Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

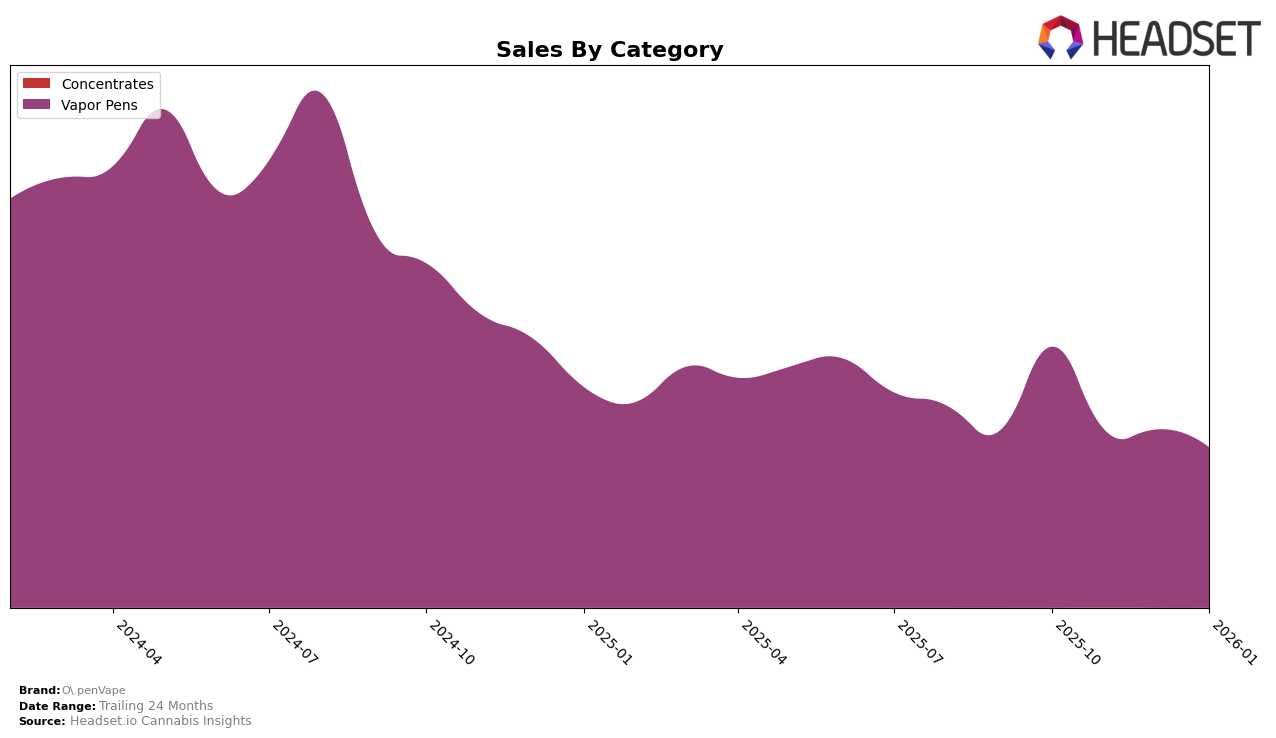

In the state of Colorado, O.penVape has experienced a notable decline in its performance within the Vapor Pens category over the analyzed months. Starting from a robust 8th place in October 2025, the brand has seen a gradual drop, reaching the 16th position by January 2026. This downward trend is accompanied by a decrease in sales, with January 2026 figures showing a reduction from the October 2025 sales. Such a decline could indicate a shift in consumer preferences or increased competition within the Colorado market.

In contrast, in Maryland, O.penVape's presence is less pronounced, as it did not rank within the top 30 brands in the Vapor Pens category for the majority of the months analyzed. The brand only appeared in the rankings in November 2025, coming in at 49th place. This sporadic appearance suggests that O.penVape may be facing challenges in establishing a strong foothold in Maryland's competitive market. The absence from the rankings in other months could be seen as a missed opportunity for growth in a potentially lucrative market.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, O.penVape has experienced a notable decline in its ranking from October 2025 to January 2026, dropping from 8th to 16th place. This downward trend in rank is mirrored by a decrease in sales, which have fallen consistently over the same period. In contrast, Eureka has shown resilience with fluctuating ranks but managed to surpass O.penVape in January 2026, climbing to 15th place. Meanwhile, Seed and Smith (LBW Consulting) has shown a positive trajectory, improving its rank to 14th in January 2026, indicating a potential threat to O.penVape's market share. Additionally, Billo made a significant leap into the top 20 by December 2025 and maintained its position close to O.penVape in January 2026. These shifts suggest that while O.penVape remains a key player, it faces increasing competition from brands like Eureka and Seed and Smith, which are gaining traction in the Colorado vapor pen market.

Notable Products

In January 2026, Tiger's Blood Distillate Cartridge (1g) maintained its top rank in the Vapor Pens category for O.penVape, despite a sales decrease to 607 units. The Craft Reserve - Strawberry Cheesecake Distillate Cartridge (1g) rose significantly to the second position, showing a strong performance with 566 units sold. Alaskan Thunder F*** Distillate Cartridge (1g) held steady in third place, with a slight increase in sales compared to December 2025. Daily Strains - Northern Lights Distillate Cartridge (1g) dropped to fourth place, while Daily Strains - Maui Wowie Distillate Cartridge (1g) completed the top five, showing a consistent decline in sales over the months. Overall, the product rankings indicate a dynamic market with significant shifts in consumer preference within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.