Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

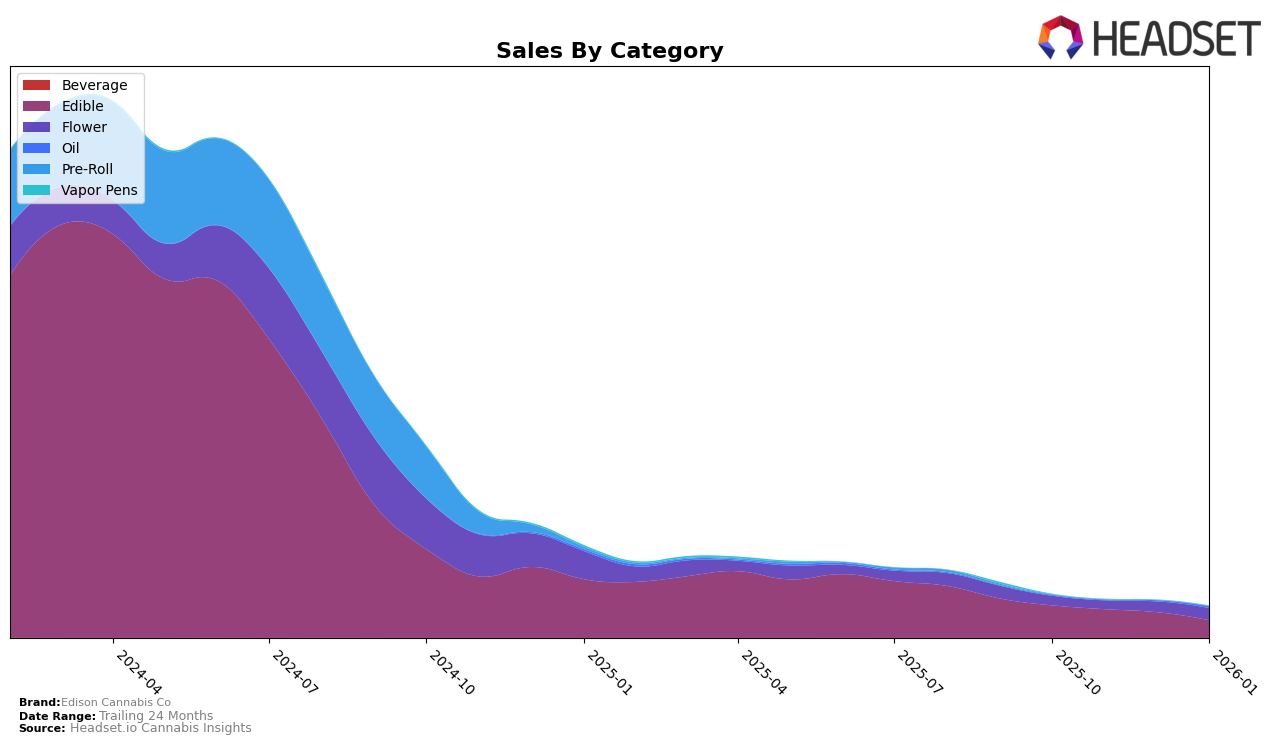

Edison Cannabis Co has shown varied performance across different categories and provinces. In the Alberta market, the brand has maintained a presence in the Edible category, albeit with a gradual decline in rankings from 14th in October 2025 to 18th by January 2026. This downward trajectory is accompanied by a consistent decrease in sales, suggesting possible challenges in maintaining consumer interest or facing increased competition. Conversely, in the Flower category within the same province, Edison Cannabis Co has remained relatively stable around the 90th position, indicating a more consistent, albeit less prominent, presence in this category.

In British Columbia, Edison Cannabis Co experienced fluctuations within the Edible category, starting at 14th in October and dropping to 18th by January. Despite this drop, the sales figures reveal a spike in November, suggesting a temporary resurgence in consumer demand. Meanwhile, in Ontario, the brand's performance in the Edible category improved, climbing from outside the top 30 to a peak of 27th in December before settling at 30th in January 2026. This upward movement, coupled with increasing sales during the latter part of 2025, indicates a growing acceptance or strategic push within this market. Such trends highlight the dynamic nature of Edison Cannabis Co's market presence, with varying degrees of success across different regions and product categories.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Edison Cannabis Co has shown a steady performance, maintaining a consistent rank of 90 from December 2025 to January 2026, despite a dip to 99 in November 2025. This consistency is notable given the fluctuating ranks of competitors such as Palmetto, which saw a significant rise from 91 in November to 73 in December before dropping to 83 in January. Meanwhile, EastCann demonstrated a strong upward trend, moving from 87 in November to 63 in December, although it fell back to 85 in January. Stigma Grow experienced more volatility, missing the top 20 in November and December but reappearing at 99 in January. Edison Cannabis Co's stable rank amidst these fluctuations suggests a resilient market position, although its sales figures indicate room for growth compared to higher-performing brands like GORILLA GARDEN CRAFT CANNABIS & EXTRACTS, which, despite a decline in rank to 94 in January, previously held a stronger sales position.

Notable Products

In January 2026, the top-performing product from Edison Cannabis Co was the Jolts Sativa Electric Lemon Lozenge (10mg), which climbed to the number one spot with impressive sales of 4047 units. This product showed a consistent rise from the third position in previous months. The Sonics CBD/THC 1:1 Kiwi Berry Burst Gummies 2-Pack, previously holding the top rank, dropped to second place. The Sonics CBD/THC 1:1 Red Razz Chiller Gummies 2-Pack also experienced a decline, moving from second to third position. Notably, the Jolts Sativa Arctic Cherry Lozenge maintained its fourth position, demonstrating stable performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.