Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

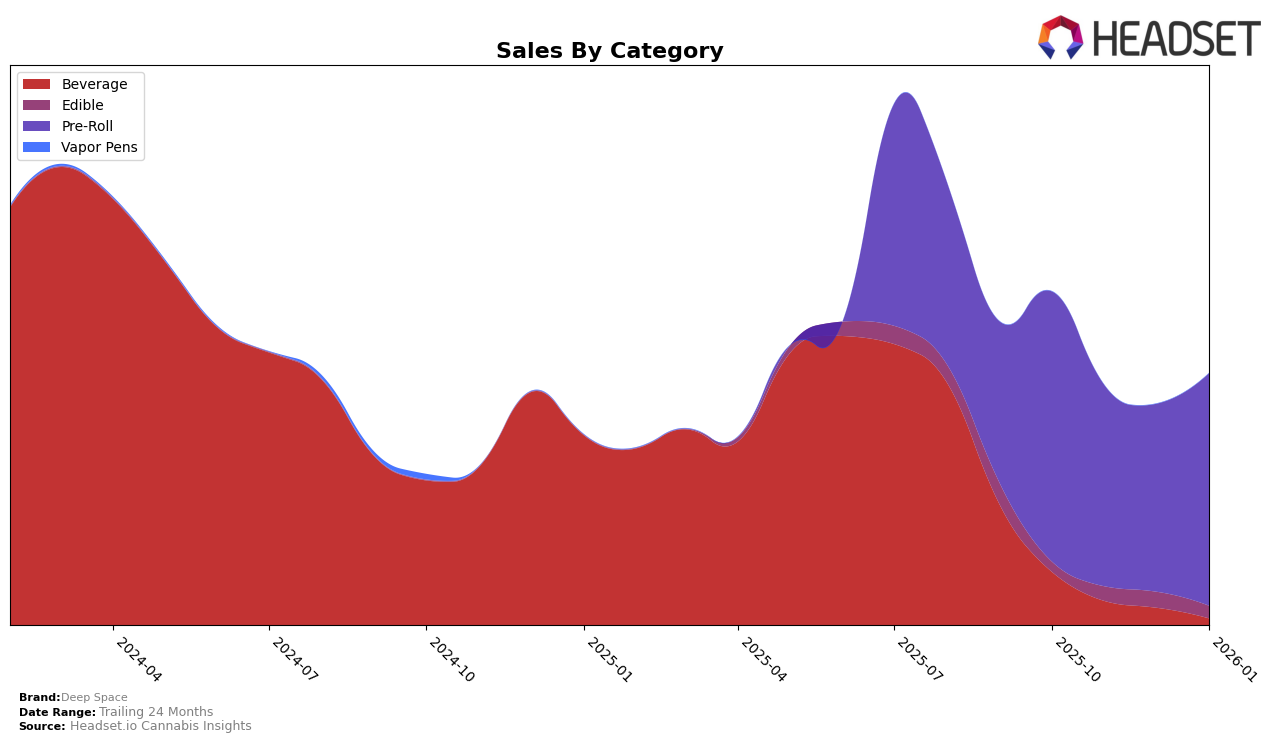

Deep Space has shown varied performance across different categories and regions, with some notable movements in rankings and sales. In the Alberta market, Deep Space's position in the Beverage category was solid in October 2025, securing the 14th rank. However, their absence from the top 30 in subsequent months suggests a decline in presence or increased competition. On the other hand, the Pre-Roll category in Alberta tells a different story. Starting from a lower position of 84th in October 2025, Deep Space climbed to 54th by January 2026, indicating a positive trend and potentially growing consumer interest in their pre-roll offerings.

In Ontario, Deep Space made it to the 28th rank in the Beverage category in October 2025 but did not maintain a top 30 position in the following months. This could signal challenges in sustaining market share or shifts in consumer preference within the province. The data underscores the importance of regional strategies and category focus, as the brand's performance in Alberta's Pre-Roll category contrasts with its Beverage category trajectory in both Alberta and Ontario. This dynamic performance suggests that while Deep Space has potential strengths, particularly in pre-rolls, it may need to address competitive pressures and consumer trends in the beverage sector.

Competitive Landscape

In the competitive landscape of Pre-Roll cannabis brands in Alberta, Deep Space has shown a significant upward trajectory in rank and sales, particularly from December 2025 to January 2026. While initially lagging behind competitors, Deep Space surged from a rank of 96 in December 2025 to 54 in January 2026, indicating a strategic move or market shift that has positively impacted its position. This leap is noteworthy when compared to brands like 7 Acres and Ritual Green / Ritual Gold, which have seen a decline or stagnation in ranks during the same period. Meanwhile, Tuck Shop and SUGR have maintained relatively stable positions, with SUGR showing a slight improvement. Deep Space's impressive rank improvement suggests a successful strategy that has resonated well with consumers, potentially driven by product innovation or effective marketing campaigns, setting it apart from its competitors in the Alberta Pre-Roll market.

Notable Products

In January 2026, Big Bang Berry Infused Pre-Roll 3-Pack (1.5g) reclaimed the top position among Deep Space products, maintaining its lead from October and November 2025, with a slight increase in sales to 2554 units. Xpress - Limon Splashdown Gummy (10mg) slipped to second place after a peak in December 2025, indicating robust but slightly reduced sales performance. Milky Way Melon Infused Pre-Roll 3-Pack (1.5g) consistently held the third position, showing a recovery in sales figures from the previous months. Propulsion - THC/CBG 1:1 Cosmic Cherry Lime Soda (10mg THC, 10mg CBG 355ml) moved up to the fourth rank, while Propulsion - CBG/THC 1:1 Lemon Lime Soda (10mg CBG, 10mg THC, 355ml) rounded out the top five, experiencing a significant drop in sales. Overall, while some fluctuations are evident, the top products have largely maintained their rankings with minor shifts in position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.