Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

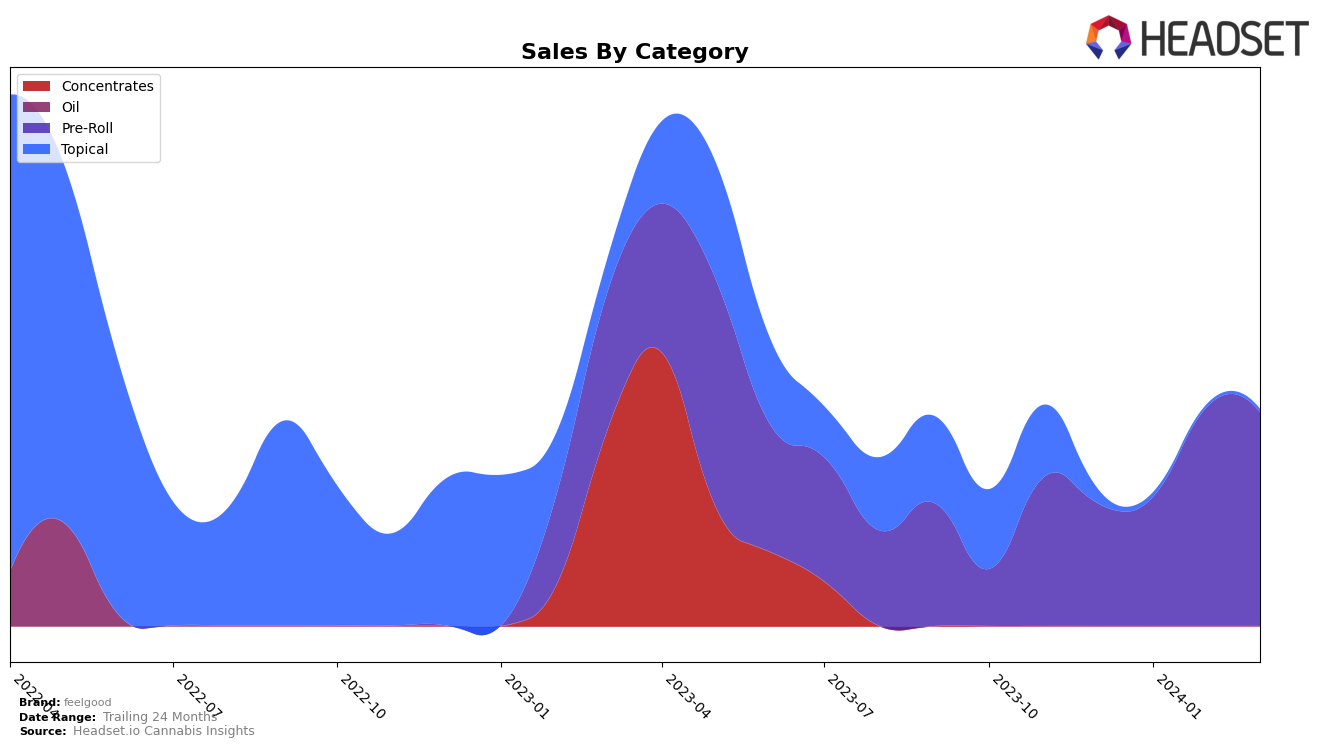

In the topical category, feelgood has shown a notable presence across different provinces, albeit with mixed results. In Ontario, the brand was not ranked in the top 30 for December 2023 and January 2024, which suggests a lack of significant market penetration or visibility in this category during these months. However, an upward trend is observed with the brand breaking into the rankings at 31st place in February 2024 and improving to 27th place in March 2024. This improvement indicates a growing consumer interest or enhanced marketing efforts in Ontario, with sales increasing from 131.0 in February to 157.0 in March. On the other hand, in Saskatchewan, feelgood had a stronger start, ranking 13th in December 2023 and improving to 12th in January 2024. The absence of ranking data for February and March 2024 could imply a potential drop in visibility or sales performance, which might concern stakeholders looking at consistency in brand performance across provinces.

The contrasting performance of feelgood in the topical category between Ontario and Saskatchewan highlights the brand's fluctuating market presence. In Ontario, the brand's late but steady climb in rankings suggests a resilience and potential for growth, despite initial setbacks. The sales figures in Ontario for March 2024, although the only specific figure mentioned, hint at a positive trajectory that could pique the interest of investors or retailers looking for emerging brands with growth potential. Conversely, the initial strong performance in Saskatchewan followed by a lack of ranking data raises questions about the brand's sustainability and market strategies in different regions. This discrepancy underscores the importance of regional market dynamics and the need for tailored strategies to maintain and enhance brand visibility and consumer engagement across provinces. The analysis of feelgood's performance, while limited, provides valuable insights into the challenges and opportunities faced by cannabis brands in navigating the diverse Canadian market landscape.

Competitive Landscape

In the competitive landscape of the Topical category in Ontario, feelgood has shown a notable entrance and upward movement in rank from not being in the top 20 in December 2023 and January 2024, to 31st in February 2024, and further improving to 27th in March 2024. This trajectory suggests a growing consumer interest or effective market penetration strategies. Among its competitors, Müv / MUV has experienced fluctuating ranks but maintained a presence in the top 30, indicating a somewhat stable consumer base despite a significant drop in sales from December 2023 to March 2024. Tidal, another competitor, also showed variability in its ranking but managed to stay within the top 25, highlighting resilience in the market. Notably, Mary's Medicinals only appeared in the rankings in March 2024 at 21st, suggesting a potential new entry or resurgence. Transit, with sporadic appearances, indicates challenges in maintaining a consistent market presence. The dynamic shifts in rankings and sales among these brands underscore a competitive and evolving market landscape that feelgood is navigating as it seeks to establish and expand its footprint.

Notable Products

In March 2024, feelgood's top-selling product was the Blueberry Infused Pre-Roll 2-Pack (1.5g) from the Pre-Roll category, maintaining its number one position since December 2023 with sales reaching 1703 units. Following in second place, the CBD:THC Facial Rejuvenating Cream (720mg CBD, 36mg THC, 90ml) from the Topical category also held its rank consistently from January through March. Notably, the THC Extra Strength Muscle Cream (450mg THC, 90ml), another Topical category product, had previously ranked second in December 2023 but did not make the top rankings from January 2024 onwards. The stability at the top of the rankings for the leading products indicates a steady consumer preference for these items over the observed months. This consistency suggests that feelgood's customers have a strong loyalty to their favorite products, particularly the Blueberry Infused Pre-Roll 2-Pack, which has shown remarkable sales figures and sustained popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.