Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

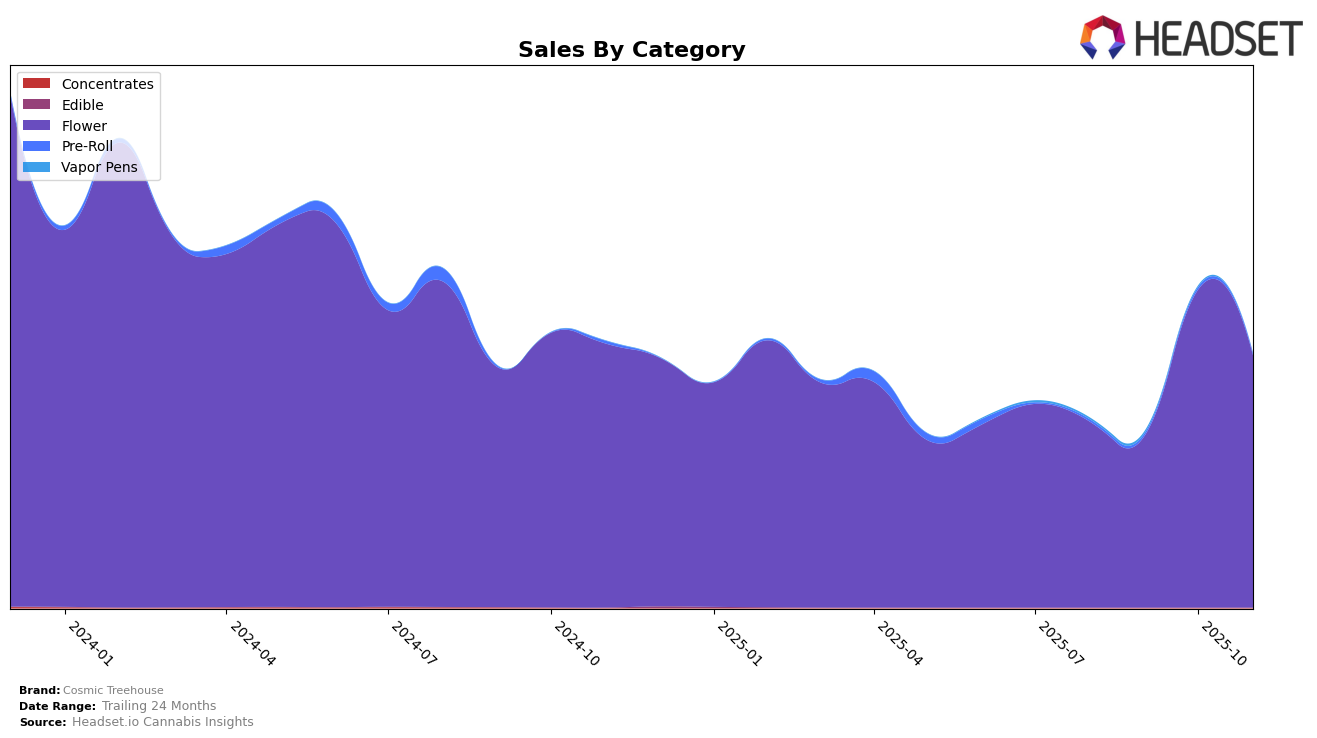

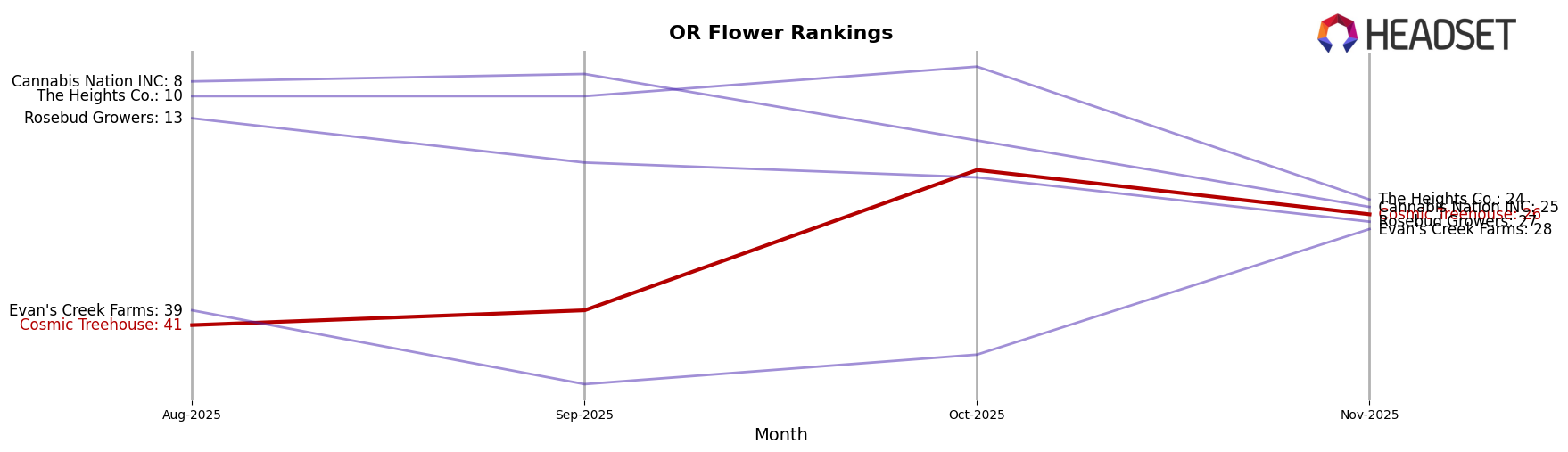

In the state of Oregon, Cosmic Treehouse has shown significant fluctuations in the Flower category rankings over the past few months. Notably, the brand was not in the top 30 in August and September 2025, ranking 41st and 39th respectively. However, it made a remarkable leap to 20th place in October, before settling at 26th in November. This upward trajectory in October coincided with a substantial increase in sales, indicating a strong market presence during that period. The brand’s ability to enter the top 30 in October suggests a successful strategy or product offering that resonated well with consumers in Oregon.

Despite the positive movement in October, the drop to 26th place in November highlights the competitive nature of the Flower category in Oregon. The brand's presence outside the top 30 in earlier months underscores the challenges faced in maintaining consistent market visibility. Nevertheless, the improvement in rankings from August to November indicates a potential for growth and adaptation in the dynamic cannabis market. Observing these trends can provide valuable insights into the brand's performance strategies and consumer preferences in Oregon, although a deeper analysis into other states and categories would be necessary to fully understand Cosmic Treehouse's overall market positioning.

Competitive Landscape

