Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

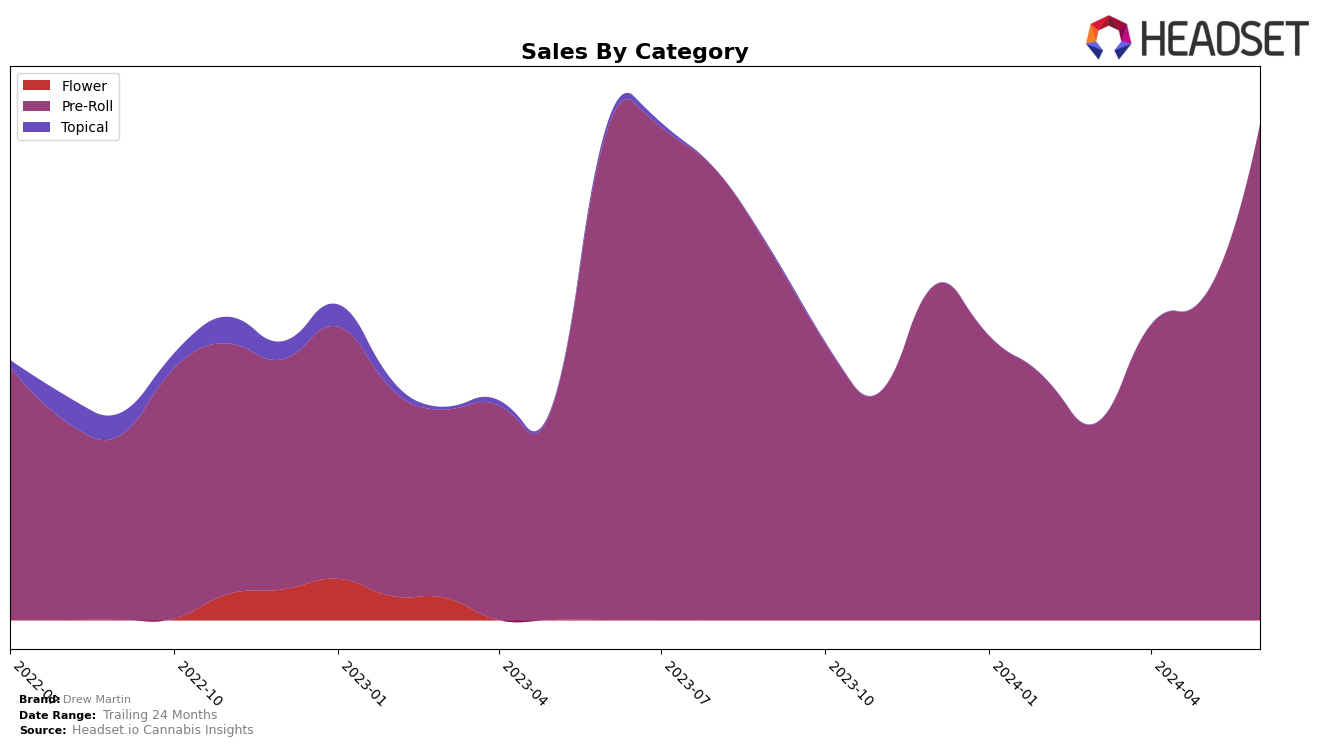

Drew Martin's performance in the pre-roll category in New York has shown notable fluctuations over the past few months. In March 2024, the brand was ranked 24th, and while it slipped slightly to 28th in April, it fell out of the top 30 in May. However, June saw a remarkable recovery with Drew Martin climbing to 18th place. This upward trajectory in June is underscored by a significant increase in sales, suggesting a strong rebound and growing consumer interest in the brand within the state.

While Drew Martin's performance in New York has been mixed, the brand's ability to re-enter and climb within the top 20 rankings in June is a positive indicator. The brand's sales figures reflect this improvement, with a notable jump from May to June. The fluctuations in rankings and sales highlight both the competitive nature of the pre-roll category and Drew Martin's resilience and potential for growth in this market.

Competitive Landscape

In the competitive landscape of the New York pre-roll category, Drew Martin has shown significant fluctuations in its rank over recent months. Notably, Drew Martin climbed from a rank of 32 in May 2024 to 18 in June 2024, indicating a strong upward trend in sales performance. This improvement places Drew Martin ahead of Weekenders, which saw a rank of 19 in June 2024, despite Weekenders experiencing a similar positive trend. However, Drew Martin still trails behind brands like Miss Grass and Heady Tree, which have consistently maintained higher ranks and sales figures. For instance, Miss Grass ranked 17 in June 2024, showing a slight decline but still outperforming Drew Martin. Similarly, Heady Tree held a rank of 16, demonstrating stable performance. The data suggests that while Drew Martin is gaining momentum, it faces stiff competition from established brands that have maintained higher sales and ranks over the long term.

Notable Products

In June 2024, Drew Martin's top-performing product was Lavender Infused Pre-Roll 2-Pack (1g), which climbed to the first position with notable sales of 1138 units. Rose Hash Infused Pre-Roll 2-Pack (1g) secured the second spot, showing strong market presence. Be Open - Rose Hash Infused Pre-Roll 2-Pack (1g) followed closely in third place. Ginger Hash Infused Pre-Roll 2-Pack (1g) came in fourth, maintaining competitive sales figures. Be Open - Hybrid Rose Botanically Blended Pre-Roll 6-Pack (4.5g) consistently held the fifth position from May 2024, indicating stable demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.