Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

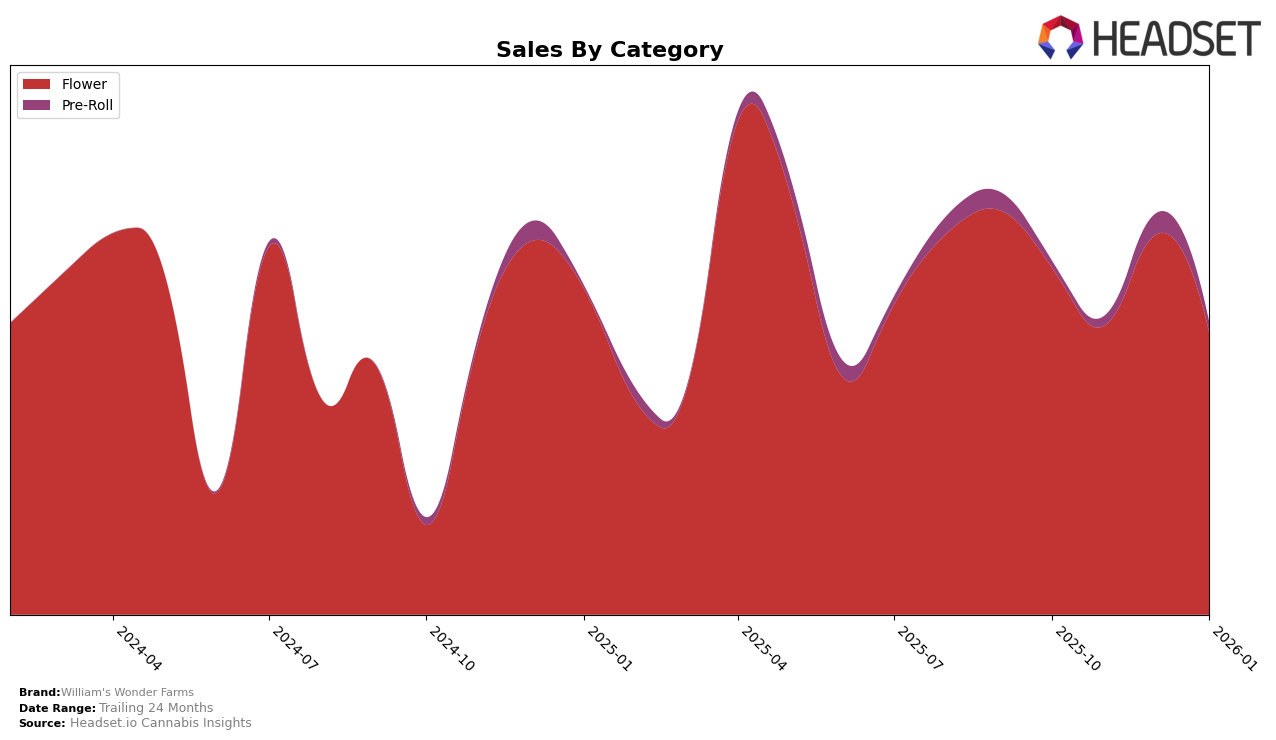

William's Wonder Farms has experienced notable fluctuations in its performance across different categories and states. In the Oregon market, the brand's Flower category saw a notable rise in December 2025, moving from the 20th position in November to 15th, indicating a significant improvement in consumer preference or availability. However, this momentum did not sustain into January 2026, as it dropped to the 24th rank. This decline might suggest increased competition or a shift in consumer demand. It's important to note that the Flower category's sales in October 2025 were the highest during this period, showcasing a peak that was not matched in subsequent months.

In contrast, the Pre-Roll category in Oregon did not achieve a top 30 ranking until January 2026, where it landed at the 73rd position. This indicates that while there is some market presence, the brand struggles to gain significant traction in this category compared to its Flower products. The absence of a ranking in the top 30 for the preceding months could be seen as a challenge for the brand to overcome, highlighting potential areas for strategic improvement. The data suggests that while William's Wonder Farms has a foothold in the Flower category, there is room for growth and increased market penetration in other product segments.

Competitive Landscape

In the competitive landscape of the Oregon flower category, William's Wonder Farms experienced fluctuating rankings and sales from October 2025 to January 2026. Notably, the brand's rank improved from 20th in November to 15th in December, indicating a positive reception during the holiday season, but it fell out of the top 20 by January 2026. This volatility contrasts with Oregon Roots, which maintained a relatively stable presence in the top 20, although it also dropped out by January. Meanwhile, Midnight Fruit Company showed a consistent upward trend, reaching 22nd place by January, suggesting a potential threat to William's Wonder Farms' market share. Additionally, Gud Gardens and True Care Farms have shown varying performances, with True Care Farms making a significant leap from 86th to 25th, indicating aggressive competition in the market. These dynamics highlight the need for William's Wonder Farms to strategize effectively to regain and sustain a higher market position amidst evolving consumer preferences and competitive pressures.

Notable Products

In January 2026, Eurostep #4 (1g) emerged as the top-performing product for William's Wonder Farms, climbing from third place in December 2025 to secure the number one spot. Primate (1g) maintained its second-place position, demonstrating consistent sales with a notable figure of 1,839 units sold. The Vision (1g), which had previously held the top rank in December, dropped to third place. Roasted Garlic Margy Bitty Buds (Bulk) and Herijuana Cookies (Bulk) entered the rankings at fourth and fifth positions, respectively, showing new interest in bulk Flower products. This shift in rankings highlights a dynamic market with Eurostep #4 (1g) gaining significant traction this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.