Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

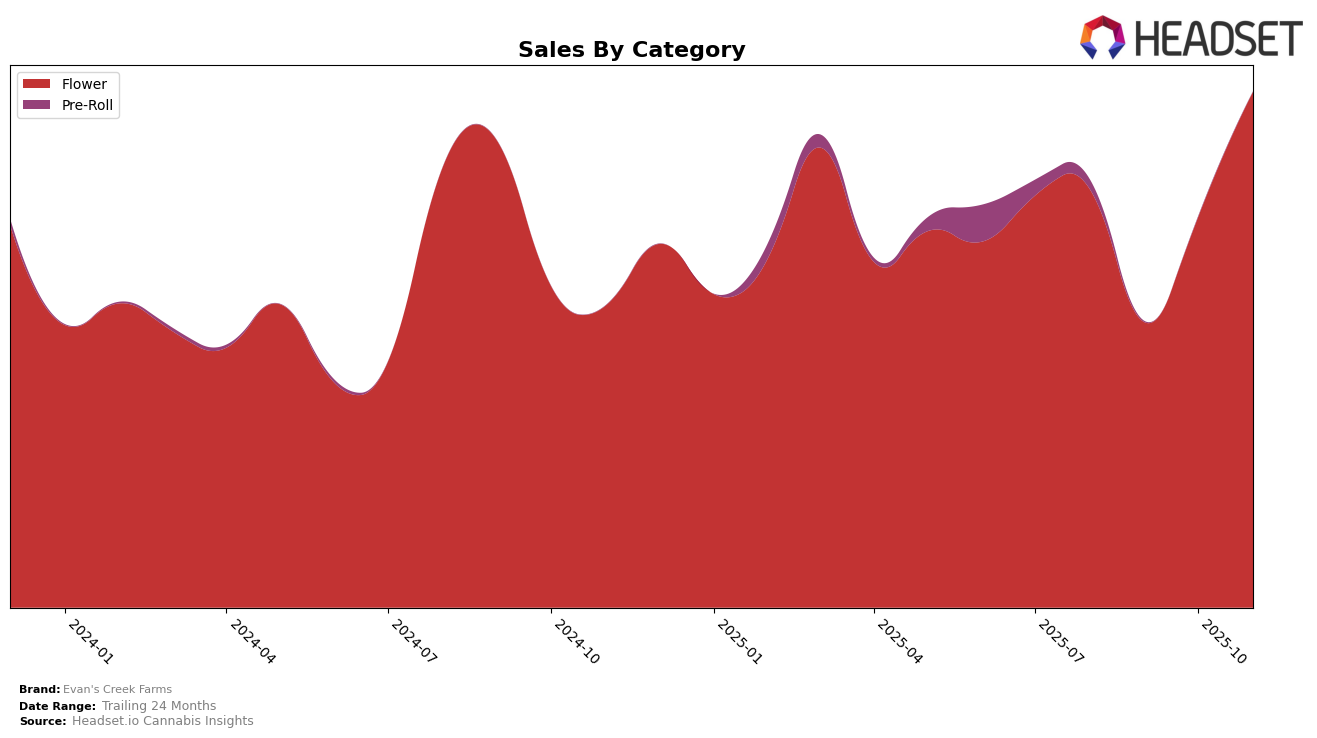

Evan's Creek Farms has demonstrated notable performance shifts across various categories and states, particularly in the Oregon market. In the Flower category, the brand has shown a consistent improvement in its rankings over the last few months. While it was initially outside the top 30 brands, ranking 39th in August 2025, it has risen to 28th by November 2025. This upward trajectory is a positive indicator of the brand's increasing market presence and consumer acceptance in Oregon, suggesting effective strategies or growing demand for their products. The sales figures, which peaked in November, reinforce this trend, though specific numbers are not disclosed here.

However, the absence of Evan's Creek Farms from the top 30 rankings in other states or categories during this period could indicate limited geographical or category-specific penetration. This lack of presence in other states might suggest opportunities for growth or a need for strategic adjustments to expand their footprint. While the brand's performance in Oregon's Flower category is commendable, further analysis would be required to understand its overall market strategy and potential areas for expansion. Such insights could provide valuable guidance for stakeholders looking to capitalize on the brand's momentum or address any existing challenges.

Competitive Landscape

In the competitive landscape of Oregon's flower category, Evan's Creek Farms has shown notable fluctuations in its market position over recent months. Despite a challenging start in September 2025, where it dropped to a rank of 49, Evan's Creek Farms made a significant comeback by November 2025, climbing to the 28th position. This upward trajectory in rank is indicative of a recovery in sales performance, as evidenced by the increase from September to November. In contrast, competitors like Cosmic Treehouse and Rosebud Growers have experienced varying degrees of volatility, with Cosmic Treehouse peaking at 20th in October before slipping to 26th in November, and Rosebud Growers dropping from 13th in August to 27th in November. Meanwhile, Derby's Farm and Drewby Doobie / Epic Flower have also seen shifts in their rankings, with Derby's Farm moving from 22nd in September to 29th in November, and Drewby Doobie / Epic Flower maintaining a more stable presence despite a slight decline. These dynamics highlight the competitive pressures and opportunities for Evan's Creek Farms to capitalize on its recent momentum and potentially gain further market share in the Oregon flower market.

Notable Products

In November 2025, M.A.C. #1 (Bulk) emerged as the top-performing product for Evan's Creek Farms, climbing from the third position in August to first place, with sales reaching 1058 units. Pi Chew (Bulk) also showed significant improvement, advancing from fourth place in previous months to secure the second spot. Fire Belly Toad (7g) maintained a strong presence, ranking third, although it was previously second in August. Toad Venom (Bulk) experienced a decline, dropping to fourth place after being the top product in October. Grandpa's Gun Chest (Bulk) saw a notable drop from first place in September to fifth in November, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.