In the competitive landscape of the Oregon Flower category, Cosmic Treehouse has demonstrated a notable upward trajectory in recent months. After not ranking in the top 20 in August and September 2025, Cosmic Treehouse surged to 20th place in October, before settling at 26th in November. This improvement in rank coincides with a significant increase in sales in October, indicating a successful strategy or product launch. In contrast, Rosebud Growers and Cannabis Nation INC experienced declines in their rankings, with Rosebud Growers dropping from 13th in August to 27th in November, and Cannabis Nation INC falling from 8th to 25th over the same period. Meanwhile, The Heights Co. also saw a drop from 10th to 24th, despite a sales peak in October. These shifts suggest that Cosmic Treehouse is gaining ground against its competitors, potentially capturing market share from brands like Rosebud Growers and Cannabis Nation INC, which have seen declines in both rank and sales.

Notable Products

In November 2025, Cosmic Treehouse's top-performing product was Guzzlers (3.5g) in the Flower category, securing the number one rank with sales reaching 2,734 units. Wedding Cake (3.5g), also in the Flower category, followed closely in second place. Dirty Love Sugar (Bulk) showed notable improvement, climbing to the third position from a consistent fourth place in the previous two months. Grape Gummiez (Bulk) and Strawberry Shortcake (Bulk) rounded out the top five, maintaining their fourth and fifth ranks, respectively, from previous months. This indicates a stable demand for bulk Flower products, with Dirty Love Sugar showing a positive sales trajectory.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.