Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

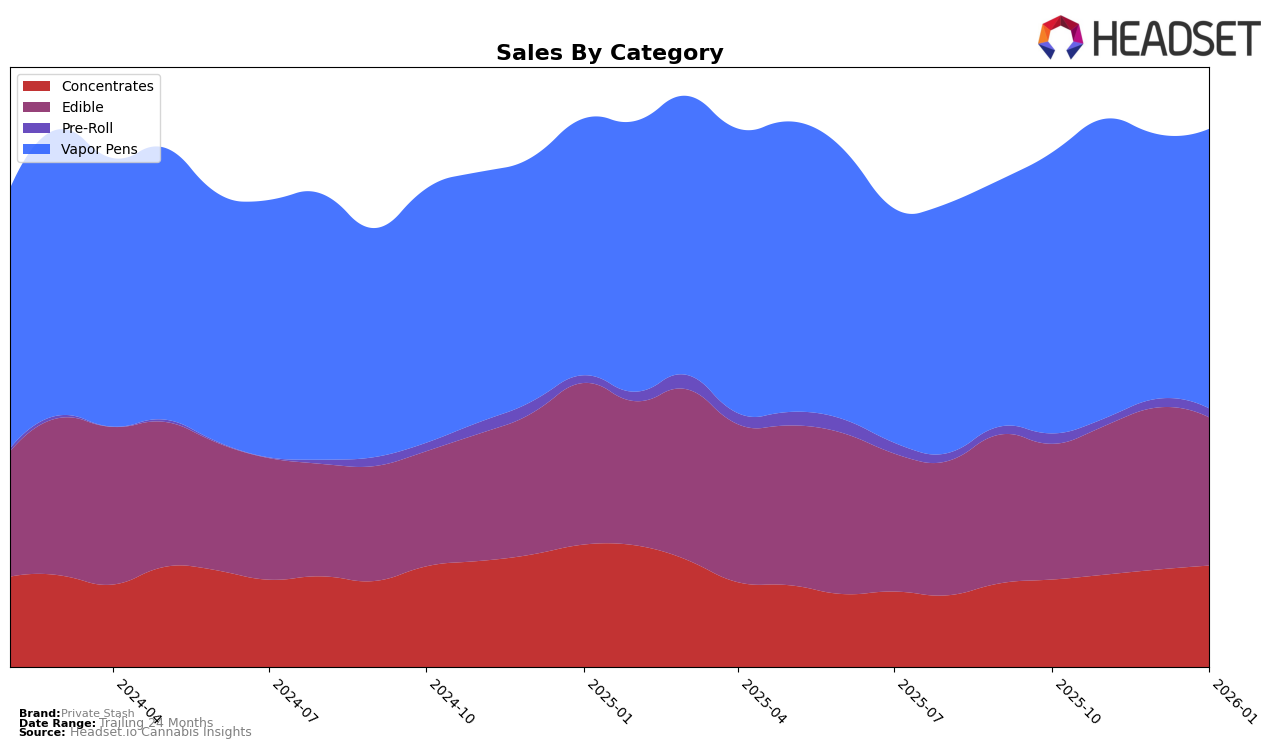

Private Stash has shown varied performance across different product categories in Oregon. In the Concentrates category, it has demonstrated a consistent upward trend, moving from rank 20 in October 2025 to rank 18 by January 2026. This indicates a positive reception and growing demand for their concentrates in the market. Conversely, the Pre-Roll category has not seen the same success, with Private Stash failing to maintain a top 30 position after October 2025, suggesting room for improvement or a shift in consumer preferences away from their offerings in this category.

The Edible category has been a strong point for Private Stash, maintaining a steady presence in the top 10 rankings in Oregon, with a slight fluctuation but ultimately retaining the 9th position in both November 2025 and January 2026. This consistent performance highlights the brand's strong foothold and competitive edge in the edible market. In the Vapor Pens category, Private Stash has seen some volatility, with rankings oscillating between 19 and 23 over the months. Despite this, the brand has managed to secure a rank of 20 in January 2026, reflecting its resilience and potential for growth in the vapor pen segment.

