Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

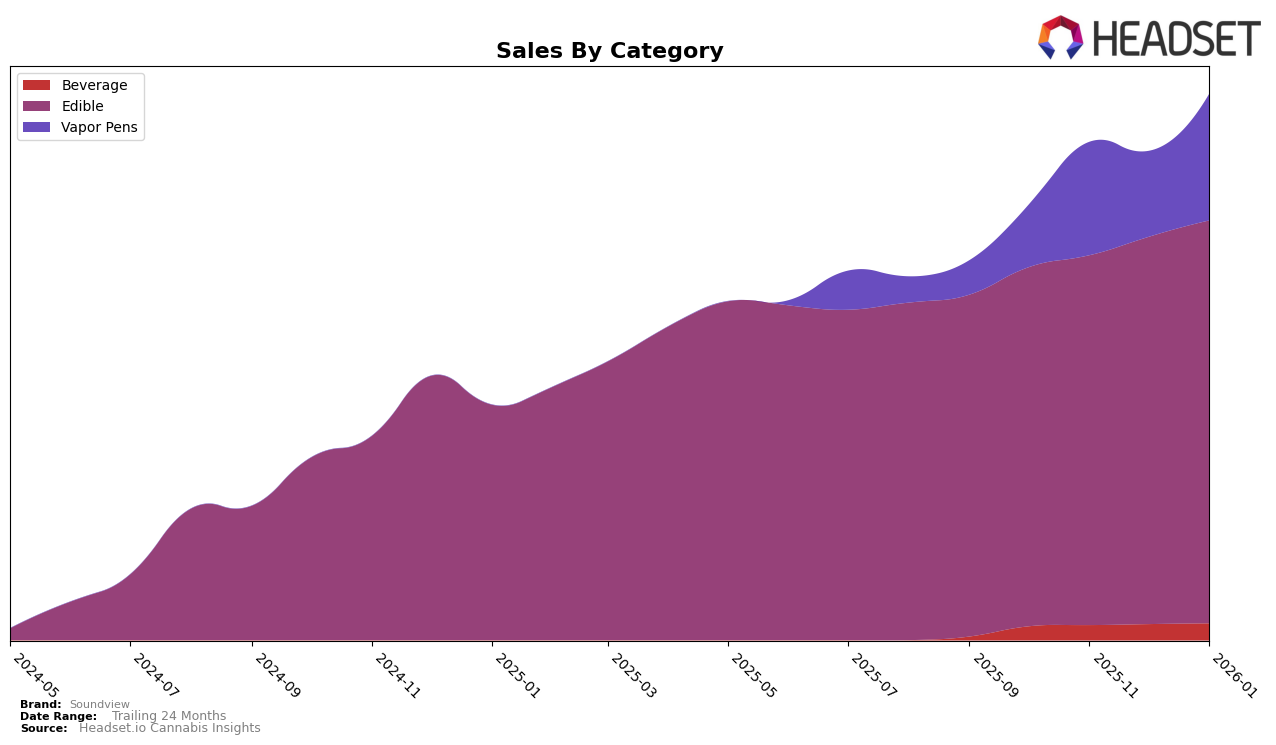

Soundview has demonstrated a strong presence in the Connecticut cannabis market, particularly in the Beverage category. Despite a slight dip in December 2025, where they moved from the second to third position, they quickly regained their standing by January 2026, reclaiming the second spot. This indicates a resilient performance despite competitive pressures. The Edible category has maintained a consistent ranking at second place throughout the months from October 2025 to January 2026, showcasing Soundview's stable market position and consumer preference for their edible products in Connecticut.

In the Vapor Pens category, Soundview's performance has been more variable. Starting at the tenth position in October 2025, the brand improved to eighth place by November, only to slip back to tenth in December. By January 2026, they managed to climb back to ninth place, indicating some challenges in sustaining a higher rank in this competitive category. Notably, Soundview's sales in this category showed significant fluctuations, potentially reflecting seasonal trends or shifts in consumer preferences. Their absence from the top 30 in other states or categories suggests areas for potential growth or the need for strategic adjustments to enhance their market footprint beyond Connecticut.

Competitive Landscape

In the competitive landscape of the Edible category in Connecticut, Soundview has consistently maintained its position as the second-ranked brand from October 2025 through January 2026. Despite not surpassing Encore Edibles, which holds the top spot with a significant lead in sales, Soundview has shown a steady increase in sales over the months, indicating a positive growth trajectory. This stability in ranking amidst competitors like Wana and Camino, who have fluctuated between third and fourth positions, highlights Soundview's strong market presence and customer loyalty. As the brand continues to grow its sales, it remains a formidable player in the Connecticut edible market, poised to challenge for the top position if current trends continue.

Notable Products

In January 2026, Soundview's top-performing product remained the CBN/THC 5:1 BlueZZZberry Gummies 20-Pack, maintaining its first-place rank for the fourth consecutive month with sales reaching 8,671 units. The THC/CBN 2:1 G'Night Grape Gummies 20-Pack also held steady at second place, although its sales slightly declined compared to previous months. New to the top rankings, the Peach RSO Gummies 20-Pack secured the third position, indicating a strong entry into the market. The CBD/CBN/THC 1:1:1 Mellow Mango Gummies improved its rank from fifth to fourth, showing increased consumer interest. Meanwhile, Black Cherry Fast Acting Gummies entered the rankings at fifth place, suggesting growing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.