Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

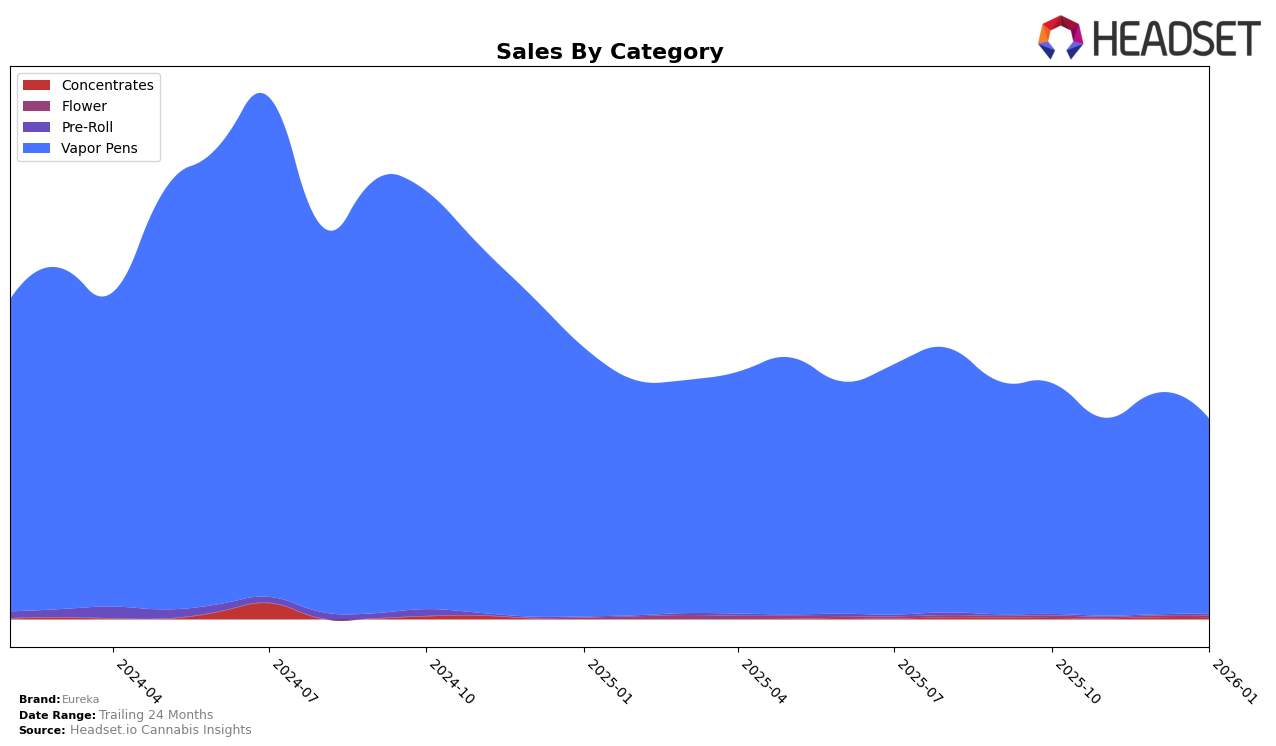

In the realm of vapor pens, Eureka demonstrates a varied performance across different states. In California, the brand has consistently remained outside the top 30, holding steady at rank 53 from October 2025 through January 2026. This stagnation suggests a challenge in penetrating the competitive California market. Conversely, in Colorado, Eureka shows a more dynamic presence, fluctuating within the top 20 ranks. The brand experienced a slight drop from rank 12 in December 2025 to rank 15 in January 2026, yet it remains a significant player in the state's vapor pen category.

In New York, Eureka's performance in the vapor pen category indicates a downward trend, with its rank slipping from 22 in October 2025 to 29 by January 2026. This decline might be indicative of increasing competition or shifting consumer preferences in the New York market. Despite these rankings, Eureka's sales figures suggest a resilience, with fluctuations that hint at potential for recovery or growth. While specific sales numbers are not disclosed, the overall movement in rankings provides a snapshot of Eureka's challenges and opportunities across these key markets.

Competitive Landscape

In the competitive landscape of Vapor Pens in Colorado, Eureka has shown a fluctuating performance in terms of rank and sales. Starting from October 2025, Eureka was ranked 12th, dipped to 16th in November, rebounded to 12th in December, and slightly declined to 15th in January 2026. This indicates a volatile market presence, with sales peaking in December. In comparison, O.penVape consistently maintained a higher rank than Eureka, although their sales showed a downward trend from October to January. Meanwhile, Sauce Essentials demonstrated a strong performance by climbing from 15th in October to 13th in January, with sales surpassing Eureka in December and January. Seed and Smith (LBW Consulting) also posed a competitive challenge by ending January with a higher rank than Eureka. These dynamics suggest that while Eureka remains a significant player, it faces stiff competition from brands like Sauce Essentials and O.penVape, which could impact its market share and necessitate strategic adjustments to maintain or improve its standing.

Notable Products

In January 2026, Eureka's top-performing product was the Obama Runtz x Banana Dosi Bubble Hash Infused Pre-Roll in the Pre-Roll category, securing the number one rank with a notable sales figure of 1937 units. The Fusion - Tropical Twist Distillate Reload Disposable in the Vapor Pens category followed closely, moving from first place in December 2025 to second place in January 2026. The Fusion - Concord Crush Resin Reload Pod maintained a steady position, holding third place in both December 2025 and January 2026. The Classic - Triple Diesel Distillate Reload Pod and Strawberry Clemonade Distillate Reload Pod rounded out the top five, ranking fourth and fifth, respectively. This shift in rankings indicates a strong preference for infused pre-rolls at the start of the new year, while vapor pens continue to maintain a significant presence in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.