Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

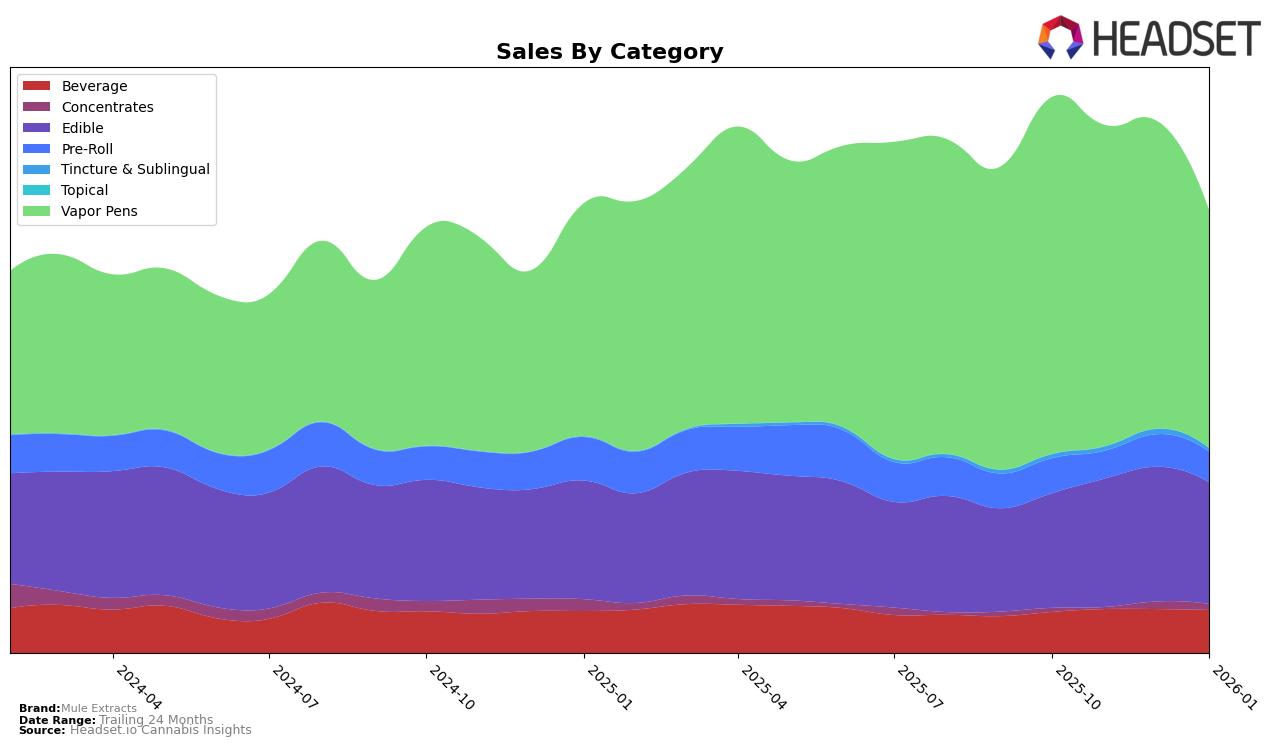

In the state of New Jersey, Mule Extracts showed fluctuating performance across different categories. Notably, the brand's edible category managed to enter the top 30 rankings in November 2025, climbing to the 25th position in December before slipping out of the top 30 by January 2026. In the vapor pens category, Mule Extracts consistently stayed out of the top 30, with their best ranking being 35th in December. This indicates a challenging market environment for the brand in New Jersey, particularly in the vapor pens category, where they face stiff competition.

Conversely, in Oregon, Mule Extracts maintained a strong presence, especially in the beverage and edible categories where they consistently ranked third and fifth, respectively, over the observed months. The pre-roll category also saw a stable position, maintaining around the 25th rank. However, the vapor pen category experienced a noticeable decline, dropping from third place in October 2025 to ninth by January 2026, which might be indicative of increased competition or shifts in consumer preferences. This data suggests that while Mule Extracts has a solid foothold in Oregon, especially in edibles and beverages, they may need to strategize to regain momentum in vapor pens.

Competitive Landscape

In the competitive landscape of Oregon's vapor pen market, Mule Extracts experienced a notable decline in its rankings from October 2025 to January 2026. Initially holding a strong position at rank 3 in October 2025, Mule Extracts saw a gradual decrease, ultimately landing at rank 9 by January 2026. This downward trend in rank corresponds with a consistent decline in sales over the same period. In contrast, Farmer's Friend Extracts maintained a relatively stable position, fluctuating between ranks 6 and 7, while White Label Extracts (OR) also showed stability, hovering around ranks 9 and 10. Meanwhile, Echo Electuary and Loot Bar remained consistent in their rankings, with Echo Electuary slightly dropping from rank 11 to 12 in December before recovering. These competitors' steadiness amidst Mule Extracts' decline suggests a shift in consumer preferences or competitive strategies that may have impacted Mule Extracts' market share and sales performance.

Notable Products

In January 2026, Mule Kicker - Raspberry Pomegranate Gummies 10-Pack (100mg) maintained its top position as the best-selling product from Mule Extracts, with sales figures reaching 8,918 units. The Twisted Citrus Live Resin Gummy (100mg) held steady at the second rank, mirroring its performance from the previous two months. Peachy Gummy (100mg) consistently remained in third place from November to January. Notably, the CBG/THC 2:1 Sour Passion Orange Guava Gummies 2-Pack debuted in the rankings at fourth place, indicating a strong market entry. Meanwhile, the Nite Qaud Kicker - THC/CBD/CBN/CBG 2:1:4:1 Sour Blackberry Lemonade Gummies 2-Pack slipped from fourth to fifth place, showing a slight decline in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.