Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

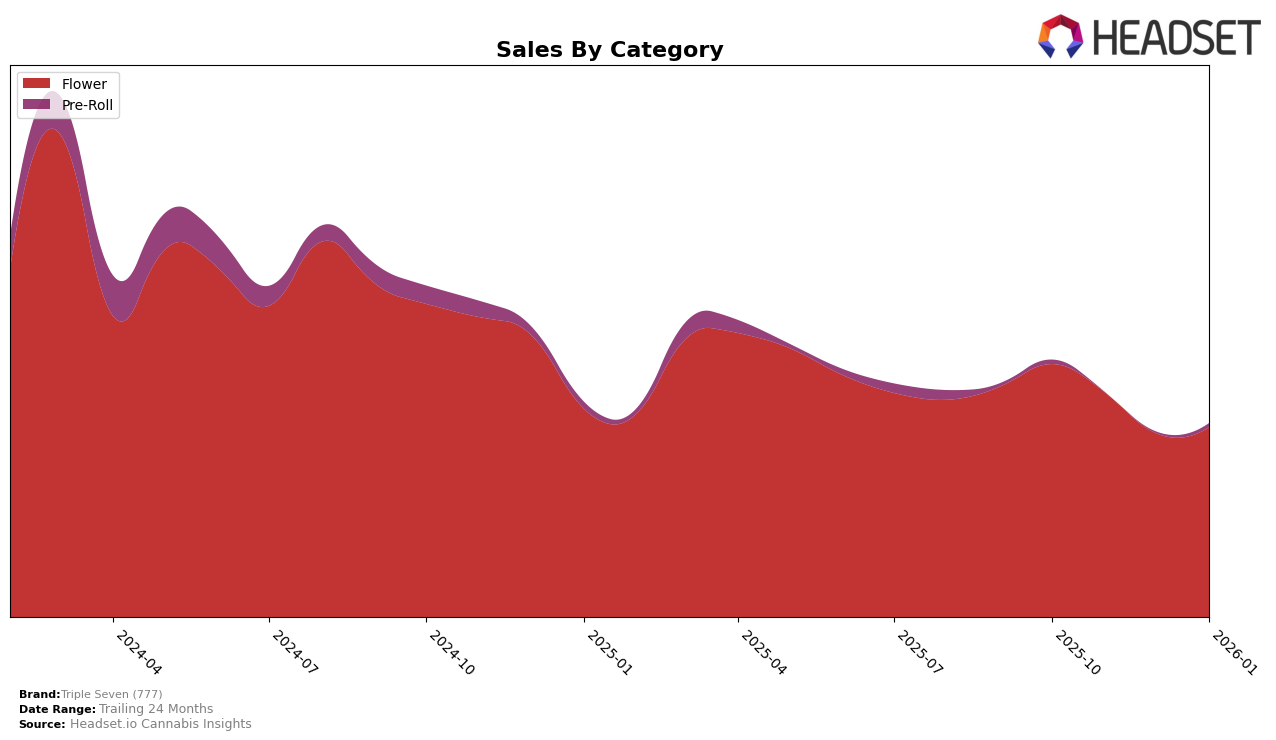

Triple Seven (777) has shown varied performance across different states and product categories. In Colorado, the brand maintains a strong presence in the Flower category, consistently ranking within the top four brands from October 2025 to January 2026. Despite a dip in sales from October to December, Triple Seven (777) regained momentum in January 2026, indicating resilience in the market. In contrast, the brand's performance in Illinois is less robust, with Flower category rankings hovering in the late 40s, showing a gradual upward trend. The Pre-Roll category in Illinois tells a different story; despite not making it to the top 30 in November and December, the brand reappeared in January 2026, suggesting potential for growth in this segment.

In Maryland, Triple Seven (777) experienced fluctuations in the Flower category, with notable rankings in October and December but missing from the top 30 in November and January. This inconsistency highlights challenges in maintaining a steady market presence. Interestingly, the brand debuted in the Maryland Pre-Roll category in December 2025, securing a top 30 position, which could signal an emerging opportunity. Meanwhile, in New Jersey, Triple Seven (777) saw a decline in Flower rankings from October to December before slightly improving in January. The Pre-Roll category in New Jersey saw the brand entering the top 40 in January 2026, suggesting a potential area for expansion. These movements across states and categories underscore the dynamic nature of Triple Seven (777)'s market performance.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Triple Seven (777) has maintained a strong presence, consistently ranking within the top four brands from October 2025 to January 2026. Despite a slight dip in sales from October to December 2025, Triple Seven (777) rebounded in January 2026, securing the third position. This resilience is noteworthy when compared to competitors like Green Dot Labs, which fluctuated between the third and fourth ranks, and 710 Labs, which showed a more volatile ranking pattern, moving from the tenth to the fifth position over the same period. Meanwhile, Good Chemistry Nurseries consistently held the second spot, while Seed & Strain Cannabis Co. dominated the market, maintaining the top rank. These dynamics suggest that while Triple Seven (777) faces strong competition, its ability to recover and maintain a high rank highlights its competitive edge and potential for growth in the Colorado market.

Notable Products

In January 2026, Black Triangle (3.5g) emerged as the top-performing product for Triple Seven (777), leading the sales with 6,863 units sold. Following closely, Ky Jealous Pre-Roll (1g) secured the second position, while Biscotti (3.5g) ranked third. Notably, Ky Jealous (3.5g) experienced a drop from its previous top rank in December 2025 to fourth place in January. Longbottom Boogie (14g) re-entered the rankings, securing the fifth position after being absent in November and December 2025. These shifts highlight a dynamic change in consumer preferences over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.