Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

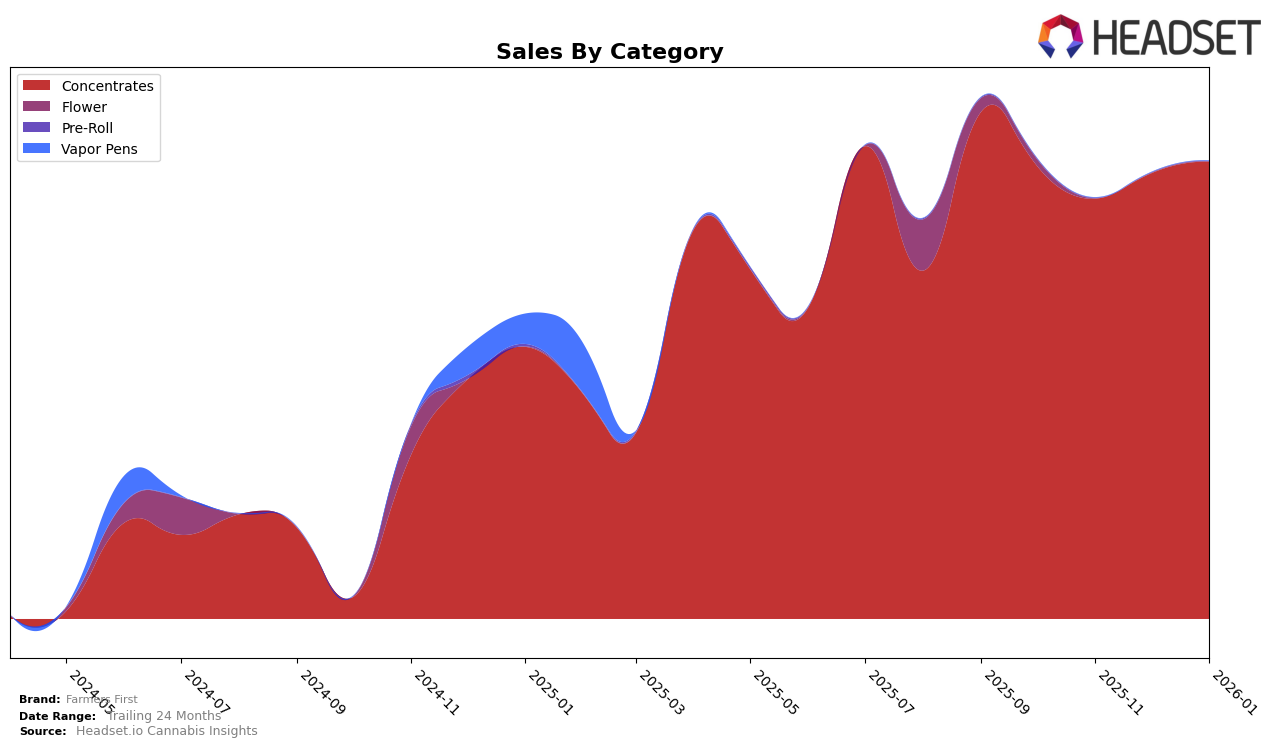

Farmers First has shown a dynamic performance in the Oregon market, particularly in the Concentrates category. Over the past few months, the brand has maintained a presence within the top 30 rankings, demonstrating resilience and adaptability. In October 2025, Farmers First achieved a rank of 16, but experienced a slight drop to 18 in November. This downward trend continued into December with a rank of 20, before recovering back to 18 in January 2026. This fluctuation indicates a competitive landscape in Oregon's Concentrates category, yet Farmers First remains a strong contender, consistently securing a spot in the rankings.

Despite the ranking variations, Farmers First's sales figures in Oregon have shown an overall upward trend from November 2025 to January 2026. After a dip in November, sales rebounded in December and exceeded October's figures by January. This suggests that while the brand faced some challenges in maintaining its rank, it managed to enhance its sales performance, which is a positive indicator of consumer demand and effective market strategies. However, the absence of Farmers First in the top 30 for any other categories or states suggests areas where the brand might focus on expansion or improvement.

Competitive Landscape

In the Oregon concentrates market, Farmers First has experienced some fluctuations in its ranking over the past few months, moving from 16th in October 2025 to 18th by January 2026. This indicates a slight decline in its competitive position, although its sales have remained relatively stable, suggesting consistent consumer demand. In contrast, Higher Cultures and Disco Dabs have seen more significant changes in their rankings, with Higher Cultures improving from 23rd to 19th and Disco Dabs dropping from 15th to 20th. Meanwhile, Gorge Grown has shown a notable upward trend, climbing from 23rd to 16th, which could pose a competitive threat to Farmers First if this momentum continues. Private Stash has also improved its rank from 20th to 17th, indicating a strengthening market presence. These shifts highlight the dynamic nature of the concentrates market in Oregon and suggest that Farmers First may need to enhance its competitive strategies to maintain or improve its market position.

Notable Products

In January 2026, Blueberry Cookies Live Resin (1g) emerged as the top-performing product for Farmers First, climbing from the second position in December 2025 to secure the number one spot, with sales reaching 2934 units. Sour Stunna Sugar Wax (1g) slipped to second place, despite being the top product in the previous month. Tangelo Live Resin (1g) showed a strong performance, moving up from fifth in December to third in January. Dulce De Lemon Live Resin (1g) entered the rankings at fourth place, while GMO Cookies Sugar Wax (1g) rounded out the top five. The Concentrates category demonstrated significant dynamism, with notable shifts in product rankings from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.