Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

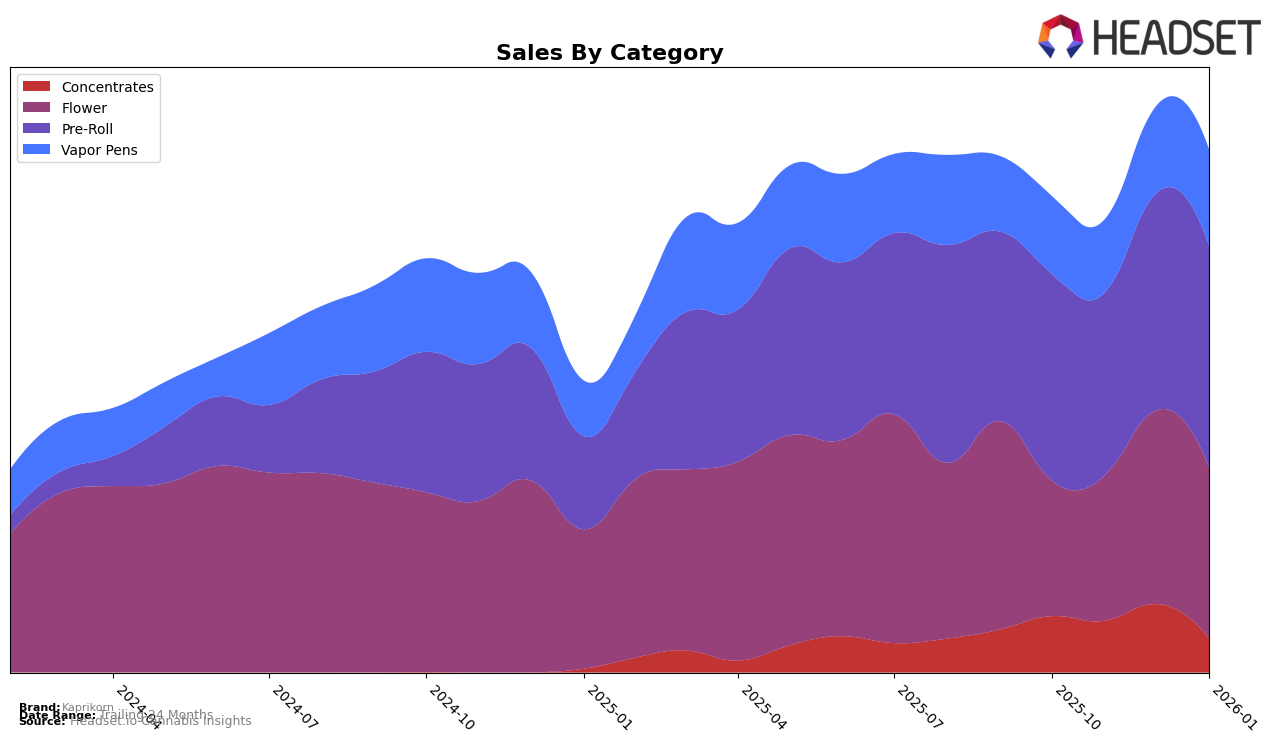

Kaprikorn has shown varied performance across different categories in Oregon. In the Concentrates category, the brand maintained a consistent ranking of 14th place from October to December 2025 but experienced a notable drop to 23rd place in January 2026. This decline might be a cause for concern, especially considering the significant reduction in sales during this period. Conversely, Kaprikorn's performance in the Flower category has been more promising, with an upward trajectory from 14th place in October to 7th place in December, before settling at 10th place in January 2026. This indicates a strong presence and growing consumer preference in this category.

In the Pre-Roll category, Kaprikorn has maintained a steady and impressive ranking, consistently holding the 5th spot for most of the observed period. This stability suggests a robust market position and consumer loyalty in this segment. However, the Vapor Pens category paints a different picture, where the brand has remained in the lower tier, fluctuating between 25th and 28th place. Despite this, there is a slight upward movement in January 2026, which could hint at potential growth opportunities. The lack of top 30 rankings in some months for certain categories highlights areas where Kaprikorn could focus on improving its market strategy to enhance its overall performance.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, Kaprikorn has shown resilience and consistency in its market position. Over the months from October 2025 to January 2026, Kaprikorn maintained a stable rank, oscillating between 5th and 6th position. This stability is notable given the fluctuations in sales figures, with a dip in November 2025 followed by a recovery in December 2025 and a further increase in January 2026. Competing brands such as Benson Arbor and Portland Heights consistently held higher ranks at 4th and 3rd positions, respectively, indicating a strong market presence. Meanwhile, Meraki Gardens and Fire Dept. Cannabis showed upward trends, with Meraki Gardens improving its rank from 9th to 7th, and Fire Dept. Cannabis maintaining a steady 6th position. These dynamics suggest that while Kaprikorn is holding its ground, the competitive pressure is significant, and strategic adjustments could be necessary to climb higher in rank and capitalize on sales opportunities.

Notable Products

In January 2026, the top-performing product for Kaprikorn was the 8" Bagel Pre-Roll 2-Pack (1.5g) in the Pre-Roll category, achieving the number one rank with sales of $2,208. The Smashburger Pre-Roll 2-Pack (1.5g) followed closely in second place. Cherry Dosi (7g), a Flower category product, secured the third rank. Notably, Tropicanna Cherries Pre-Roll 2-Pack (1.5g) improved its ranking from fifth in December 2025 to fourth in January 2026, with sales increasing from $1,101 to $1,527. Acai Gelato Pre-Roll 2-Pack (1.5g) maintained its position at fifth place, indicating consistent performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.