Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

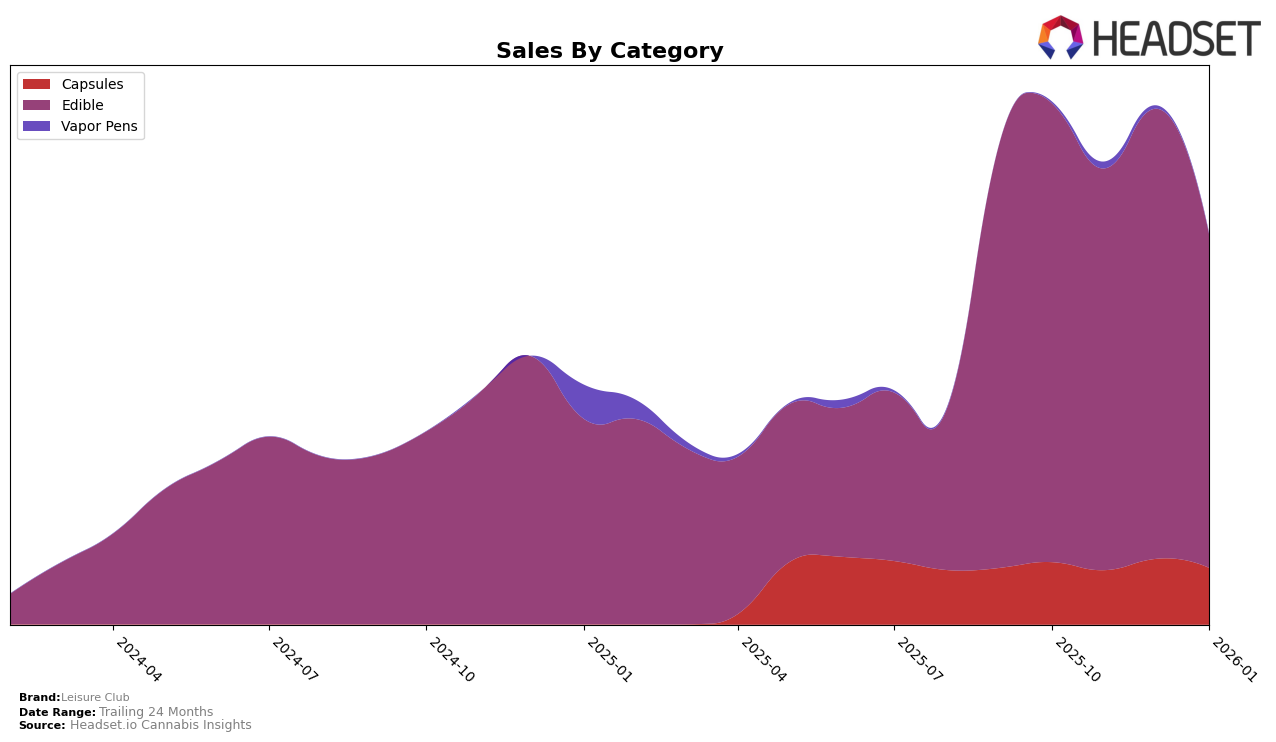

Leisure Club has shown varying performance across different categories and regions. In Alberta, the brand's presence in the Capsules category has been relatively strong, maintaining a consistent rank of 7 from October through December 2025, before slightly improving to 6 in January 2026. This upward movement suggests a positive reception in the Capsules market, despite a fluctuation in sales figures. On the other hand, in the Edible category within the same province, Leisure Club maintained a steady rank of 7 throughout the observed months, indicating stable market positioning. However, it's worth noting the noticeable drop in sales from November to January, which could imply a seasonal trend or increased competition.

In Ontario, Leisure Club's performance in the Edible category tells a different story. Starting with a rank of 27 in October 2025, the brand fell out of the top 30 by November and did not reappear in the rankings for December 2025 and January 2026. This decline may indicate challenges in maintaining market share or adapting to consumer preferences in Ontario's competitive landscape. The absence from the rankings could be viewed as a setback, highlighting the need for strategic adjustments to regain traction in this key market. Despite these challenges, the brand's performance in Alberta suggests potential areas of strength that could be leveraged for recovery.

Competitive Landscape

In the Alberta edibles market, Leisure Club consistently maintained its 7th rank from October 2025 to January 2026, indicating a stable position amidst fluctuating sales figures. Despite a notable dip in sales from November to January, Leisure Club's rank remained unchanged, suggesting that its competitors experienced similar challenges. However, brands like Olli and No Future have shown stronger upward momentum, with Olli climbing to the 4th position in December 2025 and maintaining a higher sales trajectory. This highlights a competitive pressure on Leisure Club to innovate or enhance its offerings to prevent potential rank drops. Meanwhile, Chowie Wowie and Monjour have seen similar rank fluctuations, indicating a competitive cluster around Leisure Club's current standing. As the market evolves, Leisure Club may need to strategize to capture more market share and improve its rank against these agile competitors.

Notable Products

In January 2026, the top-performing product for Leisure Club was the Pink Kush Capsule 5-Pack (50mg), which climbed to the number one spot in the Capsules category, despite a slight decrease in sales to 2880 units. The CBN/CBD/THC 1:1:1 Cloudberry Live Rosin Gummies 10-Pack (10mg CBN, 10mg CBD, 10mg THC) ranked second, maintaining a strong position in the Edible category. Pineapple Express Capsule 5-Pack (50mg) held steady at third place, demonstrating consistent popularity. Cherry Fizz Live Rosin Gummies 5-Pack (10mg) dropped from first place in December to fourth, showing a notable decline in sales. The CBG/CBD/THC 1:1:1 Tangerine Splash Live Rosin Gummies 10-Pack (10mg CBG, 10mg CBD, 10mg THC) slipped to fifth, indicating a downward trend from its previous rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.