Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

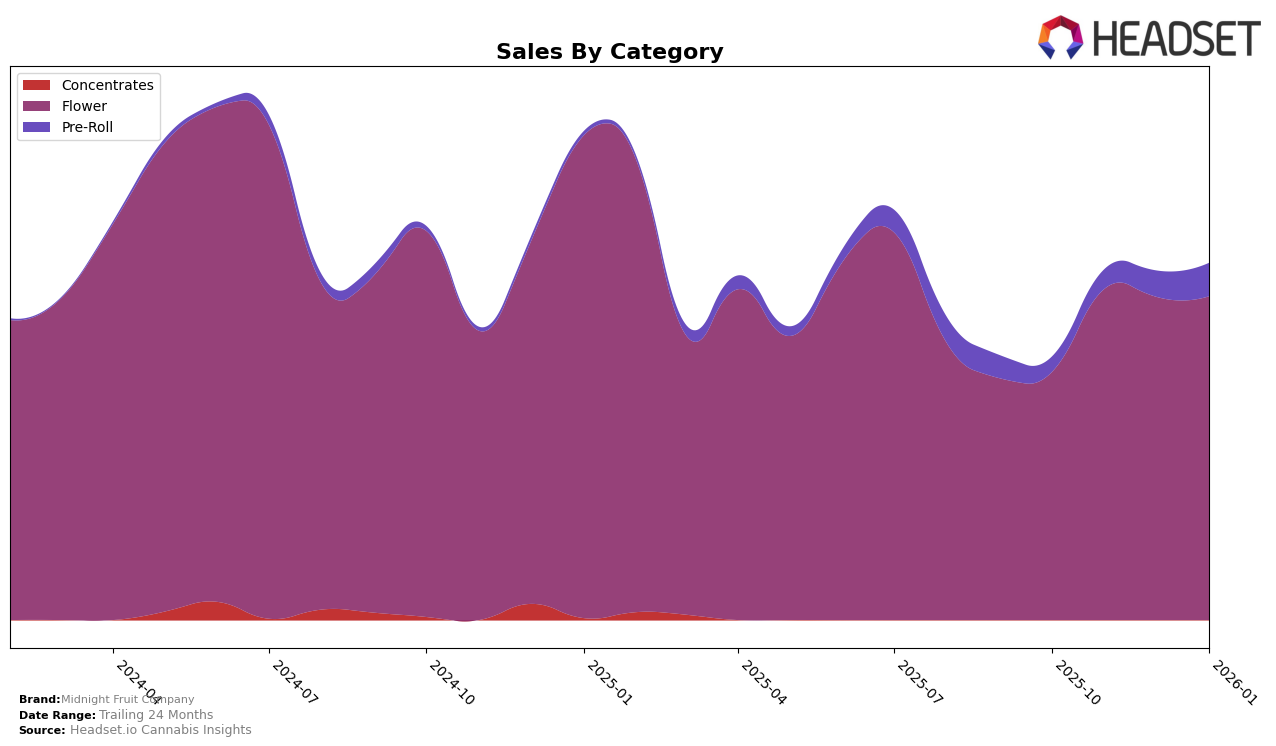

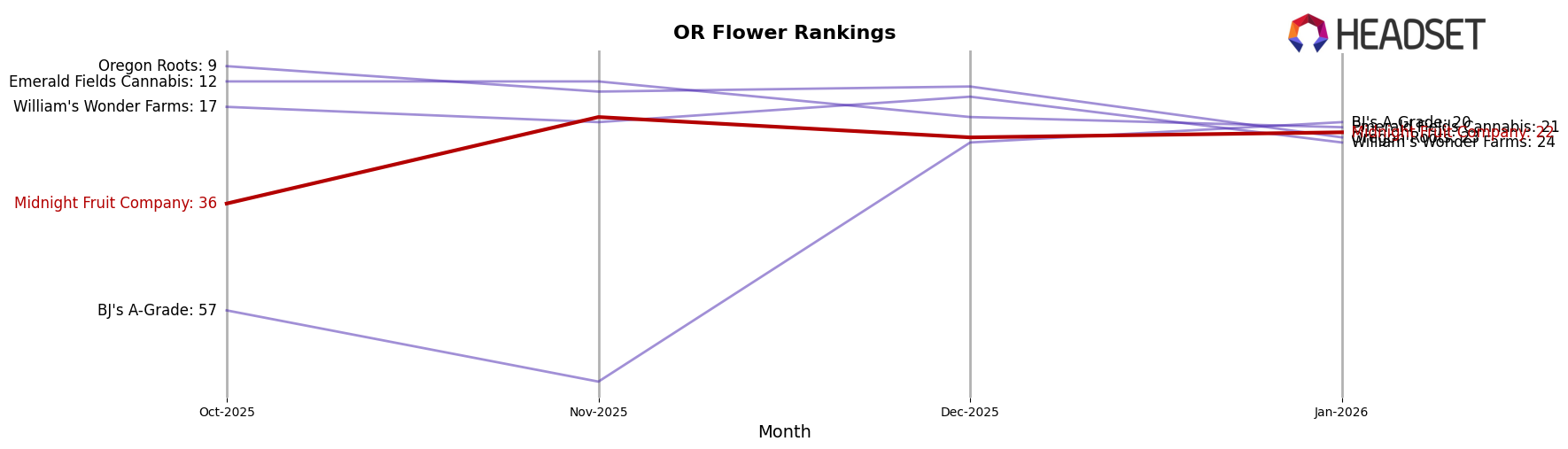

Midnight Fruit Company has shown notable performance in the Oregon market, particularly in the Flower category. Starting from October 2025 with a rank of 36, the brand climbed to the 19th position by November, demonstrating a significant improvement. Although there was a slight dip in December, where they ranked 23rd, the brand managed to recover to the 22nd position in January 2026. This upward movement in rankings correlates with an increase in sales, as the brand saw a rise from $181,827 in October to $237,684 by January. Such trends suggest that Midnight Fruit Company is strengthening its presence in the Flower category in Oregon, indicating robust brand performance and potential for further growth.

In the Pre-Roll category, Midnight Fruit Company has also made strides, albeit with a different trajectory. Initially, the brand was not in the top 30, ranking at 94 in October 2025, which highlights a challenge in establishing a strong foothold in this category. However, the subsequent months saw a steady climb, reaching the 60th position by January 2026. This progression is accompanied by a consistent increase in sales, reflecting a growing acceptance and demand for their Pre-Roll products. Despite not yet breaking into the top 30, the continuous improvement suggests a positive trend that could eventually lead to a more competitive standing in the Pre-Roll category within Oregon.