Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

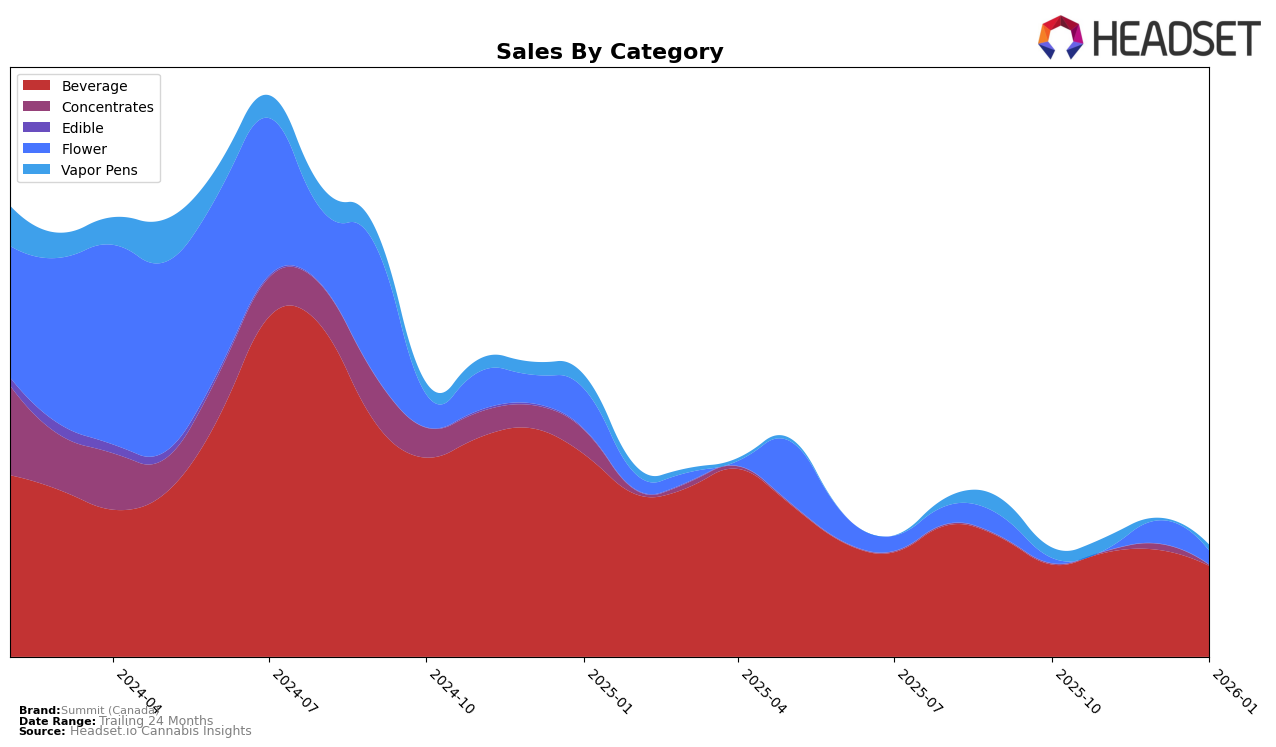

Summit (Canada) has shown varied performance across different provinces in the Beverage category. In Alberta, the brand has maintained a steady presence, consistently ranking around the 10th and 11th positions from October 2025 to January 2026. This stability suggests a strong foothold in the Alberta market, with sales showing a positive trend from November 2025 to January 2026. Conversely, in British Columbia, Summit (Canada) experienced slight fluctuations in their ranking, moving from 12th to 13th place in the same period. Despite this minor drop, the sales figures indicate a robust performance in November and December 2025, hinting at potential growth opportunities in the British Columbia market.

In Ontario, Summit (Canada) has faced challenges in maintaining a consistent rank within the top 30 brands in the Beverage category. The brand's ranking shifted from 27th in October 2025 to 26th in January 2026, with a brief improvement in November and December 2025. This indicates a competitive market environment in Ontario, where Summit (Canada) needs to strategize to enhance its standing. Additionally, in Colorado, Summit (Canada) entered the Flower category ranking at 94th in January 2026, highlighting the brand's expansion efforts into new categories, though not yet achieving a top 30 position. The absence of previous rankings in Colorado signifies that Summit (Canada) is still in the early stages of establishing its presence in this market segment.

Competitive Landscape

In the competitive landscape of the beverage category in Alberta, Summit (Canada) has experienced fluctuations in its rank and sales over the past few months. In October 2025, Summit held the 10th position but dropped to 11th in November and December, before regaining its 10th place in January 2026. This indicates a resilient performance amidst a competitive market. Notably, Collective Project consistently outperformed Summit, maintaining a higher rank and significantly higher sales figures, particularly in December 2025. Meanwhile, Solei and Astro Lab have been close competitors, with Solei mirroring Summit's rank in October and January, and Astro Lab consistently holding the 9th position. Palmetto, although never surpassing Summit, showed a notable increase in sales in November, suggesting a potential rise in consumer interest. Summit's ability to regain its rank in January 2026 highlights its competitive resilience and potential for growth in the Alberta beverage market.

Notable Products

In January 2026, the top-performing product from Summit (Canada) was Lemonade Iced Tea (10mg THC, 355ml) in the Beverage category, maintaining its number one rank from the previous two months with sales of 3459 units. Peach Iced Tea (10mg THC, 355ml) reclaimed the second spot, up from third in December, indicating a resurgence in popularity with 2609 units sold. Crank Yanker (Bulk) in the Flower category slipped to third place after debuting in second in December with sales dropping to 2129 units. Clementine Crush Seltzer (10mg THC, 355ml) remained steady at fourth position across the months, while Apple Pie Iced Tea (10mg THC, 355ml) maintained its fifth rank, showing consistent interest despite lower sales figures. Overall, the Beverage category continues to dominate the rankings, with slight shifts in product popularity month over month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.