Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

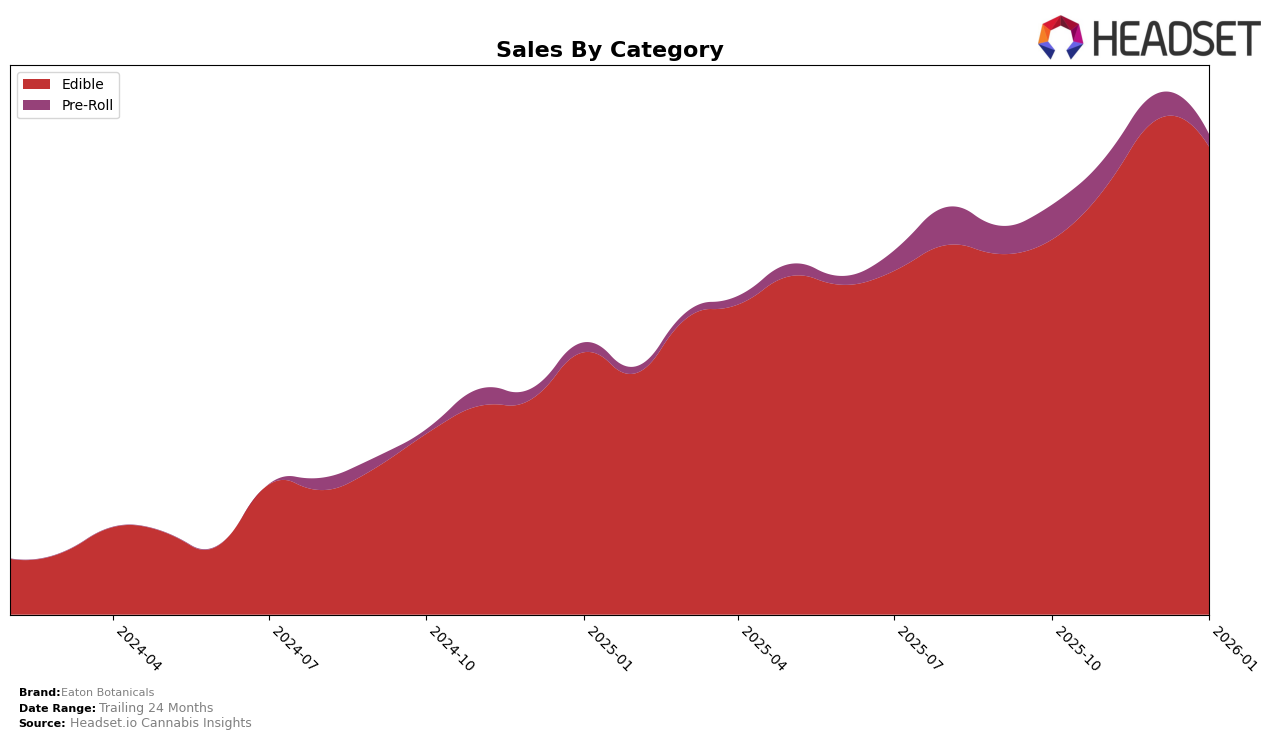

In New York, Eaton Botanicals has shown consistent strength in the Edible category, maintaining a steady 7th place ranking from November 2025 through January 2026. This stability indicates a robust market presence and suggests that their products resonate well with consumers in this category. The brand saw a notable increase in sales from October to December 2025, with sales peaking in December before experiencing a slight dip in January 2026. This trend may reflect seasonal purchasing behaviors or successful promotional efforts during the latter months of 2025.

Conversely, Eaton Botanicals has struggled to make a significant impact in the Pre-Roll category within New York. Their ranking remained outside the top 30 for the months of December 2025 and January 2026, following a position in the low 90s in October and November 2025. This suggests challenges in gaining traction or competing against more established brands in the Pre-Roll market. The absence from the top 30 could highlight potential areas for improvement or a need to adjust their strategy to better capture consumer interest in this segment.

Competitive Landscape

In the competitive landscape of the edible cannabis category in New York, Eaton Botanicals has demonstrated consistent performance, maintaining its rank at 7th place from November 2025 through January 2026. This stability is notable given the dynamic shifts among competitors. For instance, Wana improved its position from 14th in October 2025 to 8th by January 2026, indicating a significant upward trend. Meanwhile, Ayrloom and Mfny (Marijuana Farms New York) consistently held higher ranks at 6th and 5th respectively, showcasing strong sales figures that Eaton Botanicals could aspire to surpass. Jaunty remained close behind, fluctuating between 9th and 10th place, which suggests a competitive edge for Eaton Botanicals to maintain its lead. Overall, Eaton Botanicals' stable ranking amidst these shifts highlights its resilience and potential for growth in a competitive market.

Notable Products

In January 2026, the top-performing product from Eaton Botanicals was Nightly Nightcap - THC/CBN 1:1 Dark Cherry Gummies 20-Pack, maintaining its number one rank consistently from October 2025 through January 2026, with a notable sales figure of 5645 units. Daily Elevation- CBG/THC 1:1 Peach Gummies 20-Pack also held steady at the second position throughout the same period, showing slight fluctuations in sales. Serenity Now - CBD/THC 4:1 Lemon Lavender Gummies 20-Pack remained third, indicating stable consumer preference for this product. Fixer Upper - CBD/THC 1:1 Mango Ginger Gummies 20-Pack saw a slight improvement, moving up from fifth place in December 2025 to fourth in January 2026. Gal Pal - CBD/THC 1:1 Watermelon Gummies 20-Pack, although dropping to fifth in January 2026, showed strong sales consistency in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.