Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

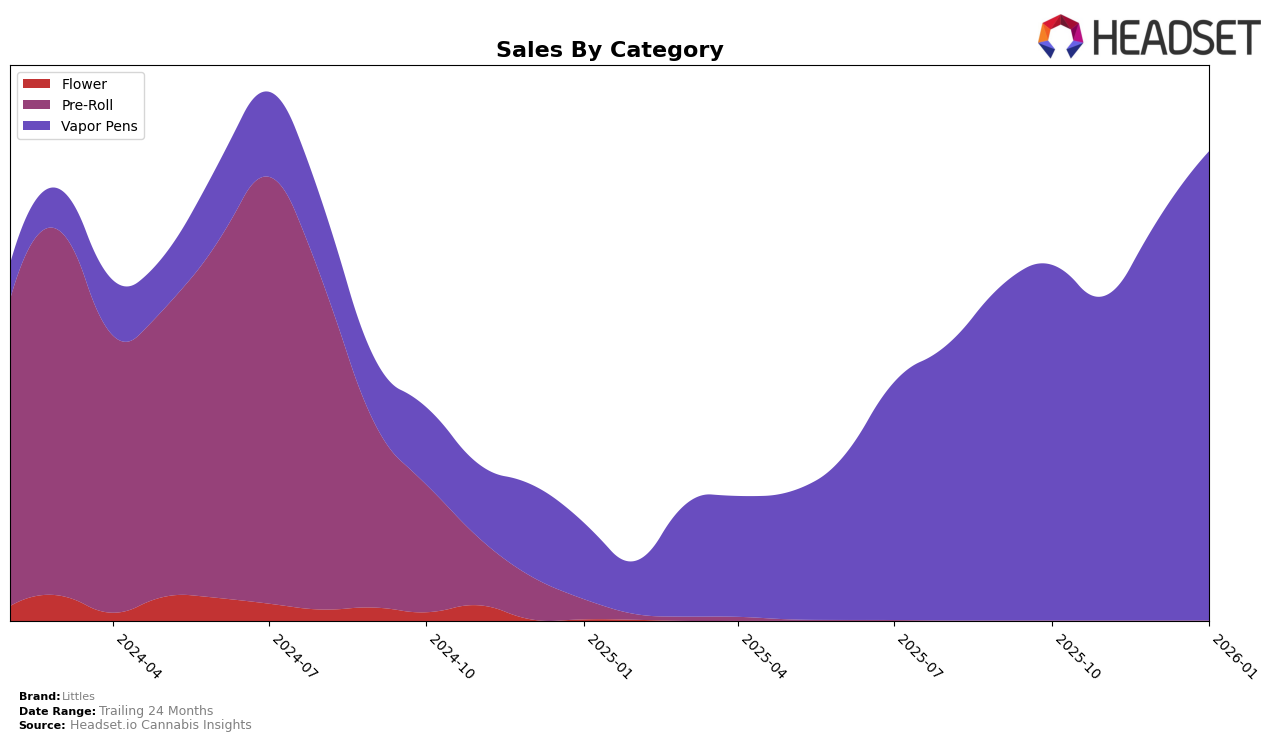

In the New York market, Littles has shown an upward trajectory in the Vapor Pens category over the last few months. Starting from a rank of 31 in October 2025, the brand has gradually climbed to the 28th position by January 2026. This movement into the top 30 indicates a positive reception and growing consumer interest in their products. The sales figures also reflect this trend, with a notable increase from $395,135 in October to $521,781 by January. This suggests that Littles is effectively capitalizing on consumer demand and possibly enhancing their market strategies to improve visibility and sales in this competitive category.

However, it's important to note that Littles' presence outside of the top 30 in October and November indicates that there is still room for growth and improvement. While they have managed to break into the rankings by December, maintaining and improving this position will require continued effort and adaptation to market dynamics. The brand's ability to sustain this momentum and further climb the rankings will be crucial for its long-term success in the New York market. Observing how Littles adapts its strategies in response to competition and consumer preferences will be key in predicting its future performance.

Competitive Landscape

In the competitive landscape of Vapor Pens in New York, Littles has shown a steady improvement in its ranking from October 2025 to January 2026, moving from 31st to 28th position. This upward trend in rank is accompanied by a notable increase in sales, indicating a positive reception in the market. However, Littles faces stiff competition from brands like Brass Knuckles, which has demonstrated significant volatility but maintained a strong presence by climbing to the 7th position in November 2025. Meanwhile, Eureka and Magnitude have experienced fluctuating ranks, with Eureka falling out of the top 20 by January 2026. Off Hours has remained relatively stable, consistently ranking around the mid-20s. Littles' consistent improvement in both rank and sales suggests a growing market presence, but the brand must continue to innovate and differentiate to compete effectively against these established players.

Notable Products

In January 2026, the top-performing product from Littles was the Blueberry Jam Live Resin Disposable (1g) in the Vapor Pens category, maintaining its consistent number one rank from the previous months, with sales reaching 2290 units. Following closely, the Tangie Cookies Live Resin Disposable (1g) held onto its second position, showing a steady increase in sales figures each month. The Birthday Cake Live Resin Cartridge (1g) climbed to third place, up from fourth in December 2025, indicating a positive trend in its popularity. Meanwhile, the Birthday Cake Live Resin Disposable (1g) slipped slightly to fourth place, despite a modest increase in sales. Finally, the Watermelon Punch Live Resin Disposable (1g) re-entered the rankings at fifth place after being absent in November and December 2025, showing renewed interest among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.