Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

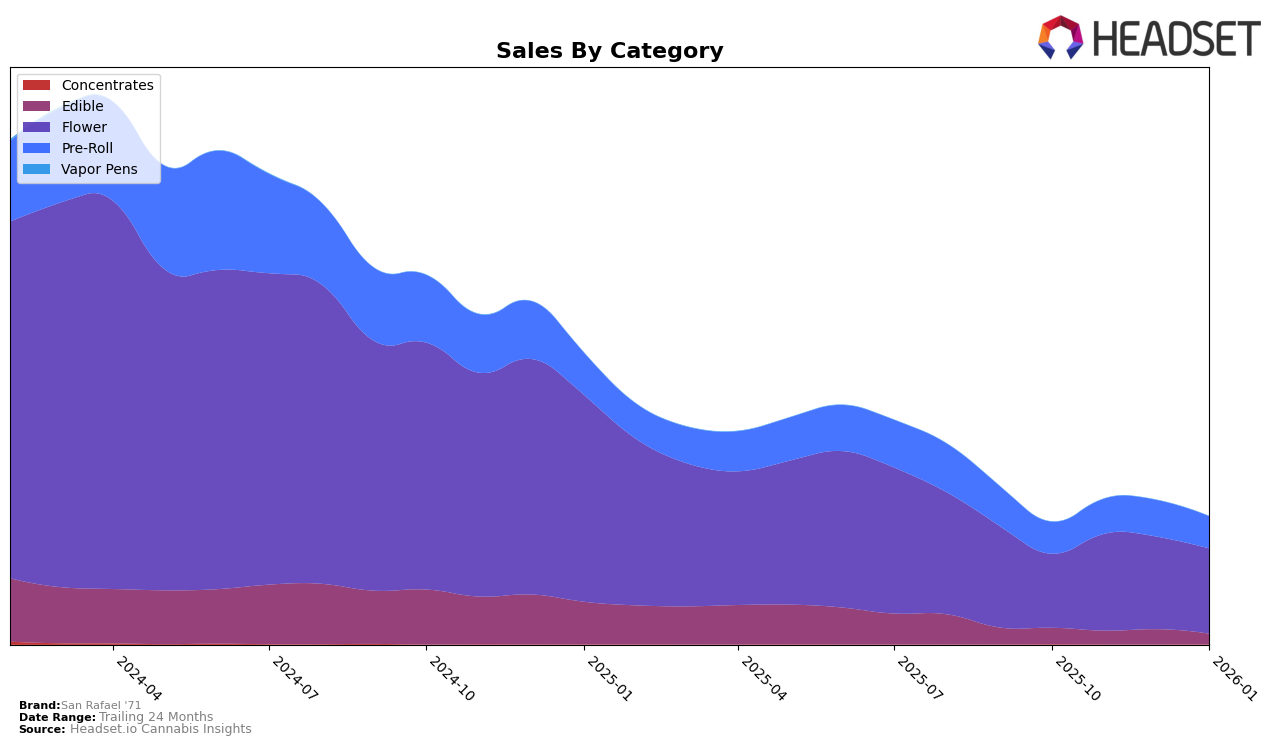

San Rafael '71 has shown a mixed performance across various categories and provinces. In Alberta, the brand's presence in the Edible category has been relatively stable, albeit with a slight decline, maintaining a rank within the top 30, moving from 21st in October 2025 to 23rd by January 2026. However, their Flower category performance in Alberta has not been as strong, consistently ranking outside the top 40. In the Pre-Roll category, they have seen a notable fluctuation, with a peak at 81st in December 2025, indicating some volatility in their market position.

In British Columbia, San Rafael '71 has experienced significant movement in the Flower category, climbing from 64th in October 2025 to 46th in December, before dropping back to 61st in January 2026. This indicates a competitive and shifting market landscape. The Pre-Roll category in British Columbia presents a challenge, as the brand fell out of the top 30 in November 2025, which suggests a need for strategic adjustments. Meanwhile, in Ontario, their Edible category has remained consistent around the 22nd to 23rd rank, showing stability. However, the Flower category in Ontario has seen improvement, rising from 80th in October 2025 to 66th by January 2026, highlighting potential growth opportunities in this province.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, San Rafael '71 has shown a positive trajectory in terms of rank and sales over the past few months. From October 2025 to January 2026, San Rafael '71 improved its rank from 80th to 66th, indicating a steady upward trend. This improvement is notable when compared to competitors such as Weed Me, which experienced fluctuations and even dropped out of the top 20 in November 2025. Meanwhile, BC OZ saw a decline from 47th to 68th place, suggesting a potential opportunity for San Rafael '71 to capture more market share. Similarly, Four54 also experienced a downward trend, ending at 69th place in January 2026. Interestingly, After Hours showed a significant improvement, jumping from 93rd to 65th, which could pose a competitive challenge. Overall, San Rafael '71's consistent rise in rank and sales positions it favorably against its competitors, highlighting its growing presence in the Ontario Flower market.

Notable Products

In January 2026, the top-performing product for San Rafael '71 was the Moon Berry Pre-Roll 3-Pack (1.5g), maintaining its consistent first-place ranking from previous months with a sales figure of 5275. The Tangerine Dream Cured Resin Gummies 4-Pack (10mg) held steady in the second position, although its sales slightly decreased. Notably, Pink Diesel '71 (3.5g) emerged in third place, showing a new entry for the month. Cosmic Cream (3.5g) remained in fourth place, experiencing a slight decline in sales. Black Jelly (3.5g) reappeared in the rankings at fifth, showing a drop in its sales figures compared to October and November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.