Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

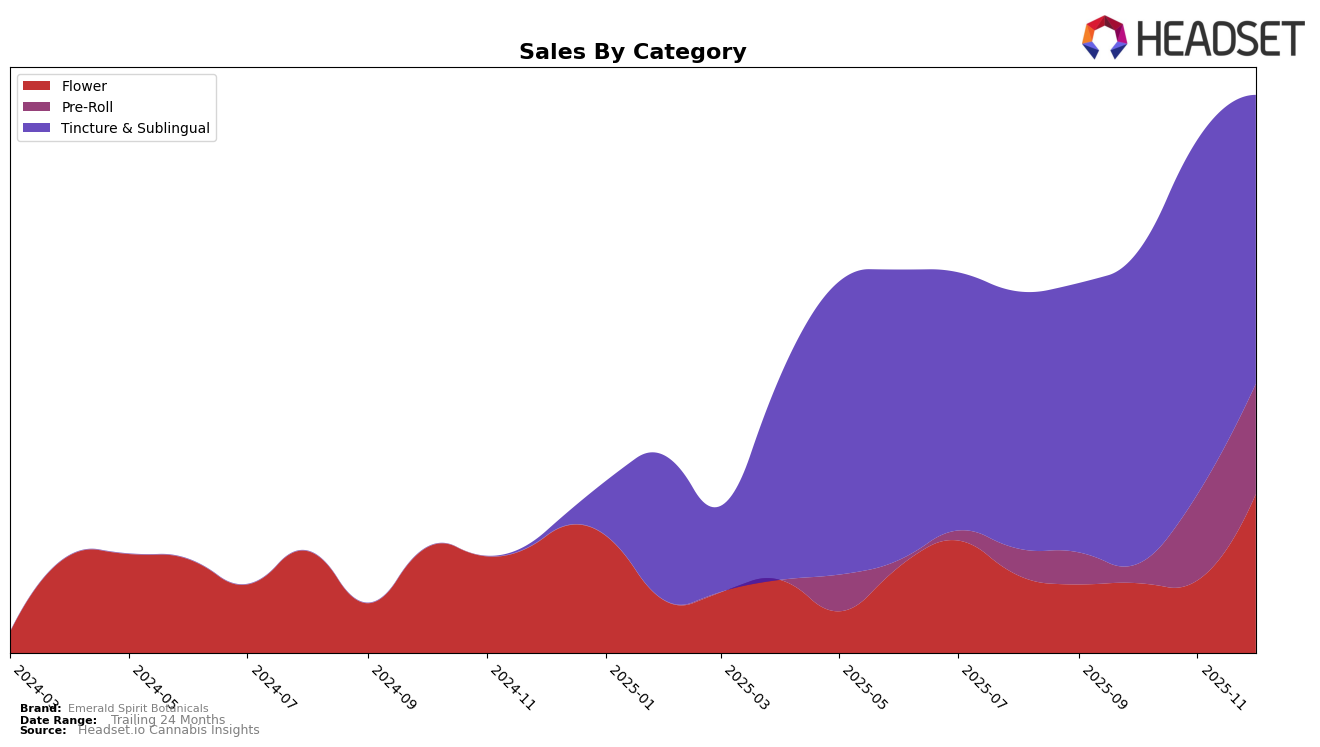

Emerald Spirit Botanicals has shown a noteworthy performance in the California market, particularly within the Tincture & Sublingual category. Despite not being ranked in the top 30 brands for September and October 2025, they made a significant leap to secure the 21st position by November. This upward trajectory indicates a growing consumer interest and possibly an effective strategy shift or product launch that resonated well with the market. The absence of a ranking in the earlier months highlights the competitive nature of the category, but their emergence in November suggests a potential for further growth if they maintain or improve their market positioning.

Interestingly, the data does not provide a complete picture for December 2025, as Emerald Spirit Botanicals is not listed among the top 30 brands in the Tincture & Sublingual category for that month. This could imply a temporary setback or increased competition during the holiday season, which is often a peak period for sales. However, the brand's ability to enter the rankings in November after months of absence is a positive indicator of their potential to reclaim or even improve their standing in the coming months. Such fluctuations are not uncommon in the cannabis industry, where market dynamics can shift rapidly, and brands must continuously adapt to consumer preferences and competitive pressures.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Emerald Spirit Botanicals has shown a notable presence by entering the top 20 brands in December 2025 with a rank of 21. This marks a significant achievement as they were not ranked in the top 20 in the preceding months of September, October, and November 2025. This upward movement suggests a positive trend in brand visibility and consumer preference. In contrast, competitors like Chemistry and Mama Sue have seen fluctuations, with Chemistry dropping out of the top 20 by October 2025 and Mama Sue entering the top 20 in December 2025 at rank 22. The competitive dynamics indicate that Emerald Spirit Botanicals is gaining traction, potentially driven by strategic marketing efforts or product innovation, positioning them well against competitors who are experiencing more volatility in their rankings.

Notable Products

In December 2025, the top-performing product for Emerald Spirit Botanicals was the THC/THCv 1:1 Pink Boost Goddess Pre-Roll 2-Pack (1.2g) in the Pre-Roll category, maintaining its number one rank from November. The CBD/THC 20:1 Rose Queen Tincture rose to the second position, achieving notable sales of 106 units. The Pink Boost Goddess (3.5g) saw a significant jump, climbing from fifth in November to third in December. The Emerald Spirit x Farm Cut - Royal Blueberry Pre-Roll 2-Pack (1g) secured the fourth position, showing an improvement from its previous absence in the rankings. The Emerald Spirit x Farm Cut - Pink Boost Goddess Pre-Roll 2-Pack (1g) remained steady in fifth place, demonstrating consistent performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.