Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

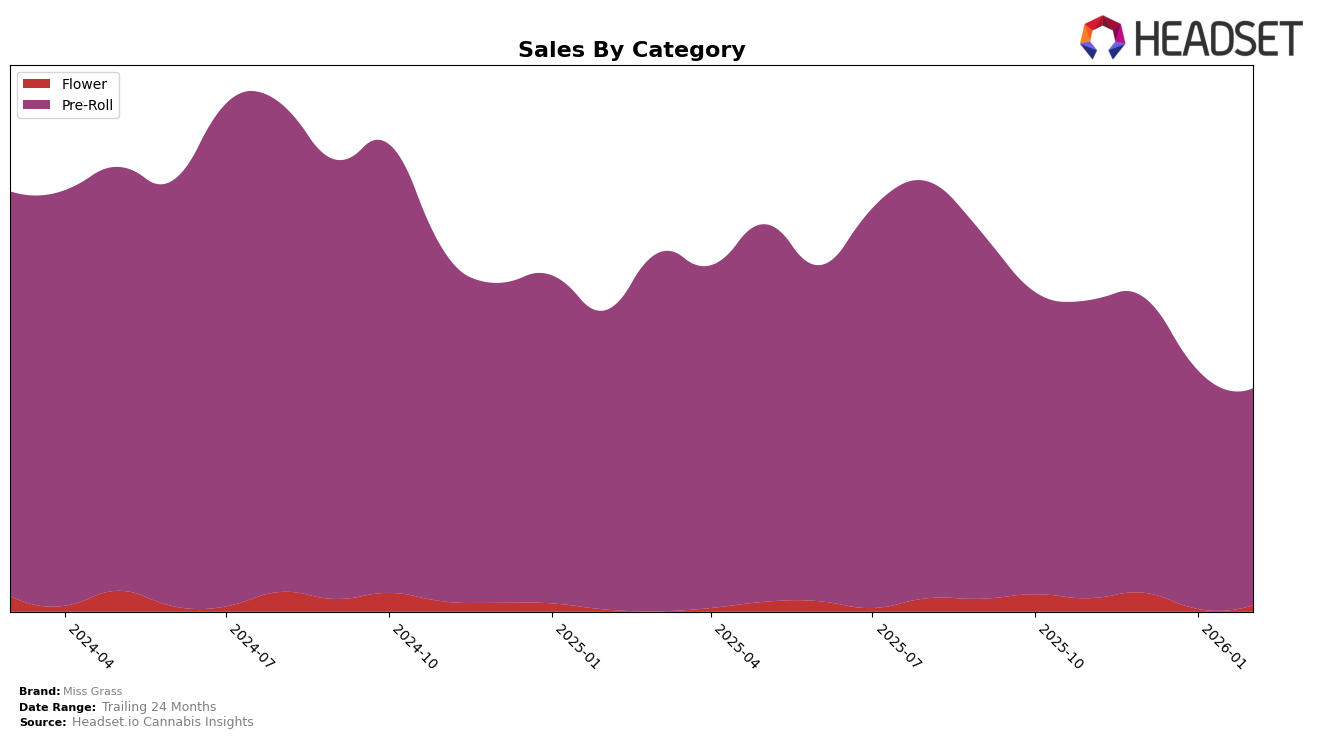

Miss Grass has shown varied performance across different states and product categories. In the Connecticut market, the brand made a notable entry in the Pre-Roll category by securing the 18th position in February 2026, indicating a positive movement as it was not ranked in the top 30 in the preceding months. Similarly, in Illinois, Miss Grass has demonstrated a steady climb, improving its rank from 47th in November 2025 to 39th in February 2026 in the Pre-Roll category. This upward trend suggests a growing acceptance and increased consumer interest in Miss Grass products within these states.

Meanwhile, in Massachusetts, Miss Grass experienced a decline in the Pre-Roll category, dropping from the 16th rank in November 2025 to maintaining a 25th position in both January and February 2026. This could reflect a shift in consumer preferences or increased competition. In New Jersey, Miss Grass maintained a strong presence in the Pre-Roll category, consistently ranking 6th, except for a slight dip to 7th in January 2026. However, their performance in the Flower category was less consistent, with a notable absence from the top 30 in January 2026, which might indicate challenges in market penetration or product positioning. These insights reflect the dynamic nature of Miss Grass's market performance across different regions and categories.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in New Jersey, Miss Grass has shown resilience amidst fluctuating market dynamics. Over the four-month period from November 2025 to February 2026, Miss Grass maintained a relatively stable rank, oscillating between 6th and 7th position. This consistency is notable given the competitive pressure from brands like Lowell Herb Co / Lowell Smokes and Pete's Farmstand, which consistently ranked higher. Despite a slight dip in sales from December to February, Miss Grass outperformed Dogwalkers, which remained in the lower ranks. The brand's ability to maintain its position suggests a loyal customer base and effective marketing strategies, although there is room for growth to close the gap with higher-ranking competitors like Rove and Lowell Herb Co / Lowell Smokes.

Notable Products

In February 2026, the top-performing product from Miss Grass was Fast Times - Joels Lemonade x Drip Station Mini Pre-Roll 5-Pack (2g) in the Pre-Roll category, maintaining its first-place rank from previous months despite a sales figure of 5031. All Times - Hybrid Blend Pre-Roll 5-Pack (2g) held steady in second place, continuing its consistent performance since November 2025. Quiet Times - Indica Blend Minis Pre-Roll 5-Pack (2g) climbed to third place, showing improvement from its fifth-place rank in November and December 2025. Fast Times - Hybrid Blend Minis Pre-Roll 5-Pack (2g) saw a rise to fourth place, marking a notable entry into the rankings in January 2026. Quiet Times - Modified Rootbeer x RTZ Pre-Roll 5-Pack (2g) re-entered the top five in fifth place, highlighting a resurgence after not being ranked in December 2025 and January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.