Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

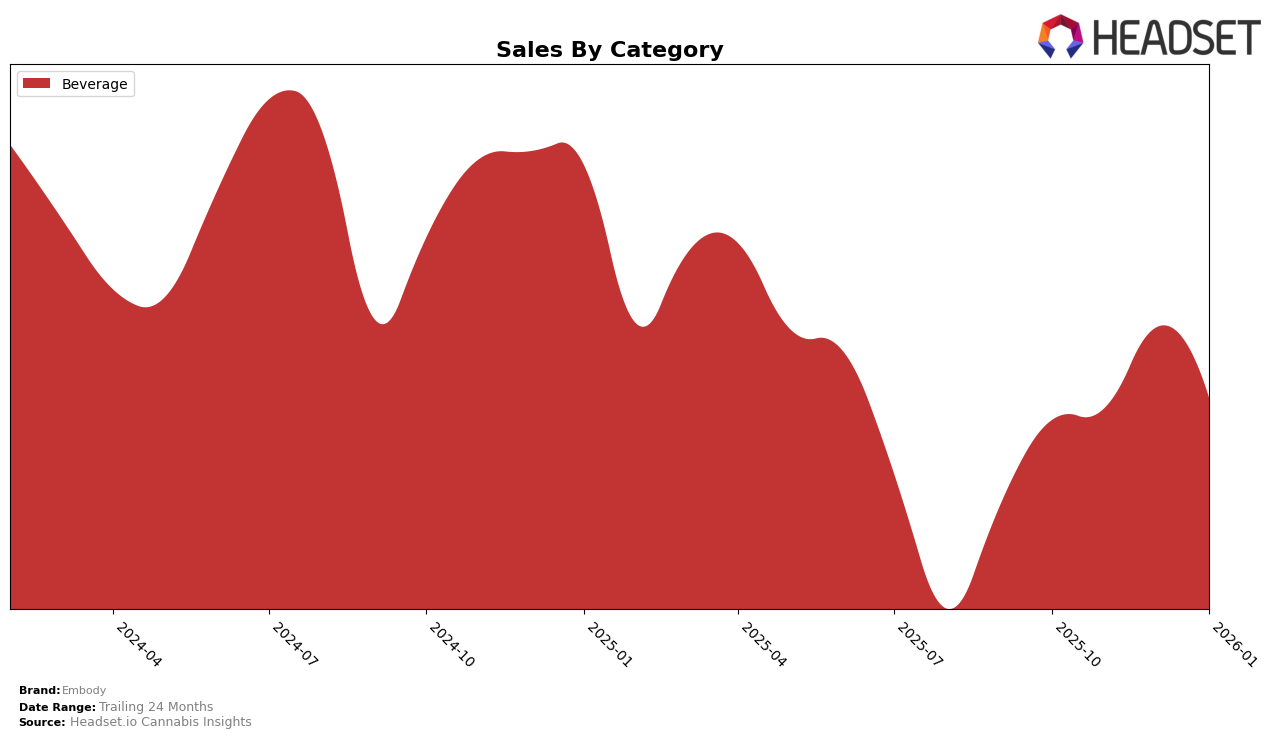

Embody has shown a consistent presence in the Beverage category in Ontario, maintaining a steady position within the top 30 brands. Over the four-month period from October 2025 to January 2026, Embody's rankings fluctuated slightly, starting at 22nd place in October, peaking at 20th in December, and then settling back to 21st by January. This indicates a stable performance with minor improvements, particularly in December, which could suggest a successful marketing strategy or seasonal demand affecting sales positively. The absence of any month where Embody fell out of the top 30 is a positive indicator of its resilience and consistent consumer interest in the Ontario market.

While the brand's ranking movements are modest, the sales figures provide additional context, showing a notable increase in December 2025. This spike in sales aligns with the improved ranking during that month, suggesting a correlation between sales volume and brand visibility in the rankings. However, despite the slight dip in sales from December to January, Embody managed to maintain its rank, indicating that other brands may have experienced similar trends, or that Embody's market strategies effectively cushioned the impact. The brand's ability to remain within the top 30 across all months in Ontario's competitive beverage market speaks to its solidified presence and potential for future growth.

```Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Embody has shown a steady improvement in its market position, moving from 22nd in October 2025 to 20th by December 2025, before slightly dropping to 21st in January 2026. This upward trend in rank during the last quarter of 2025 is indicative of Embody's growing influence in the market, although it still trails behind brands like Dulces, which fluctuated but maintained a higher rank, and Palmetto, which consistently stayed ahead of Embody. Despite Aspire entering the top 20 only in December 2025, its presence indicates increasing competition. Meanwhile, Frootyhooty remained behind Embody, suggesting that Embody's strategies are effectively positioning it ahead of some competitors. Embody's sales figures reflect this competitive positioning, showing a notable increase in December 2025, which aligns with its peak rank during this period, though it experienced a slight decline in January 2026, mirroring its rank drop.

Notable Products

In January 2026, Embody's top-performing product was the CBD/THC Peach + Ginger White Sparkling White Tea, which maintained its number one rank for the fourth consecutive month, achieving sales of 1,751 units. Following closely, the CBD/THC Blood Orange + Rosemary Tea secured the second position, consistently holding this rank since October 2025 with sales of 596 units. Notably, both products are part of the Beverage category and have shown steady performance without any changes in their rankings over the past months. The Peach + Ginger variant has seen a slight fluctuation in sales figures but remains the leader in the market. Overall, Embody's top products have demonstrated strong consistency in consumer preference and market performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.