Competitive Landscape

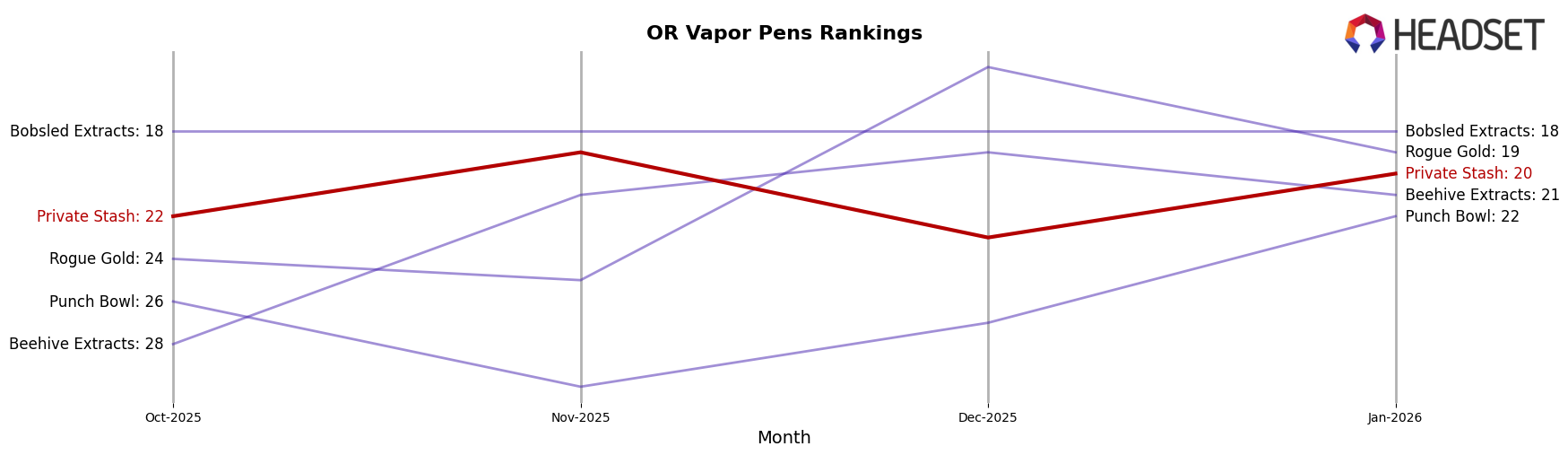

In the competitive Oregon vapor pens market, Private Stash has experienced fluctuating rankings, highlighting both challenges and opportunities. From October 2025 to January 2026, Private Stash's rank varied between 19th and 23rd, reflecting a competitive landscape. Notably, Bobsled Extracts maintained a consistent 18th position, indicating stable performance, while Rogue Gold showed significant improvement, jumping from 25th in November to 15th in December. This upward trend for Rogue Gold suggests increasing consumer preference or effective marketing strategies that Private Stash might consider emulating. Meanwhile, Beehive Extracts and Punch Bowl also demonstrated varying ranks, with Beehive Extracts peaking at 19th in December, indicating a competitive push. These dynamics suggest that while Private Stash remains a strong contender, there is room for strategic adjustments to enhance its market position and capitalize on the growing demand in Oregon's vapor pens category.

Notable Products

In January 2026, the top-performing product from Private Stash was the Hybrid Pink Lemonade Full Spectrum Fruit Chew Blast (100mg), maintaining its number one rank from previous months with notable sales of 7447 units. The Mango Serrano Full Spectrum Fruit Chew Blast 2-Pack (100mg) held steady at the second position, following a consistent rise from third place in October and November 2025. Candy Cane Crunch Fruit Chew (100mg) made a significant leap, climbing to third place from its fifth position in December 2025. Bohemian Blue Razzberry Fruit Chew Blast (100mg) saw a decline, dropping to fourth place compared to its second-place rank in October and November 2025. Lastly, the Hybrid Strawberry Is My Jam Fruit Chew Blast (100mg) remained in fifth place, consistent with its December 2025 ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.