Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

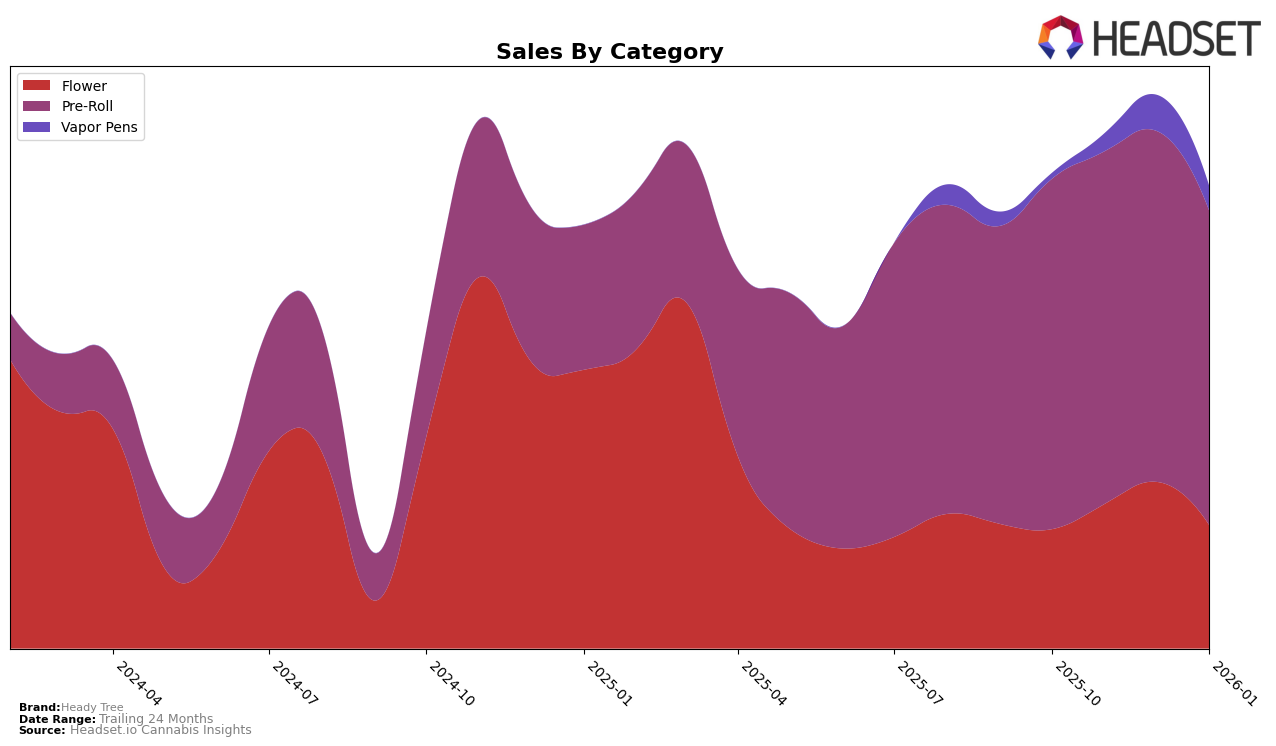

In the New York market, Heady Tree has shown varied performance across different product categories. In the Flower category, the brand has struggled to break into the top 30, with its rank sliding from 32 in December 2025 to 47 by January 2026. This decline suggests challenges in maintaining market share or consumer interest, despite a peak in sales during December 2025. Conversely, in the Pre-Roll category, Heady Tree has maintained a relatively strong position, consistently ranking within the top 10, although there was a slight dip from 6th place in late 2025 to 8th in early 2026.

For the Vapor Pens category, Heady Tree's presence has been less stable. The brand did not appear in the top 30 in October 2025, but it made a notable entry at 75 in November, improving to 57 in December before slipping to 65 in January 2026. This fluctuation indicates a volatile market position, possibly due to changing consumer preferences or competitive pressures. The brand's overall sales trajectory in this category suggests a need for strategic adjustments to capture and retain market share effectively. The variations in rankings and sales highlight the competitive landscape of New York and the importance of adaptive strategies for brands like Heady Tree.

Competitive Landscape

In the competitive landscape of the New York pre-roll category, Heady Tree experienced a notable shift in its market position from October 2025 to January 2026. Initially ranked 6th in October and November 2025, Heady Tree saw a slight decline to 7th in December and further to 8th by January 2026. This downward trend contrasts with the performance of competitors such as Ayrloom, which consistently maintained a strong position, ranking 7th in October and November, and improving to 8th in December, before reclaiming the 7th spot in January. Meanwhile, Anthem demonstrated significant growth, jumping from 12th in October to 6th by January, likely driven by a substantial increase in sales. The competitive dynamics suggest that while Heady Tree remains a key player, the brand faces pressure from both stable and rapidly ascending competitors, highlighting the need for strategic adjustments to regain its competitive edge in the New York pre-roll market.

Notable Products

In January 2026, Pineapple Slushee Pre-Roll (1g) maintained its top position as the best-selling product from Heady Tree, with sales reaching 9094 units. Pirate's Milk Pre-Roll (1g) improved its ranking, moving up to second place from third in the previous two months, showing a notable increase in sales performance. Blue Zushi Pre-Roll (1g) slipped to third place, having previously held the second spot in November and December 2025. A newcomer, Da Yayo Pre-Roll (1g), entered the rankings in January 2026 at fourth place, indicating a strong market entry. Cap Junkie Pre-Roll (1g) consistently held the fifth position from October 2025 through January 2026, despite a steady decline in sales figures over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.