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Midnight Fruit Company has demonstrated a notable upward trajectory in recent months. Starting from a rank of 36 in October 2025, the brand climbed to 19 in November, although it experienced a slight decline to 23 in December and 22 in January 2026. This positive shift in rank is indicative of a strategic improvement in market presence and consumer preference. In comparison, Oregon Roots has seen a decline from rank 9 in October to 23 by January, suggesting potential challenges in maintaining market share. Similarly, William's Wonder Farms and Emerald Fields Cannabis have fluctuated in their rankings, with both brands falling out of the top 20 by January. Meanwhile, BJ's A-Grade made a significant leap from rank 57 in October to 20 in January, indicating a strong competitive push. These dynamics highlight the competitive pressures and opportunities for Midnight Fruit Company to further capitalize on its upward momentum in the Oregon flower market.

Notable Products

In January 2026, Midnight Fruit Company's top-performing product was Las Vegas Lemon Skunk (Bulk) in the Flower category, achieving the number one rank with sales of 1,192 units. Sour Candy Lope Pre-Roll (1g) followed closely in second place among Pre-Rolls. Dyor (Bulk) moved from the top rank in November 2025 to third place in January 2026, showing a slight decline despite a sales increase to 955 units. Bubblegum Runtz (Bulk) held the fourth position, maintaining a consistent presence in the Flower category. Hash Burger (Bulk) remained stable, ranking fifth, a position it also held in December 2025, indicating steady performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.