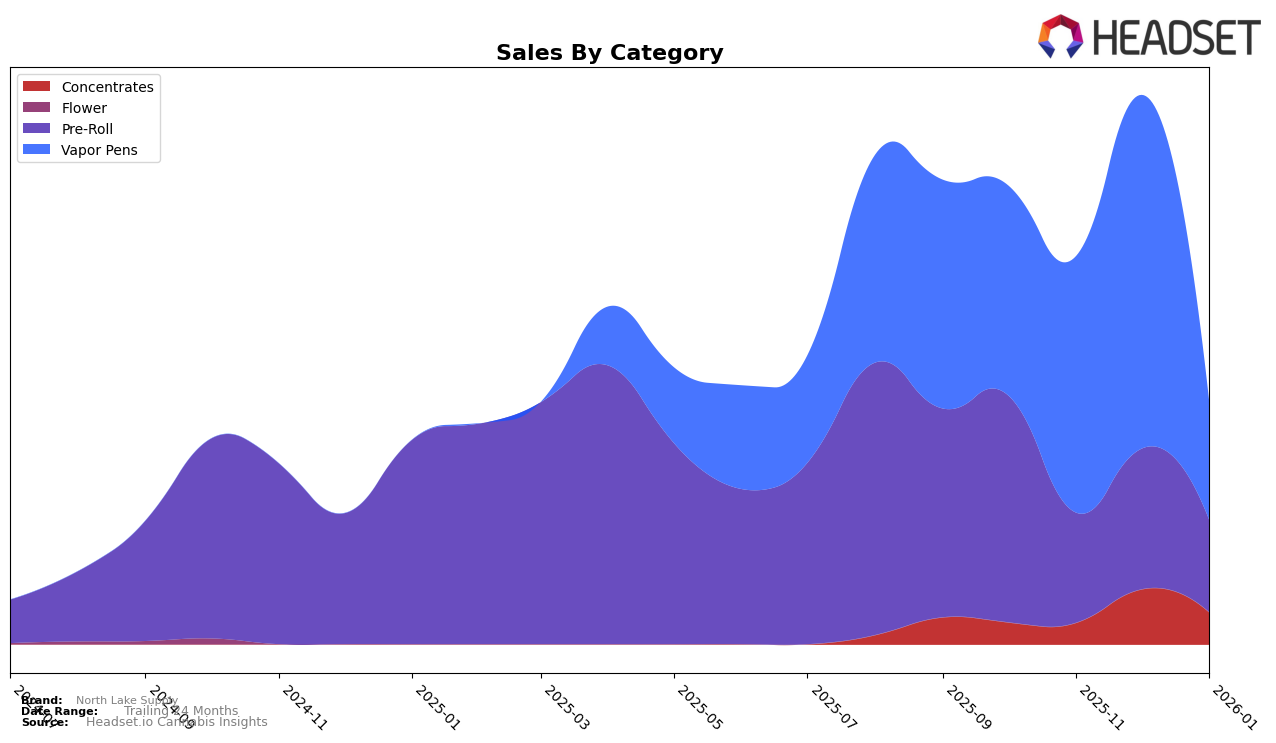

In the state of New Jersey, North Lake Supply demonstrated a fluctuating performance across several cannabis product categories. In the Concentrates category, their ranking showed a notable improvement in December 2025, reaching the 23rd position, before slipping back to 30th in January 2026. This suggests a temporary surge in popularity or possibly a successful marketing campaign during the holiday season. In contrast, their performance in the Pre-Roll category declined over the same period, with the brand starting at the 29th position in October 2025 and falling out of the top 30 by January 2026. This downward trend might indicate increased competition or a shift in consumer preferences within the state.

The Vapor Pens category presented a mixed scenario for North Lake Supply in New Jersey. The brand initially improved its ranking from 28th in October 2025 to 24th by December 2025, suggesting a positive reception or effective sales strategies during this time. However, by January 2026, they experienced a sharp decline to the 48th position, indicating challenges that could be related to supply chain issues or market saturation. Despite these fluctuations, the overall sales trend for Vapor Pens showed a substantial increase in November and December, hinting at potential areas for strategic focus to regain market position in the coming months.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, North Lake Supply has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 28th in October, North Lake Supply improved its standing to 24th by December, indicating a positive trend in sales performance. However, by January 2026, the brand experienced a significant drop to 48th, suggesting potential challenges in maintaining its competitive edge. In contrast, Mule Extracts showed a more stable presence, peaking at 35th in December before dropping to 49th in January. Similarly, Brute's Roots maintained a consistent mid-tier ranking, peaking at 44th in November. The volatility in North Lake Supply's ranking highlights the dynamic nature of the vapor pen market in New Jersey and underscores the importance of strategic marketing and product differentiation to sustain sales momentum.

Notable Products

In January 2026, the top-performing product from North Lake Supply was Kong Breath Pre-Roll 2-Pack (1g), which secured the number 1 rank with sales of 1249 units. Frosty Freeze Pre-Roll 2-Pack (1g) climbed to the second position from fourth in December, demonstrating a notable increase in popularity. Dirty Mimosa Pre-Roll 2-Pack (1g) entered the top three for the first time, indicating a growing consumer interest. Pear Herer Distillate Disposable (1g) ranked fourth, maintaining its consistent presence in the top ranks. Gouda Gas Pre-Roll 2-Pack (1g) experienced a decline, dropping from first place in December to fifth in January, suggesting a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.