Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

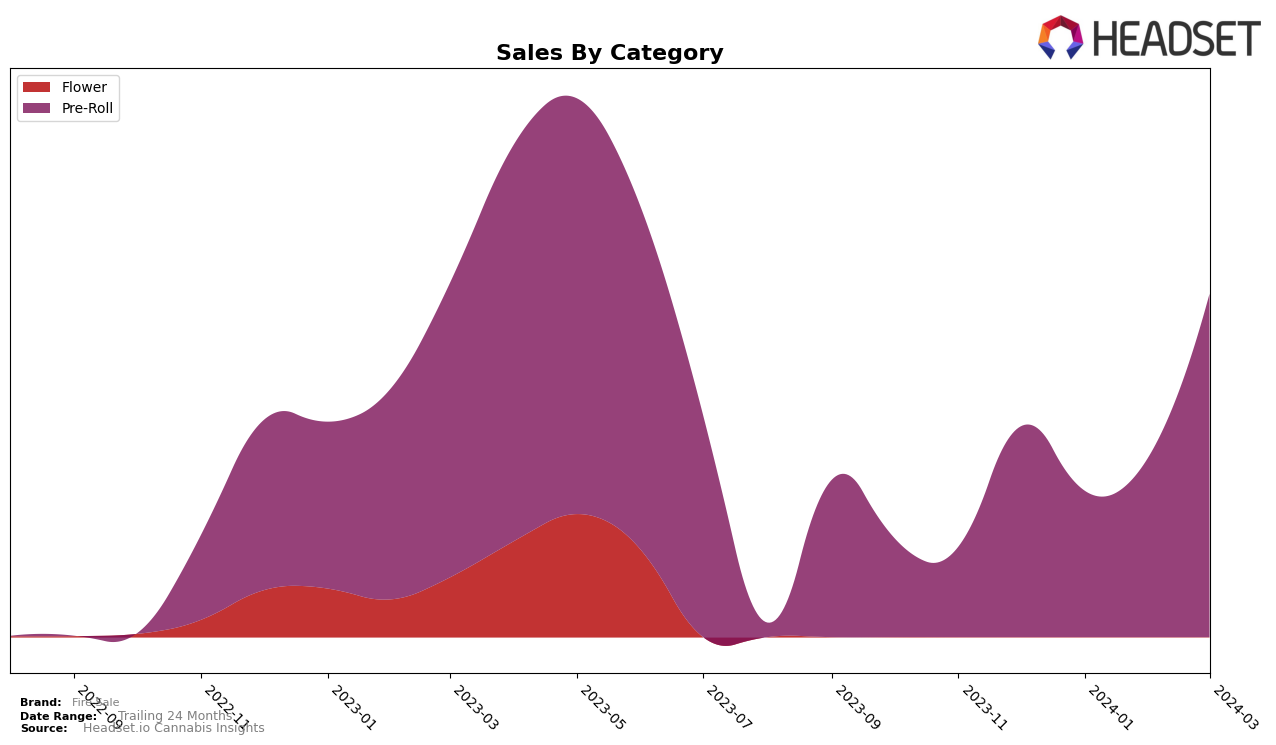

In California, Fire Sale has shown a notable upward trajectory in the Pre-Roll category, moving from a rank of 47 in December 2023 to 27 by March 2024. This significant improvement, climbing 20 places in just three months, indicates a growing consumer preference and increased market penetration for Fire Sale's Pre-Rolls in one of the most competitive cannabis markets in the United States. The sales figures underscore this positive trend, with a remarkable leap from $276,762 in December 2023 to $451,195 by March 2024, showcasing not only an increase in rank but also a substantial rise in consumer demand and sales performance.

However, the journey was not without its challenges. The initial drop from December 2023 to January 2024, where Fire Sale fell from rank 47 to 54, suggests a temporary setback or increased competition during that period. Despite this, the brand showcased resilience and a strong recovery, as evidenced by its consistent climb in the rankings over the following months. This fluctuation highlights the volatile nature of the cannabis market in California and the importance of strategic positioning and consumer engagement for brands like Fire Sale. The absence from the top 30 brands in any category or state/province for a month would be considered a setback; however, Fire Sale's ability to not only re-enter but also climb the rankings is a testament to its growing strength and appeal in the market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in California, Fire Sale has shown a notable trajectory in terms of rank and sales over the recent months. Initially not ranking within the top 20 in December 2023, Fire Sale made a significant leap to 27th place by March 2024. This upward movement is particularly impressive when considering the performance of its competitors. For instance, Paletas, which consistently held a higher rank, only moved from 29th to 25th place in the same period, indicating a more stable but less dramatic growth in rank. Similarly, Sublime Canna and Littles showed modest improvements or declines in their rankings, suggesting a competitive but relatively static field. Fire Sale's significant rank improvement, coupled with a substantial increase in sales from February to March 2024, positions it as a brand with notable momentum in the California Pre-Roll market, outpacing competitors like Coastal Sun Cannabis in terms of month-over-month growth. This dynamic shift underscores Fire Sale's growing influence and potential threat to its competitors in the market.

Notable Products

In Mar-2024, Fire Sale's top-performing product was Green Crack Pre-Roll (1g), leading the sales chart with 41,719 units sold, marking a significant jump from its previous positions. Following closely was Lemon Cherry Gelato Pre-Roll (1g), which ranked second, despite being the top seller in Feb-2024. Pie Scream Pre-Roll (1g) dropped to the third position from its leading rank in Jan-2024, showing a fluctuating sales performance over the months. Double Scoop Pre-Roll (1g) managed to secure the fourth rank, improving from its third-place in Feb-2024. Notably, Hood Candy Pre-Roll (1g) experienced a dramatic drop to the fifth position, highlighting a significant shift in consumer preferences within Fire Sale's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.